![]()

![]()

Revised: 01/25/2012

This help file will outline where in the Horizon Tenant Management module the information on the 50058 form is pulled from. HUD's Validation Tool (http://www.hud.gov/offices/pih/systems/pic/50058/pubs/cvtool/readme.cfm) has been incorporated into the program and will perform a validation when a 50058 is created. HUD's tool will check 50058 data against the MTCS Tech Reference Guide for the latest 50058 form. The HUD tool does not catch every error, it is up to the user to review the information on the 50058 as well.

See Also:

Areas on the 50058:

Family Self-Sufficiency (FSS)/Welfare to Work (WtW) Voucher Addendum

This information is displayed at the top of every page of the 50058 form.

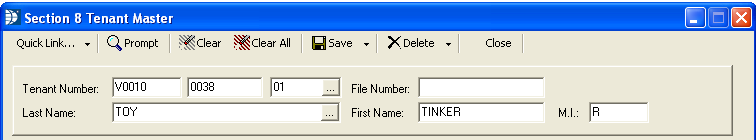

The head of household name pulls from the Tenants (Active) header record Last Name, First and Middle. The name is entered by the user and is never updated from the Household Composition record for the head of household. Make certain that the information is correct and matches the information in Household Composition for the Head of Household. Hud's Validation tool does not validate this information.

Go to Maintain>>Tenants (Active)

This information is displayed at the top of every page of the 50058 form.

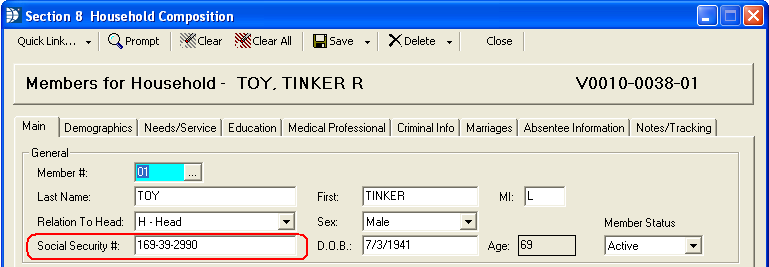

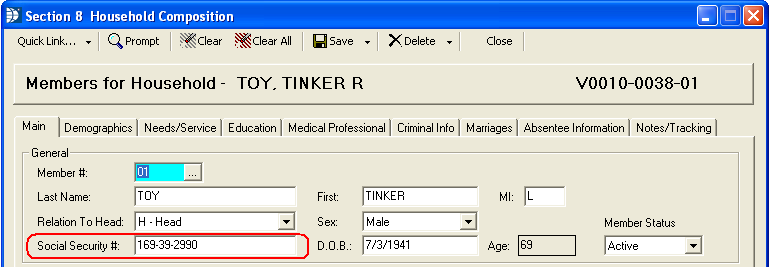

This Social Security Number is pulled from Household Composition from the record marked as H - Head in the Relation to Head field. HUD's Validation tool does not verify this information, it is validated against the information previously sent to PIC, if applicable.

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition

This information is displayed at the top of every page of the 50058 form and is the date the form was created. If the form is recreated, this date will be updated with the recreation date. The date does not pull from any date field in the Section 8 Tenant Management module.

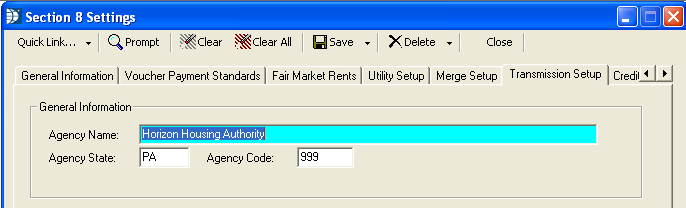

Field 1a on the 50058 form is pulled from Section 8 Settings.

Go to Settings>>Section 8 Management>>Transmission Setup>> General Information>>Agency Name.

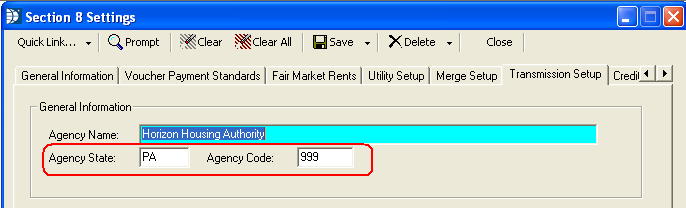

Field 1b is pulled from Section 8 Settings.

