How to Use IFC Codes

What Are IFC Codes? Inter Fund Codes are a method to record a

transaction when Fund B owes Fund A money. The accounts used are often

referred to as Due to/Due From accounts.

This can be used for intercompany transaction between Funds, Departments,

AMPs, Cost Centers. Any portion of your company that is responsible for

recording its share of income and expenses that may be originally paid for by

another portion of your company may use these codes.

These codes will even work between Horizon Financial Companies.

Accounts Payable

- In Accounts Payable the Paygroup determines which checkbook and cash

account to be used when payment of a voucher is completed.

- The Fund of the paygroup's cash account can be thought of as the "Home"

Fund for this voucher.

- When entering in the Distribution expense lines, any expense account

within the "Home" Fund will not use an IFC code. The Paygroup's Fund

and the Expense Fund match.

- Any Distribution Expense account that is outside of the "Home" Fund will

need an IFC code. This code tells the system that the "Home" Fund is

due payment for the amount of this line. The "Home" Fund must be setup

in the IFC code used as the Interfund Receivable and the outside Fund must

be the Interfund Payable. The voucher entry system will prevent

mismatches between accounts and IFC codes.

- When the voucher is posted 2 additional entries will be created. A

debit to a receivable in the "Home" Fund and a Credit to a payable Account

in the outside Fund.

Journal Entries

- When using IFC codes in a Journal Entry care must be taken to keep the

transactions in balance.

- It may help to think of how IFC codes are used in Accounts Payable.

- The first part of the transaction does not use an IFC code.

This is the transaction to the "Home" Fund. 1 J/E line with no IFC

code that is to the "Home" Fund.

- The "distribution" lines to Funds outside of "Home" Fund will need

an IFC Code.

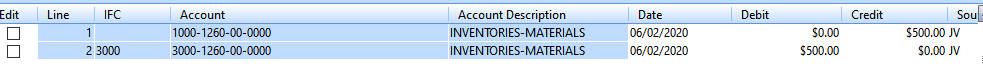

- We can show how this works with an inventory transfer.

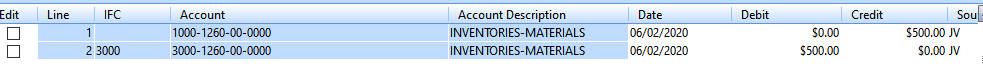

- Inventory is kept in the Central Office ("Home" Fund 1000)

Warehouse, Account 1000-1260-00-0000. We need to move $500.00 of inventory to

Fund 3000.

- First entry to the "Home" Fund will be to Credit 1000-1260-00-0000 $500.00.

The IFC Code will be BLANK

- Second entry to the Outside Fund will be to Debit 3000-1260-00-0000 $500.00.

This entry will have an IFC Code that matches the Home Receivable ad the

Outside Payable Funds. We can call this IFC Code "3000"

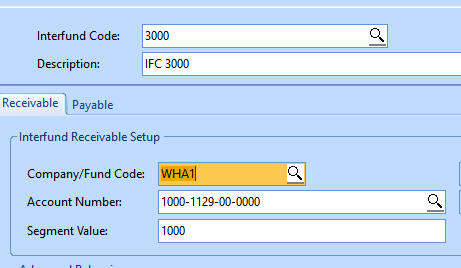

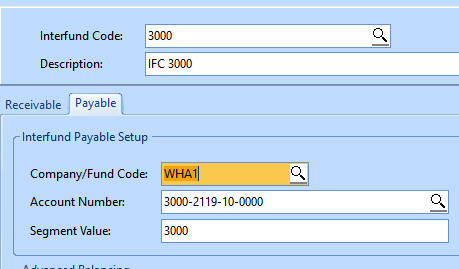

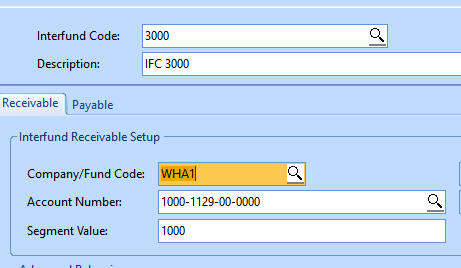

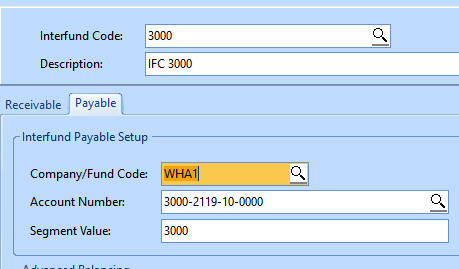

- IFC Code "3000" will be set up with Interfund Receivable

1000-1129-00-0000 and Interfund Payable 3000-2119-10-0000

-

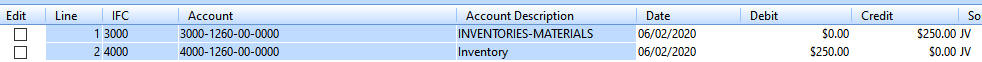

- The edit list will only show the 2 entries. When an IFC has

been entered it will show the Glaccount followed by / and the IFC code

- When posted these 2 entries will produce 4 entries in the General

Ledger.

The original 2 entries entered, and 2 IFC balancing entries.

- Each Fund now has a Debit and a Credit to stay in balance.

Fund 3000 has a payable and fund 1000 has a receivable.

- If the transaction are not in balance

attempting to post the Journal Entry will fail and an error report will show

Out Of Balance messages.

Journal Entries without an Entry to the "Home" Fund

- Normally 1 entry will be to your "Home" Fund. You can however

enter a JV with no entries to the "Home" Fund. In this case all

entries would have an IFC code. This would be done in the case

of an inventory transfer between 2 Funds that have no IFC Codes in common.

You could use the Central Office "Home' Fund as a middle man.

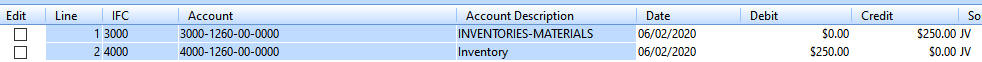

- $250.00 of inventory in Fund 3000 is transferred to Fund 4000.

- First entry is Credit 3000-1260-00-000 $250.00. The IFC Code will be "3000"

- Second entry will be to Debit 4000-1260-00-000 $250.00. The IFC Code

will be "4000"

IFC Code "3000" will be set up with Interfund Receivable

1000-1129-00-0000 and Interfund Payable 3000-2119-10-0000- IFC Code "4000" will be set up with Interfund Receivable

1000-1129-00-0000 and Interfund Payable 4000-2119-10-0000

- When posted these 2 entries will produce 6 entries in the General

Ledger.

Fund 1000 receives a debit and a credit. This is just a middle man

function, it receives from Fund 4000 and gives it to Fund 3000. Fund

3000 will have 2 entries

Credit to

inventory being removed and a debit (or negative) IFC Payable

Fund

4000 will have 2 entries

Debit to Inventory received and a

credit to IFC Payable

- Each Fund each have a Debit and a Credit to stay in balance.

Fund 4000 pays Central Office, Central office pays Fund 3000.

- NOTE: Both transaction must use an IFC code with the same Fund used as

the Interfund Receivable. They can be different GL accounts in the

same Fund.

![]()

![]()