Update Federal and State Tax Tables

Part of the Horizon annual update includes an update to the federal and state tax tables based on government guidelines. Horizon recommends using the automated tax update process; however, you can manually update tax tables.

Tax tables must be updated before the first payroll of the new year.

Tax tables must be updated before the first payroll of the new year.

Automated Tax Update

Tax tables may be updated automatically using the Automated Tax Update process.

NAVIGATION: UTILITIES menu > Year End Processing > Automated Tax Update

NAVIGATION: UTILITIES menu > Year End Processing > Automated Tax Update

- The automated updated will update the following information:

- Federal Tax Tables for Married and Single

- PA State Tax Tables for Married and Single

- At this time only PA information is verified. State tax information for other states may be updated; however, it is not verified and should be updated manually based on your states information.

- Social Security Maximum Wages

- Medicare Maximum Wages

- PA PSD code and local tax rate table

- Update the State Unemployment Information.

- Pennsylvania State Unemployment is not updated automatically as each employer's taxes will vary. This information should be entered from the letter sent from the state.

- If you do not use the automated tax update, complete the following steps to manually update the tax tables.

Manually Update Federal Tax Tables

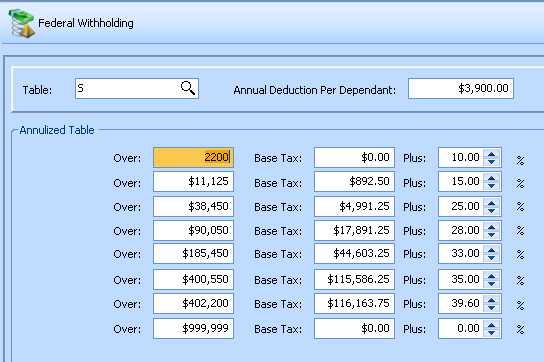

Single Tax Table

![]() NAVIGATION: MAINTAIN menu > Tax Tables > Federal Withholding Tax Table

NAVIGATION: MAINTAIN menu > Tax Tables > Federal Withholding Tax Table

- Select Table “S-Single” and click TAB.

- Overwrite the displayed information with the current tax year rates.

- Click SAVE

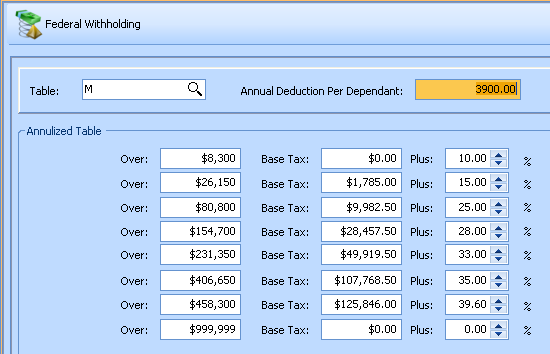

Married Tax Table

![]() NAVIGATION: MAINTAIN menu > Tax Tables > Federal Withholding Tax Table

NAVIGATION: MAINTAIN menu > Tax Tables > Federal Withholding Tax Table

- Select Table “M-Married” and click TAB.

- Overwrite the displayed information with the current tax year rates.

- Click SAVE.

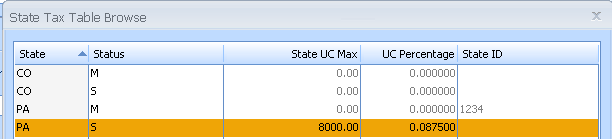

Manually Update State Tax Table and Unemployment Compensation Rate

Single

![]() NAVIGATION: MAINTAIN menu > Tax Tables > State Tax Table

NAVIGATION: MAINTAIN menu > Tax Tables > State Tax Table

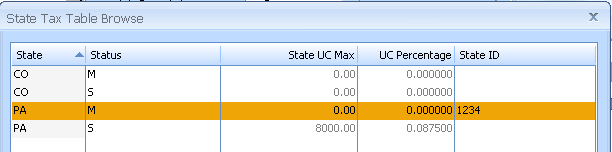

- Select the two digit state code and Status of S using the State browse button.

- On the General Tab enter the state unemployment figures assigned by your state.

- The Unemployment Information is required to be saved with the PA single record.

- Unemployment Taxable Wages

- Maximum - Enter the state maximum amount

- Enter the Percent assigned by the state to your company

- Enter your 7 character UC ID Number (include the leading zero if applicable).

- UC Reimbursable - If you are a UC Reimbursable employer check mark this box. This option will cause the UC export to submit zero in Column J, Row 2, Total Quarterly Taxable Wages subject to State UC Tax and Column K, Row 2, Employer Contributions due.

- Unemployment Taxable Wages

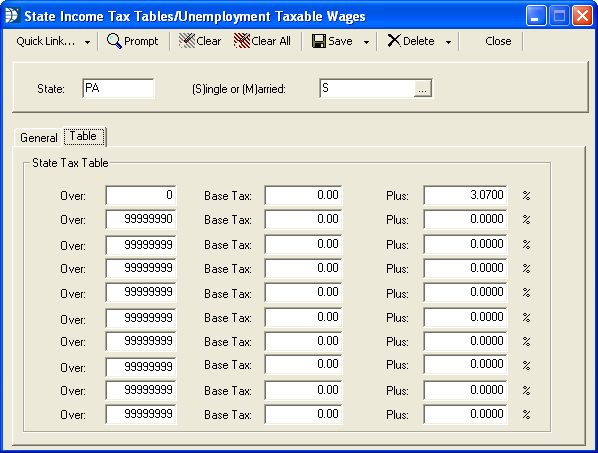

- State Tax Information

- State ID - Enter your 8 character State ID. This will appear in the employees' W2s.

- Allowance per Dependent - Enter the amount your state allows per dependent

- Allow Non Taxable Deductions - Check the box if your state allows non taxable deductions

- State Tax Table

- Enter your state tax information.

- Click SAVE

- Enter your state tax information.

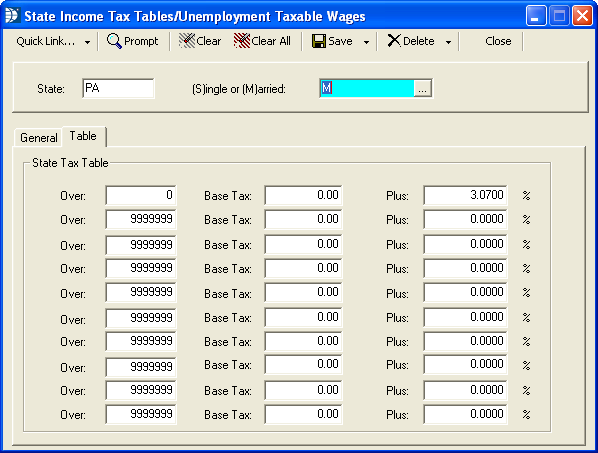

Married

![]() NAVIGATION: MAINTAIN menu > Tax Tables > State Tax Table

NAVIGATION: MAINTAIN menu > Tax Tables > State Tax Table

- Select the two digit state code and Status of M using the State browse button.

- On the General Tab you may leave the Unemployment Information section blank. The UC information is required to be saved in the Single record.

- State Tax Information

- State ID - Enter your 8 character State ID. This will appear in the employees' W2s.

- Allowance per Dependent - Enter the amount your state allows per dependent

- Allow Non Taxable Deductions - Check the box if your state allows non taxable deductions

- State Tax Table

- Enter your state tax information

- Enter your state tax information

- Click SAVE

12/2023