Go to Settings>>Section 8 Management>>Transmission Setup>> General Information>>Agency State and Agency Code.

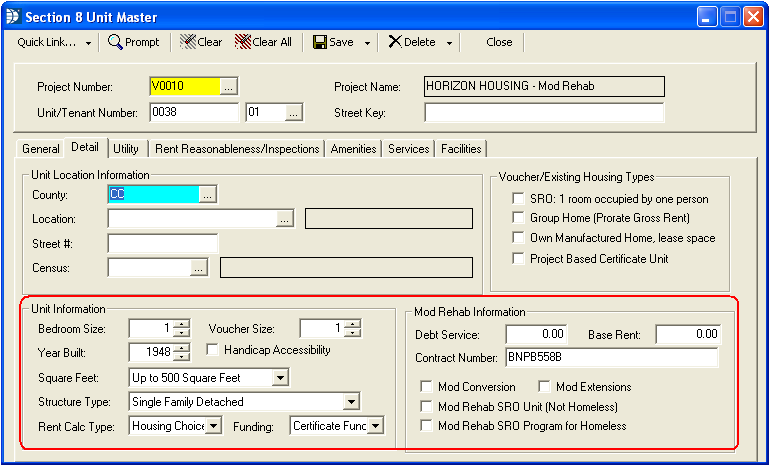

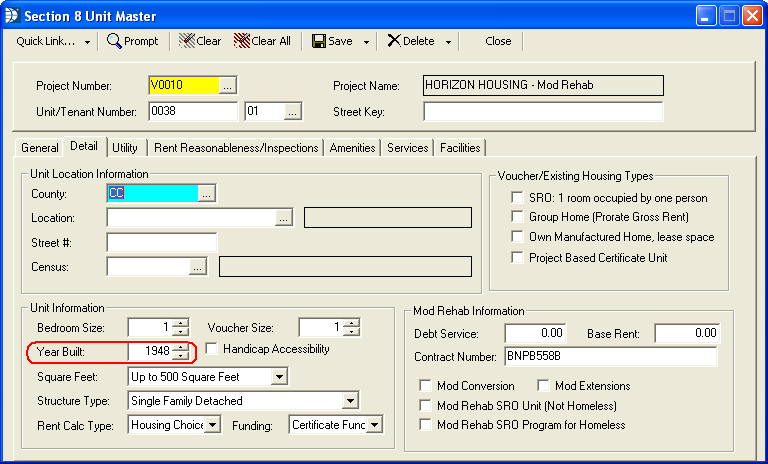

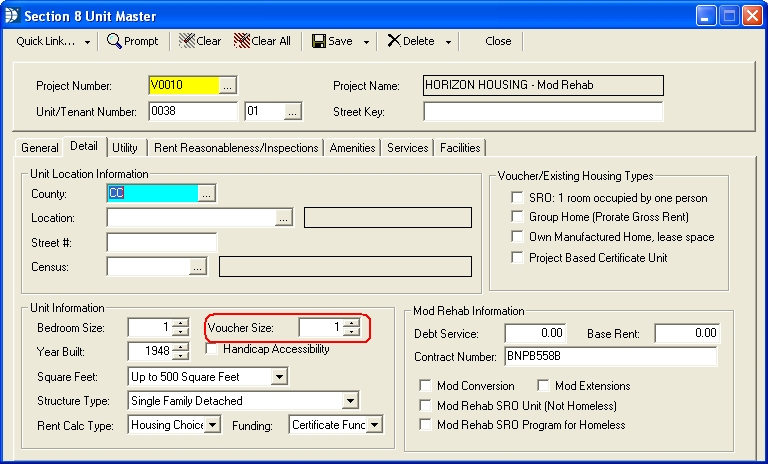

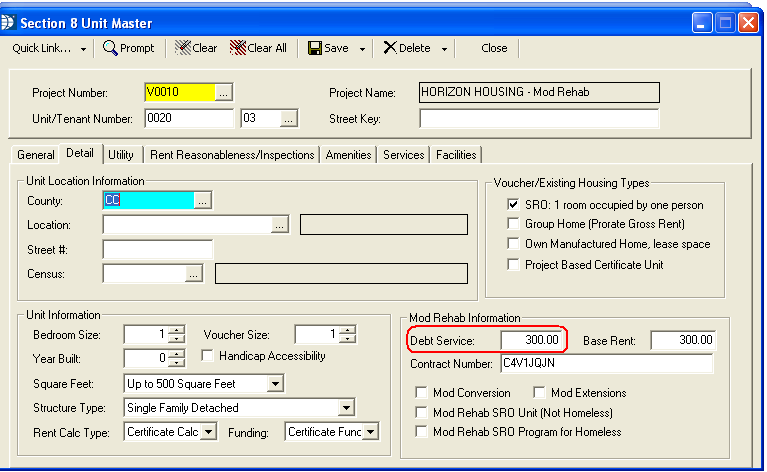

Field 1c is pulled from information entered in the Section 8 Unit Master.

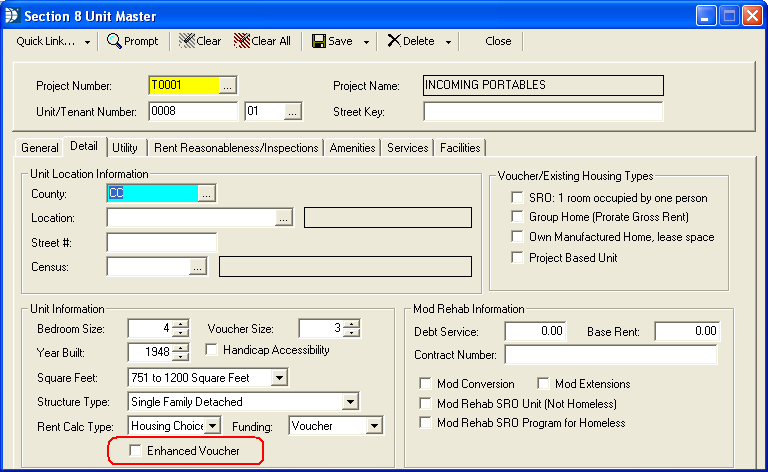

Go to Maintain>>Section 8 Tables>>Unit Master>>Detail tab

Program information may be set for one of the following options CE, VO or MR for Section 8 vouchers.

Field 1d is not used for Section 8.

Field 1e is not used for Section 8.

Field 1f is not used for Section 8.

Field 1g is not used for Section 8.

