Process Payroll Accruals

When Do Entries Post to the General Ledger?

Payroll expenses (including wage expenses and employer paid benefits) normally post as of the last day of the Pay Period (End Date) and an offsetting credit is posted to the Payroll Accrual Accounts.

On the Pay Date: Payroll Accrual Accounts are debited to remove the previous credits, Liability Accounts are credited, the Cash Account is credited, entries are made to the checkbook and Interfund Entries are posted.

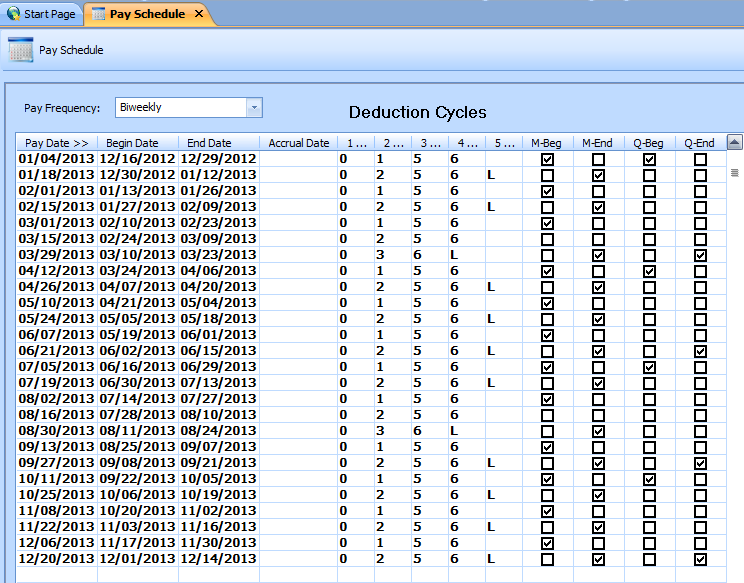

In the Pay Schedule example shown below, the Pay Date of 1/18/2023 is for Pay Period (Begin Date) 12/30/2022 and the (End Date) is 1/12/2023. When payroll is processed and posted for this pay, the expenses will post to the (End Date) of 1/12/2023.

If the pay is to be accrued with the expenses split for December and January based on days worked, an accrual date should be added to the Pay Schedule.

The Accrual Date entered for the pay will be used to post wage and expense information that is in Time Card Entry with dates prior to and including this date. Time Card dates that are after the Accrual Date will be posted using the End Date.

Usually the Accrual Date is the last day of the month, but may be for any date. Accrual dates may be entered for one pay, every pay, for the last pay of every month, or for the end of the fiscal year.

Setting up Accrual Pay Dates

Accrual dates are usually entered during the Close Payroll Year process, but may be entered for a pay date before running the Auto-Setup Time Cards for the pay.

NAVIGATION: MAINTAIN menu > Pay Date Master

NAVIGATION: MAINTAIN menu > Pay Date Master

- Select your Pay Frequency

- Enter an Accrual Date for each Pay Date line that is to be accrued.

- For example: To accrue pay dates for the end of each month, find the pays whose Begin Date is in one month and the End Date is in the next month. Such as the 1/18/2023 Pay Date. The Begin Date is 12/30/12 and the End Date is 1/12/13. Enter the Accrual Date as 12/31/2022 (see below)

- For example: To accrue pay dates for the end of each month, find the pays whose Begin Date is in one month and the End Date is in the next month. Such as the 1/18/2023 Pay Date. The Begin Date is 12/30/12 and the End Date is 1/12/13. Enter the Accrual Date as 12/31/2022 (see below)

- When Accrual Dates have been entered for the pays that are to be accrued, click Save. If Save is dimmed and not available to click, then the information is already saved. Close the Pay Date Master.

The number of days accrued may be for one or more days. For example: Pay Date 07/19/2023 has a Begin and End Date of 6/30/2023 and 7/13/2023. An Accrual Date of 6/30/2023 will accrue only one day (06/30/2023).

The number of days accrued may be for one or more days. For example: Pay Date 07/19/2023 has a Begin and End Date of 6/30/2023 and 7/13/2023. An Accrual Date of 6/30/2023 will accrue only one day (06/30/2023).

Process an Accrued Payroll

Auto-Setup Time Cards

NAVIGATION: ACTIVITIES menu > Auto-Setup Time Cards

NAVIGATION: ACTIVITIES menu > Auto-Setup Time Cards

- Run the process as normal, selecting your Pay Frequency and Pay Date.

- For example on the 01/18/2023 pay date, this process would normally add an entry in the Time Card dated 01/12/2023 (the End Date) for each earning code setup in the Employee Master.

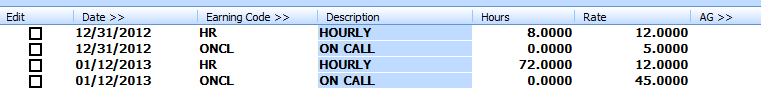

- With an Acrrual Date set, there will be two entries created for each earning code for the Accrual Date (12/31/2022) and the End Date (01/12/2023). The two entries will be prorated based on the days between Start - Accrual and End.

- For a Biweekly Frequency Example: If an employee is setup for an HR (hourly) of 80 hours and ONCL (oncall) of $50.00, the Time Card entries will be created as:

- The program is assuming a Monday – Friday work week. The 12/30/12 – 12/31/12 period only includes 1 work day Monday 12/31/12. The 1/1/2023 – 1/12/2023 period includes 9 work days.

- HR for 12/31/12 receives 8 hours (80 hours ÷ 10 work days ×1 day)

- HR for 1/12/13 receives 72 hours (80 hours ÷ 10 work days ×9 days)

- ONCL for 12/31/12 receives $ 5.00 ($50.00 ÷ 10 work days ×1 day)

- ONCL for 1/12/13 receives $ 45.00 ($50.00 ÷ 10 work days ×9 days)

- Employees that do not work a normal Monday – Friday work week will need their distribution adjusted manually.

- When entering Time off such as PTO, Sick, Vacation or Peronal, the normal process will reduce hours or salary dollars from the "Primary" earning line.

- The first "primary" earning line present will be the one to be reduced, without regard to the date of the Time Off. So, when entering Time Off, the reduction will always come out of the first period. In this example, the 12/31/2022 HR of 8 hours would be reduced. This can possible reduce the hours or salary to a negative amount.

- Care will need to be given to correct the "Primary" earning lines with regard to Time Off, making sure they are affecting the correct line.

Process Payroll and Post

NAVIGATION: ACTIVITIES menu > Process Payroll

NAVIGATION: ACTIVITIES menu > Process Payroll

- Process Payroll, print checks/direct deposit slips and post as normal.

- The General Ledger Interface will have additional entries for the Accrual Date.

- Time Card entries with the Accrual Date or earlier will post expenses on the Accrual Date.

- Employer paid expenses for these wages will be calculated and expensed on the Accrual Date

- Time Card entries after the Accrual Date will post expenses to the End Date. Employer paid expenses for this second set of wages will be calculated and expensed on the End Date.

- An Offsetting Credit to the Payroll Accrual Accounts will be made for both dates.

- G/L entries for the Pay Date will be made as usual: the Payroll Accrual Accounts are debited to remove the previous credits, Liability Accounts are credited, Cash Account is credited, entries are made to the checkbook, and Interfund Entries are posted.

12/2023