![]()

![]()

Revised: 11/26/2013

Go to Utilities>>Automated Tax Update

![]()

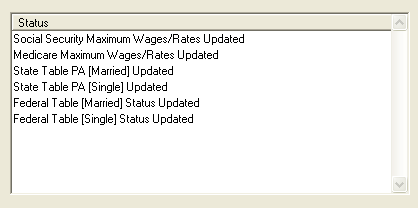

This program will update Social Security Maximum Wages/Rates, Medicare Maximum Wages/Rates, State Tax Table PA for Married and Single Employees, Federal Tax Tables for Married and Single Employees and PSD tables and local tax rates.

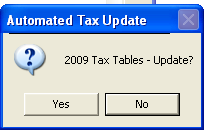

Press the Update Process button on the Quick Links bar to begin the update process. An Automated Tax Update information box like the one shown below will be displayed:

The information box displays the tax year information that is to be updated.

Click "Yes" to update tax information for the year specified if the year is valid

Click "No" to close the information box without updating the taxes

When "Yes" is clicked the system will update the tax information displayed under Status as shown below:

Users are required to review the following tax information to verify the update's success:

Payroll Settings>>FICA Parameters

State Income Tax Tables/Unemployment Taxable Wages>>State = PA for both Married and Single tables

Federal Annual Income Tax Table for both Married and Single tables

Clicking the Close button will close the program view.