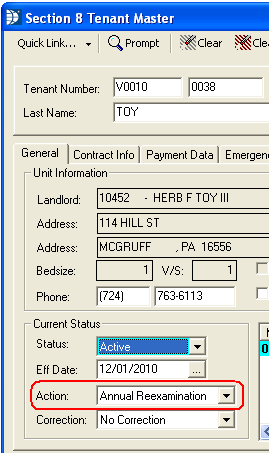

Field 2a Type of Action is based on the action code selected for the tenant in Section 8 Tenant Master (Active). Action codes are listed with their corresponding number at the bottom of the 50058 form.

Go to Maintain>>Tenants (Active)

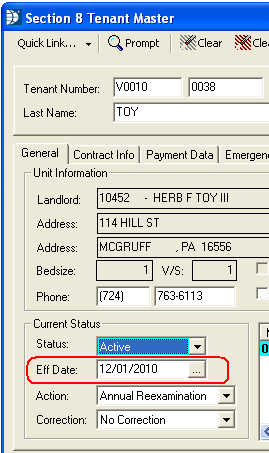

Field 2b is pulled from the Section 8 Tenant Master (Active) Eff Date field.

Go to Maintain>>Tenants (Active)>>Main>>Current Status>>Eff Date

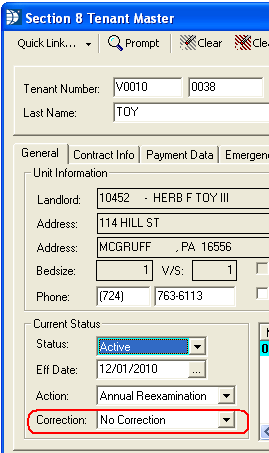

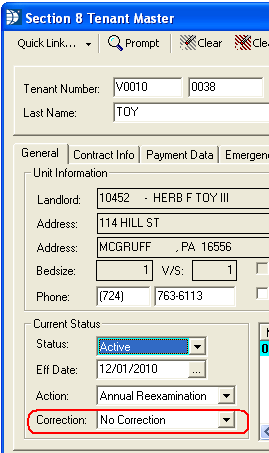

Field 2c will have a Y when the Correction field in the Tenant Master (Active) file has one of the following selected.

