![]()

![]()

Revised: 05/26/2017

Go to Maintain>> State Taxes

![]()

This program is used calculate tax information for employees. Multiple states or tables may be set up. The state tax tables are then tied to the Employee Master by selecting the appropriate Tax State (code) on the Withholding/Dates tab for each employee. Pennsylvania State taxes may be updated using the Automatic Tax Update program.

Delaware (DE) state tax calculation was added to the program in May of 2017. At this time, the DE tax tables are not included in the Automatic Tax Update process.

PA state taxes are calculated by taking the Allowance per Dependent times the dependants claimed and subtract from gross wages. For DE, the calculation is to subtract allowances from the annual tax due.

See Also:

Information may be automatically updated for the state of PA using the Automated Tax Update program or updated manually. However the tax information is updated, it should be reviewed for accuracy.

Unemployment information is unique to each company and cannot be updated automatically. Enter the unemployment information when it is received from the state.

Enter or select a two digit code for the state tax to be setup.

For Example:

Enter PA

Select either S-Single or M-Married and press F9. A table will need to be setup for both.

Enter the percent figure sent to the employer by the state. The percentage figure may be given to you as an actual number (.016523), convert it to a percentage by multiplying by 100.

For Example:

8000.00 @ 1.65%

Enter your 7 digit identification number. If the seven digit number was previously entered as the State ID, the program will copy the number to the UC ID Number field and the State ID should be updated. The UC ID Number should be entered under the Single information for the State in order to pull up in the U.I. Account # field in the Unemployment Export program.

The UC Reiimbursable box should be checked if the company/employer qualifies for reimbursable status.

Three types of employers are eligible for reimbursable status:

Article X (Commonwealth Agency (State) accounts)

Article XI (Internal Revenue Code Section 501(c)(3) non-profits)

Article XII (Political subdivisions)

Enter the company's state identification number in this field.

If the state you are entering has an allowance per dependant amount, enter it here.

This field is reserved for a future use and at this time it should always remain blank.

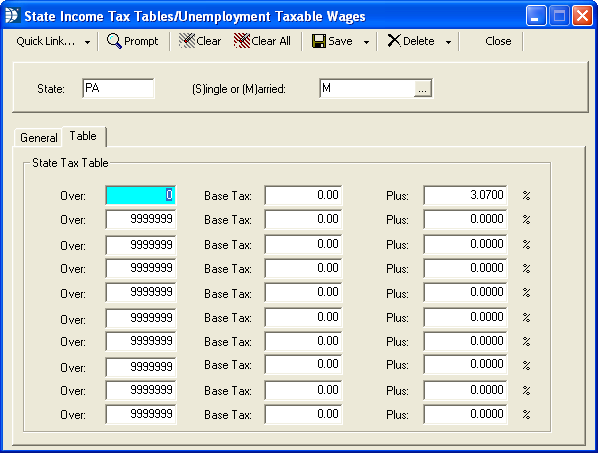

View or enter your state's tax table information in this view.

Shown is a straight percentage tax of 3.07 for Pennsylvania.