![]()

![]()

Revised: 10/08/2013

Go to Maintain>>Tenants (Active) Quick Link>>Household Composition>>Quick Link>>Deduction Information

or go to Inquiries>>Inactive Tenants>>Quick Link>>Household Composition>>Quick Link>>Deduction Information

This program is used to enter deduction information for members and may be accessed from the quick link menu or from the deduction window in Household Composition.

At the top of the view are functions such as save and delete. For more information on functions click here.

The header displays the name of the head of house, the tenant number and the member number and name of the household member that you are entering/viewing deduction information for.

Header information may be displayed in:

Red meaning the file is locked and "Read Only"

Green meaning the file is unlocked and in "Edit Mode"

Black meaning the program is not using Enhanced Edit

Blue meaning an archived copy of the tenant file is open

The entry area is used to enter or edit individual lines of deduction information. The information is not really saved until the line has been entered completely and has dropped down into the display window.

Enter an existing line number from those displayed in the window to edit or view the information.

When entering a new line, this field may be left blank and the system will assign the next available line number.

Note:

If the displayed lines are numbered incorrectly, run the Renumber/Update Tenant File utility.

Select a Deduction Class (Deduction Code) for a new line entered. For a previously entered line the deduction class will be displayed and may be edited.

When a class has been selected, its description will be displayed in the field under deduction class and in the Modified Description field.

Deduction Class codes are setup in Deduction Codes.

When a Deduction Class has been selected its description will be displayed in the field under Deduction Class and in the modified description field. The modified description may be edited/changed for this line only to more accurately reflect the deduction information being entered.

Enter the dollar amount of the deduction. Clicking on the prompt button to the right of the field ![]() or using the F4 key will bring up a calculator.

or using the F4 key will bring up a calculator.

Enter a number to indicate how often the amount is paid.

The program will calculate the annual deduction by taking the Amount entered times the Frequency entered. Users may also enter the annual deduction amount.

Clicking on the prompt button to the right of the field ![]() or using the F4 key will bring up a calculator.

or using the F4 key will bring up a calculator.

If you are tabbing through the line, the details screen will not open unless you press the enter key when the button is active (has dotted lines around it).

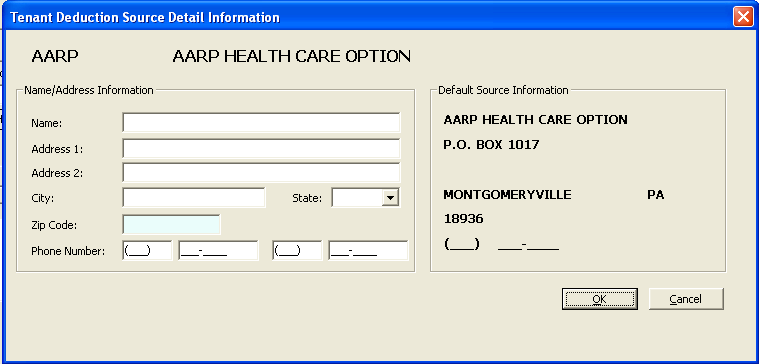

Clicking on the Details button for the line of data will open the Tenant Deduction Source Detail Information screen as shown below:

The deduction window displays the information that was entered through the entry area for each line. Some of the displayed information may be changed in the grid or the line may be brought back up into the Entry Area for editing by double clicking on a line in the window.

The following information is shown in the window:

Line (number)

Class (code)

Description

Amount >> (click on the header button to activate the calculator)

Frequency

Deduction>> (click on the header button to activate the calculator)

The total of all the deduction lines entered is displayed.

*******************

The Deduction Class and Description that was entered for the line are displayed at the top of the view.

If the Default Source Information displayed on the right side of the view is correct, this area may be left blank. The Default Source Information will be merged into forms and letters unless the Name and Address Information is filled in. When the Name and Address is filled in on the left side, it will supersede the default information for merging.

If the deduction name is different than the Default Source Information, enter it here. Otherwise leave this field blank.

In address 1 and 2 enter the address for the deduction if the source it is different than the Default Source Information on the right. Otherwise, leave these fields blank.

Enter the zip code to auto fill the City and State information or enter the City, State and Zip Code if different than the Default Source Information.

Enter a phone and fax number for the deduction line if it is different than the phone number displayed in Default Source Information.

The default source is entered in the Deduction Code Master. Changing a default source would affect every member the deduction code has been entered for.

Click the ok button to save information that has been entered and close the view.

Click the cancel button to close the view without saving information that was changed or entered.

******