Go to Maintain>>Tenants (Active)>>Main>>Current Status>>Correction

Family Correction of Income

Family Correction of Non-Income

PHA Correction of Income

PHA Correction of Non-Income

If the field is left at the default of Not Correction an N will be generated for the 50058.

Field 2d will have one of the following checked, if the corresponding correction reason was selected in the Section 8 Tenant Master (Active).

Go to Maintain>>Tenants (Active)>>Main>>Current Status>>Correction

Family Correction of Income

Family Correction of Non-Income

PHA Correction of Income

PHA Correction of Non-Income

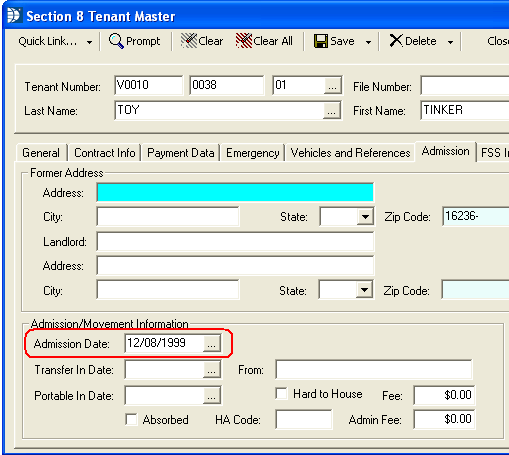

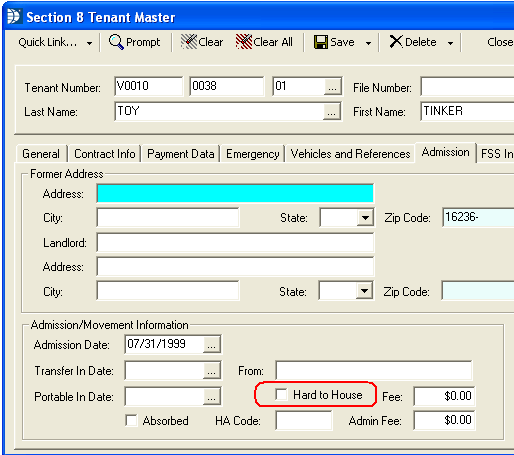

Field 2h is pulled from the admission date in the Section 8 Tenant Master (Active) file.

Go to Maintain>>Tenants (Active)>>Admission tab>>Admission Information>>Admission Date

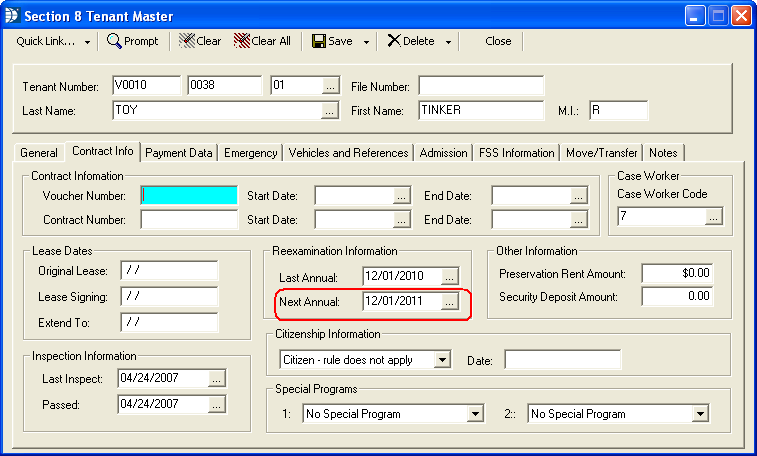

Field 2i is pulled from the Next Annual field in the Section 8 Tenant Master (Active) program.

Go to Maintain>>Tenants (Active)>>Contract tab>>Reexamination Information>>Next Annual

Field 2j Flat Rent is only used in Public Housing programs.

