Read the PA UC File

After you have exported and created the Magnetic Media File for Unemployment Compensation, you may want to open and review the file. If you do so, make sure you do not save when closing it as this may change formatting in the file which will cause it to be rejected by the state's upload process.

- Open the program Notepad

- Go to File > Open

- Change the Files of Type from Text Documents (*.txt) to All Files

- Browse to the folder the file was saved in; select the file and press Open

- The file will have been named something like: FILEUPLOAD_UC2-2A_???????.CSV. The ??????? will be your UC employer account number. Pennsylvania's specifications require the name of the file to be in this format.

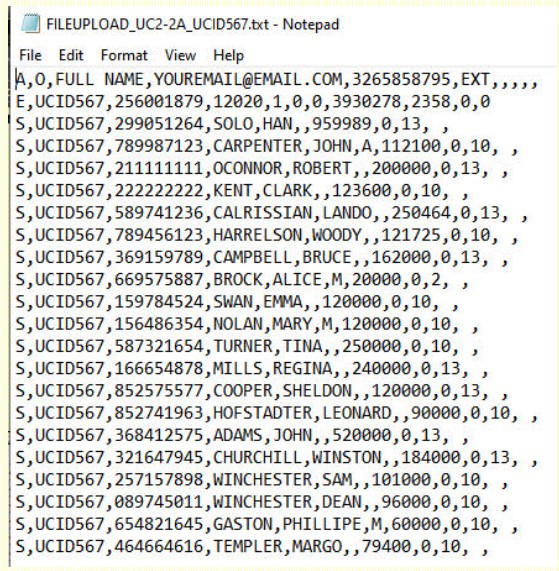

- Your file will look similar to the example below:

- All dollar amounts are written without punctuation and does not include the cents. I.E. 16813079 = $168,130.79

- The first line will start with “A,O" then will contain your contact information: Name, email, phone number, extension

- The second line will show the following columns of information separated by commas (,):

- Column 1: will always be “E”

- Column 2: Your 7 digit UC Employer Account # followed by 2 spaces

- Column 3: blank

- Column 4: Filing period written as quarter 1,2,3 or 4, then year. 12020 is 1st quarter 2020

- Column 5: # employees in 1st month

- Column 6: # employees in 2nd month

- Column 7: # employees in 3rd month

- Column 8: Total Quarterly Gross Wages subject to PA UC Employee tax

- Column 9: Total Quarterly Employee Tax due

- Column 10: Total Quarterly Taxable Wages subject to PA UC Employer tax

- Column 11: Total Quarterly Employer Contribution due

- All following lines begin with S and will include the following information for each employee:

- Column 1: will always be “S”

- Column 2: Your 7 digit UC Employer Account # followed by 2 spaces

- Column 3: The employee Social Security #

- Column 4: Employee last name

- Column 5: Employee first name

- Column 6: Employee middle name or initial

- Column 7: Employee gross wages for quarter

- Column 8: Employee Employer Taxable wages for quarter

- Column 9: Employee credit weeks for the quarter

- Column 10: blank

- Column 11: blank

- Do not make changes to the file.

- When closing Notepad, you will receive a message to save, press "No" or "Don't Save".

- Saving the file may make some unwanted formatting changes which will cause the file to be rejected.

12/2023