Process a Journal Entry

A journal entry is one way to get information into the general ledger. The process includes three steps:

- Create the journal entry

- Review Journal Entry Edit List

- Post the journal entry

Create the Journal Entry

NAVIGATION: ACTIVITIES menu > GL Journal Entry

NAVIGATION: ACTIVITIES menu > GL Journal Entry

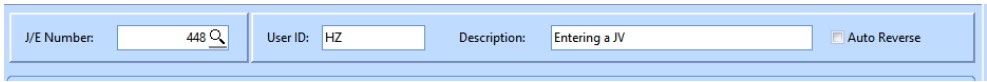

- J/E Number

- Leave this field blank when entering a new journal entry.

- The system will assign the number based upon the last journal entry number shown in General Ledger Settings.

- To view a voucher that has been entered but not posted, you may enter the unposted J/E Number or browse to pull up a voucher.

- User ID

- The system will default the user identification to the initials of the person who is logged into the module.

- The default User ID may be changed to create a unique identification for the journal transaction.

- The User ID entered is used as a selection criteria for the edit and posting programs.

- Example: If the initials CJG are entered for several transactions which are saved but not posted and another transaction must be entered, edited and posted before the other transactions. Change the initials CJG to ADJ1 (or a user identification of your choosing) for the User ID as you begin to enter the new journal entry.

- DescriptionJ/E Header: type a description for the journal entry (up to 30 characters in length).

- Auto Reverse

- When this field is checked a reversing Journal Entry will be created for the first day of the next accounting period for all transactions in the Journal Voucher when it is posted.

- When this box is checked, the entries will post for the date entered as usual; however, they will remain in the Journal Entry view. The debits and credits will be reversed and the dates will be updated to the first of the next month and the Auto Reverse check box will be unchecked. These entries will need posted a second time to complete the reversal.

- Uses: This can be used every month to accrue expenses, but is most often used at the end of a fiscal year to enter "Audit Reversing Entries". This process can be used to move expenses and revenue recorded in one month back to the previous month.

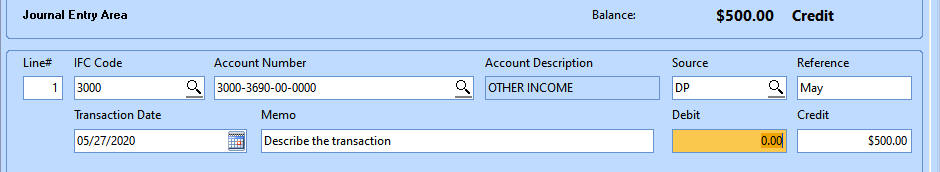

- Balance

- As each line is entered for the JV, the balance information will change.

- When you are finished with the journal entry, the balance area should display $0.00 when the journal transaction is in balance.

- If there is an amount displayed, the transaction is not in balance and will not be posted.

- If you need to post a one sided (unbalanced) entry, please call the help desk for assistance.

- Line #

- The system will automatically begin to number the lines beginning with 1.

- You may change the number displayed to retrieve a previously entered line on the journal voucher transaction.

- The entry for a line # will not be complete unless you have entered the entire transaction and the line has dropped into the display grid at the bottom of the program.

- You may call up a previously entered line by clicking in the edit box for the line in the grid. You may also make changes to any undimmed area in the grid.

- You may delete a line that is in the grid by placing the cursor in any undimmed area of the line you want to delete in the grid and press DELETE.

- You should see a "Delete this Line" confirmation box. Press YES to delete the line. NO will not delete the line.

- If you see a "Delete this record" confirmation box when you are trying to delete a line always press NO or you will delete the entire journal entry.

- Account Number

- Enter or select the general ledger account number to apply the debit or credit amount to.

- Account Numbers with an effective date range will return an "Account Number Entered not Valid for the Date Entered" error message, when an attempt is made to save the line with a transaction date that is not within the account number's effective date range.

- Account Description

- When a valid general ledger account number is selected this area will display the description for the general ledger account number and become dimmed which will not allow users to alter the description.

- There is a memo field for the line that allows users to enter a more descriptive entry for the transaction.

- Source

- Select a Source for the transaction. JV will be the most common selection.

- A source is not required; however, it is a way to group entries for a better audit trail. You may also printout or view some reports grouped by source.

- Source options:

- BC - Bank Credit

- BD - Bank Draft

- DP - Deposit

- IFC - Interfund

- INT - Interest

- JV - Journal Voucher

Please note that the source IFC does not interface to the check book. Use Source IFC only for transactions to cash accounts that do not affect the check book. These transactions must balance and have a zero effect on cash over all.

Please note that the source IFC does not interface to the check book. Use Source IFC only for transactions to cash accounts that do not affect the check book. These transactions must balance and have a zero effect on cash over all.

- Reference

- Reference is an optional field.

- You may enter anything you would like to track for the entry line.

- Use a check number, invoice number, name, etc. (up to ten characters).

- Transaction Date

- Enter or select a transaction date for this entry.

- A transaction date is required and is the date the debit or credit will be recorded in the general ledger.

- For accounts linked to a check book, the entry will also be recorded in the selected check book.

- Memo

- This field is provided for users to place a memo for the transaction line being entered.

- The memo will follow the transaction into the general ledger trial balance report.