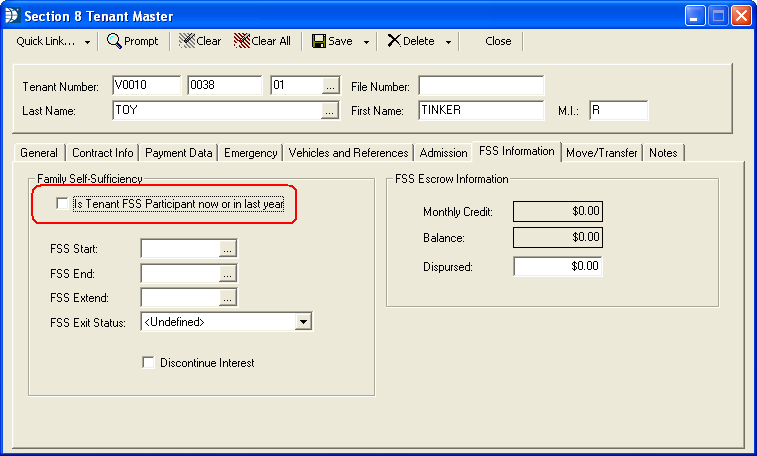

Field 2k pulls from the Is Tenant FSS Participant now or in last year check box. If checked the report will show Y. Unchecked the 50058 will display N.

Go to Maintain>>Tenants (Active)>>FSS Information>>Family Self-Sufficiency

Field 2m Enhanced Voucher check mark, pulls from the tenants Unit Master file at the very bottom of the Detail tab is an Enhanced Voucher check box. When the box is checked, the tenant's 50058 will show a checkmark in field 2m, Enhanced Voucher.

Go to Maintain>>Section 8 Tables>>Unit Master

or go to Maintain>>Tenants (Active)>>Quick Link>>Unit Information

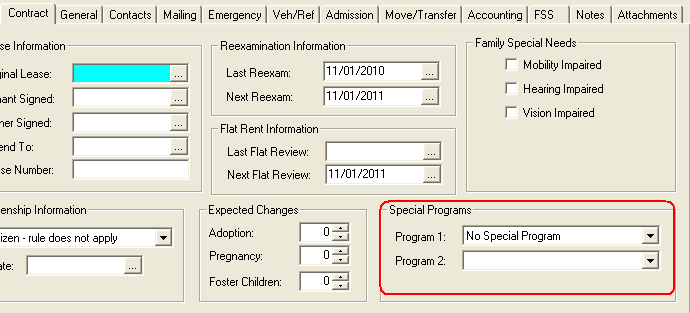

Information for field 2n (1 and 2) pulls from Tenant Master (Active)>>Special Programs.

Go to Maintain>>Tenants (Active)>>Contract tab>>Special Programs>>Program 1 and/or 2.

The program will insert the tenant's Project Number.

The program will pull the tenant's Unit Number.

The program will pull the tenant's suffix

Is left blank at this time for the Section 8 program.

The program will insert the initials of the logged in user who created the 50058.

