Print 1099 Forms

Before printing, make sure you verified and reviewed all vendor information in the previous steps.

WARNING: Make sure you are not set to print double sided to your printer. You can use Print with Setup to select your printer Then Preferences to select options, i.e., 1-Sided.

Review the Recommended Printing Steps

NAVIGATION: UTILITIES menu > 1099 Processing > Print 1099 Forms

NAVIGATION: UTILITIES menu > 1099 Processing > Print 1099 Forms

- Company Information - If the correct company information is not displayed, enter it in the appropriate lines.

- This information is pulled from the SYSTEM menu > Company Information. Make sure to update for future 1099 processing.

- Verify the correct Federal ID is entered with no spaces or hyphen.

- Sequence

- Year to Print: Enter the reporting year to print at the top of the 1099 forms.

- Electronic: Select one of the following:

- Not Electronic Only (paper)

- All

- Electronic Only

- Form Mode

- Select the Form to Print: MISC, NEC, or INT

- Warning: Changing this selection will also change the Format information selected to the Pre-Printed version.

- Format Information

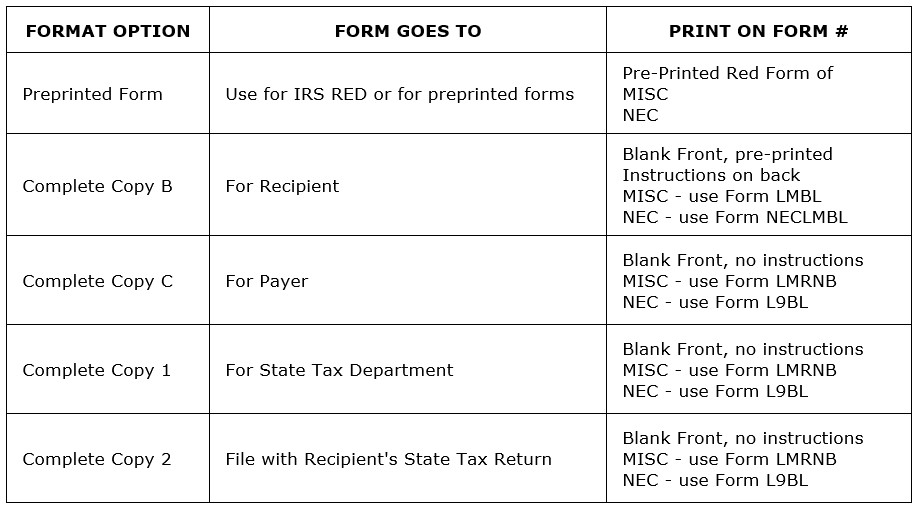

- Use the drop down to select which form you want to print. Formats with COMPLETE in the name may be previewed to review before printing.

- Dollar limit: Enter a dollar amount to print 1099s above the amount entered.

- For example, if 600.00 is entered as the limit, only 1099s with totals above 600.00 will be printed.

- Use the drop down to select which form you want to print. Formats with COMPLETE in the name may be previewed to review before printing.

- PRINT

- When all information has been entered and all selections are made you may Print.

- Click PRINT to allow default to your default printer/use PRINT WITH SETUP to select the printer and options.

- Test print the first two vendors (enter control number in Starting/Ending control field) to plain paper (or on an extra form) hold it up to a form to see if it is aligned. If the form is not printing in the boxes properly, use the adjustments.

- Horizon recommends test printing the 1099 IRS Red Copy and other pre-printed forms not purchased from Horizon.

- Review your pages for any alignment problems. Increase or decrease the adjustment values until the printing aligns within the boxes.

- Once you are satisfied with the test print, print the information on the tax forms.

- Adjustments: There are two sets of adjustments: Top form and Bottom form.

- If both forms need to move the same amount, then use the same amounts for both forms.

- Entering an amount in the Top form will not move the bottom form.

- Up/Down - If printing to low on page enter -25, if printing to high enter 25.

- Left/Right - If printing to far to the right enter -25, If to far to the left enter 25.

- Recommended: Horizon strongly recommends saving a PDF copy of the 1099 forms.

- Use format information Use the Complete Copy B For Recipient or Complete Copy C for Payer. so you can easily reprint any vendor 1099 if needed.

- Use the Export – PDF or Email options

- The file should be saved on your server where it is backed up and can be found if needed in the future.

- Repeat the steps for printing the 1099 forms until you have all of the MISC, NEC, and Interest forms that you need printed.

- The 1096 form is not available to print and must be completed by hand.

12/2024