- Debit or Credit

- Enter the amount for the transaction in either the debit or credit field. Do not enter a value in both fields.

- The amount entered will either add to or subtract from the balance display field above the entry line.

- The line being entered is not completed until it has dropped down into the grid area below the entry line.

- Display Grid

- As lines are completed, they will drop down into the display grid.

- Some information may be edited/changed within the grid or lines may be brought back into the entry area for editing.

- Click the Edit box to checkmark it and bring the line back up for editing.

- Lines may be deleted from within the grid by highlighting the line and clicking the delete button.

- Users will see an information box displaying "Delete this line".

- Click YES to confirm the deletion or press NO to close the information box without deleting the line.

- The Display Grid contains the following information:

- Edit

- Line Number

- Account Number

- Account Description

- Date

- Debit

- Credit

- Source

- Memo

- Reference

- Allocation Model

- Save

- Each line of the journal entry is saved once it is dropped down into the grid.

- Click SAVE at the top of the view to save all entries prior to leaving this view and moving on to the GL Journal Edit List.

- Possible errors before a save is allowed:

- Account Number Entered not Valid for the Date Entered - in the GL Account Master, the general ledger account entered has either a Start Date or an End Date the excludes the date of this entry.

- The Date Entered Locked From Entry - The Date entered is locked in the Accounting Period Master or the Check Book has already been reconciled and is now locked from entry.

Adjust an Unposted Journal Entry

If an unposted journal entry needs adjustments after reviewing the edit list, you may come back to the Journal Entry screen.

- J/E Number: click the browse to view the list of unposted journal entries and select the entry you want to edit

- Make any changes needed

- Save the journal entry

- Review the edit list again

Delete an Unposted Journal Entry

Only Journal Entries that have not been posted may be deleted. Once a journal entry is posted, you will need to process another journal entry to correct it.

- J/E Number: click the browse to view the list of unposted journal entries and select the entry you want to delete

- Make sure your cursor is in the J/E Number field

- Click DELETE

- You will receive a "Delete this record" confirmation box. Upon pressing YES, the entire journal entry is deleted.

GL Journal Edit List

The edit list will subtotal each journal voucher. A JV that is out of balance will be noted on the edit list. If the total of all JVs balance, they will post.

NAVIGATION: ACTIVITIES menu > Journal Edit List

NAVIGATION: ACTIVITIES menu > Journal Edit List

- Display/Order by: click the circle to select the sort order by:

- Entry Number

- When selected, the edit list will show the information for the journal entries in the order that they were entered into the Journal Entry view.

- Account Number

- When this option is selected, the journal entry information will be shown in account number order.

- Entry Number

- Reference Number User ID (Blank for All)

- Leave this field blank to generate an edit list containing all entered but unposted journal entries.

- Enter a User ID to constrain the edit list to only those journal entries that contain that user identification.

- The default User ID used when entering a journal entry are the initials of the person who is logged into the program.

- Journal Number: use this field to select one journal entry to review

- Filtering

- A Journal Number or Filtering may be used as additional selection criteria or these fields may be left blank.

- Use the Filtering options to find out of balance entries within your Balance Controlled Segments.

- For Example: If Segment Fund is out of balance for Funds 10 & 20, try running the edit list for Fund 10 to see only those entries to help find out what entry is extra or missing. Then run the edit list for Fund 20 and compare the two lists to find the incorrect entries.

- Print, preview, or save the report (see Report Preview, Print and Save Options).

- Review the edit list:

- If a journal entry is out of balance, a notice will be displayed or printed stating "Posting is Out of Balance".

- Two out of balance transactions that together balance the edit list will post.

- If any balanced controlled segments are out of balance, the end of the edit list will have a summary of these segment balances. This will show each segment that is out of balance with the total Debits, Credits and a Net (out of balance).

- Warning: If summary shows two different segments such as Fund and Department out of balance, it may be the same entry causing both balance issues.

- If out of balance segments are listed, or if you need to edit an entry Go to ACTIVITIES menu > GL Journal Entry; click on the browse button by the J/E field and select the voucher to edit.

- When finished editing, review your edit list again.

Post GL Journal Entries

NAVIGATION: ACTIVITIES menu > Post Journals

NAVIGATION: ACTIVITIES menu > Post Journals

- User ID

- The User ID will default to the user logged in.

- To post all journal entries regardless of who entered, remove the User ID and leave the field blank. All journal entries will be posted.

- To post only one user's journal entries, enter the user initials in this field. Only entries with this User ID will be posted.

- Click POST

- Print, preview, or save the report (see Report Preview, Print and Save Options).

- If you receive the following error during the posting process, "Errors in Posting Detected", click the View Errors button. This will display the error report.

- Errors may be for out of balance segments or Locked Accounting Periods. Review the errors and edit the journal entries to correct or reopen the accounting period(s).

- After correcting the journal voucher, review the edit list again and post.

Drag and Drop Journal Entries

- Journal entries may be created in Microsoft Excel, version 2003 or later and "dragged and dropped" onto the view.

- Lines within the excel file that have zero entered for both the debit and credit fields will not import into the journal.

- Blank lines within the import file will stop the import from completing.

- If errors are found in the Excel file, the process will be halted and information will be displayed in the Excel file to indicate where the error is.

See General Ledger - Import Journal Entries

See General Ledger Journal Listing

8/2023