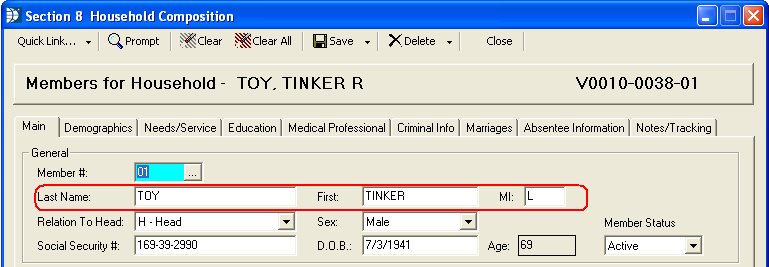

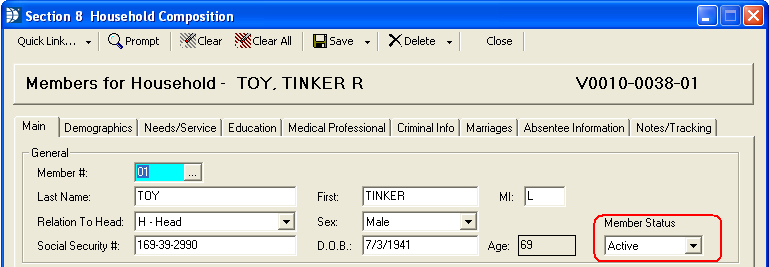

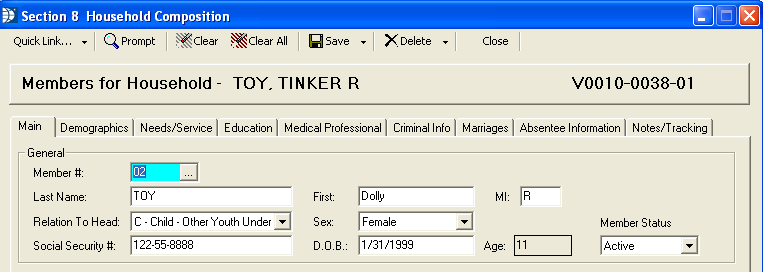

Fields 3b, 3c and 3d pulls from Household Composition for every active member.

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Main.

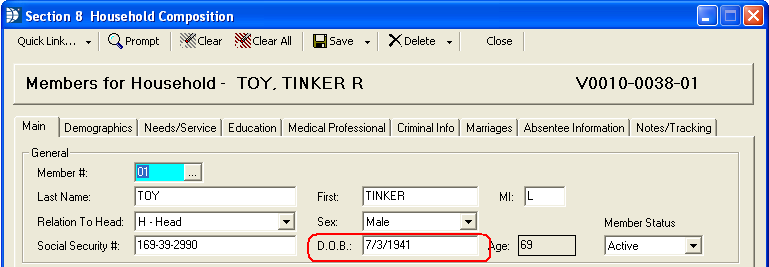

Field 3e pulls from Household Composition for each active member.

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Main>>D.O.B.

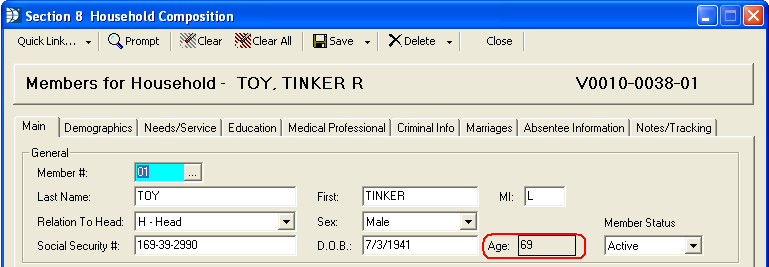

Field 3f pulls from the member's age calculated by the program based on the member's date of birth and the effective date.

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Main>>Age.

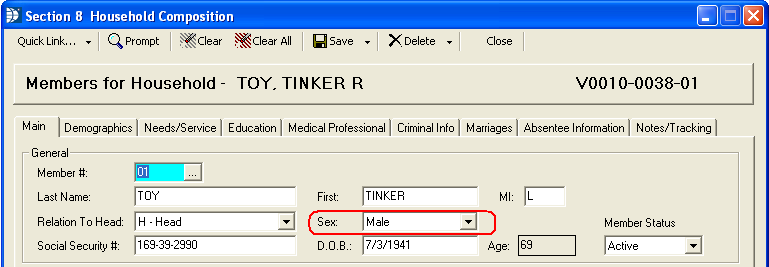

Field 3g pulls from member information entered in Household Composition.

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Main>>Sex.

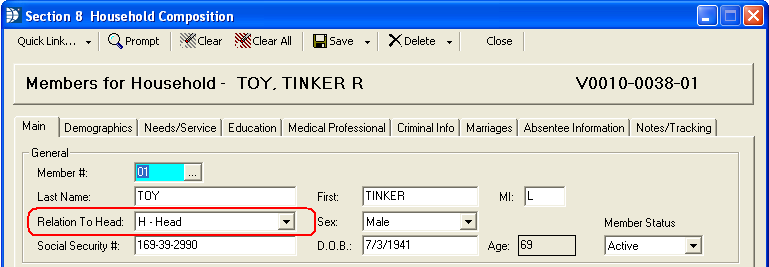

Field 3h pulls from member information entered in Household Composition.

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Main>>Relation to Head.

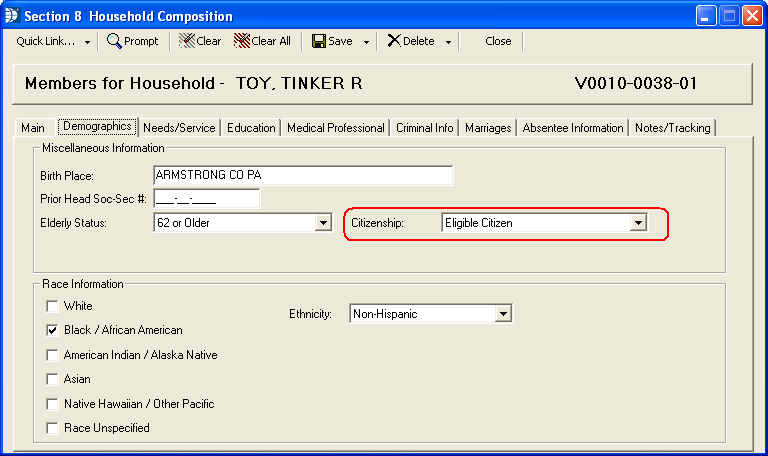

Field 3i pulls from member information entered in Household Composition.

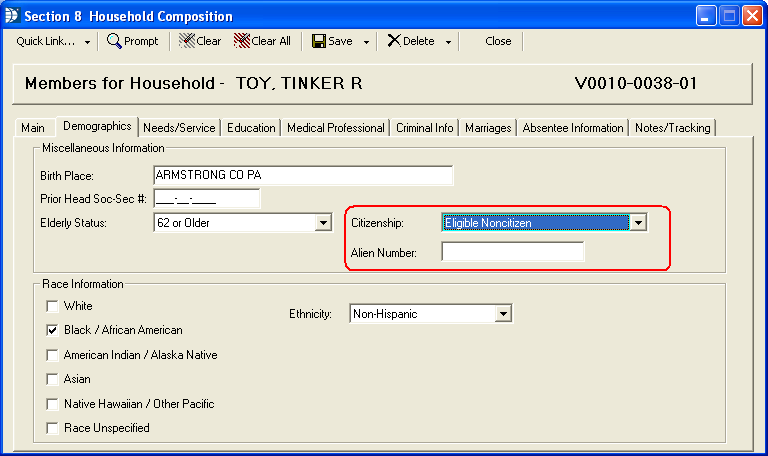

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Demographics>>Citizenship.

Field 3j is pulled from member information entered in Household Composition.

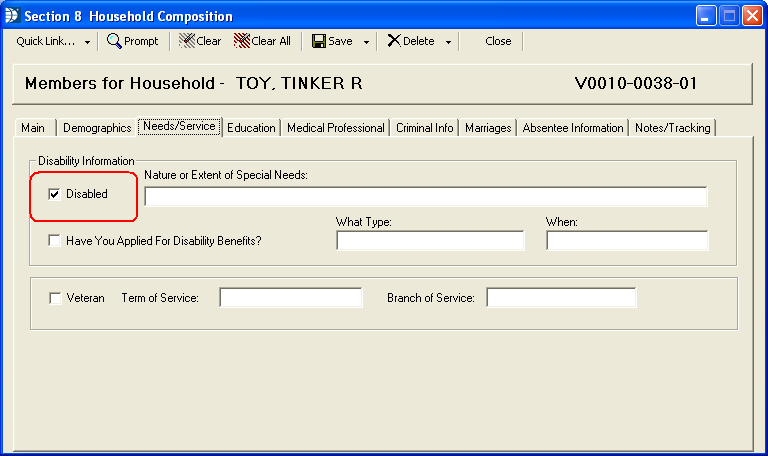

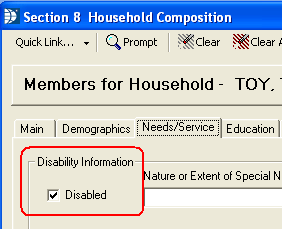

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Needs/Service>>Disability Information>>Disabled.

Field 3k is pulled from member information entered in Household Composition.

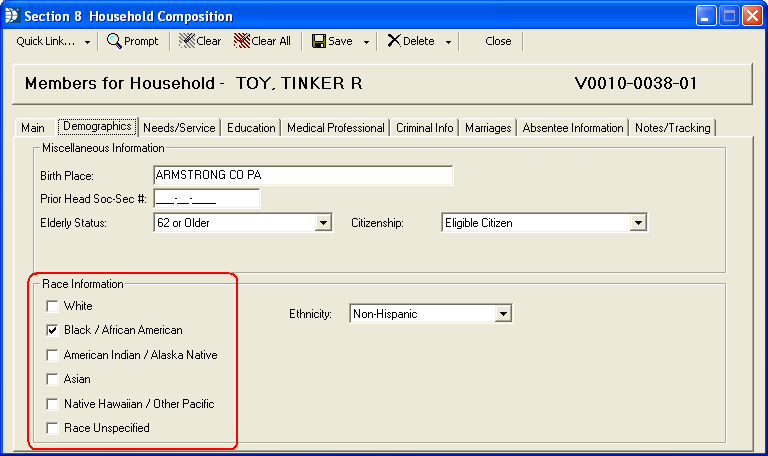

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Demographics>>Race Information.

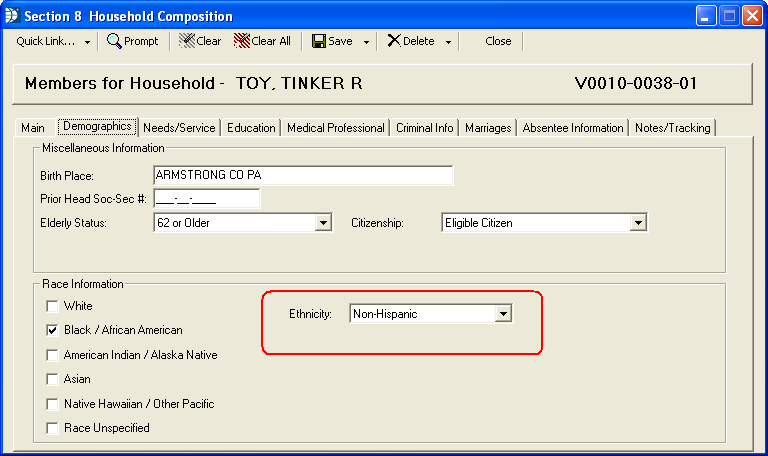

Field 3m is pulled from member information entered in Household Composition, Race Information.

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Demographics>>Race Information>>Ethnicity.

Field 3n is pulled from member information entered in Household Composition.

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Main>>General>>Social Security #.

Field 3p pulls from member information entered into Household Composition. The Alien Number field is displayed when anything other than Eligible Citizen is selected for Citizenship.

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Demographics>>Miscellaneous Information>>Alien Number.

Field 3q is only used for Public Housing.

Field 3t is calculated by the Section 8 program based on the total number of active members in Household Composition.

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition.

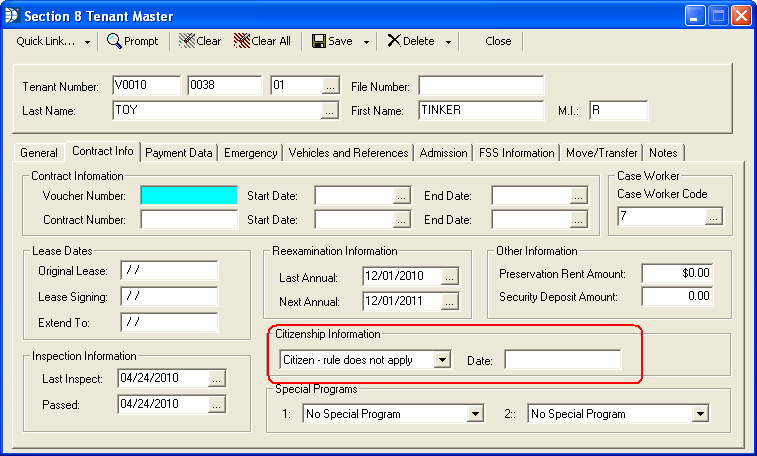

Field 3u is pulled from the Citizenship Information in the Section 8 Tenant Master program.

Go to Maintain>>Tenants (Active)>>Contract>>Citizenship Information.

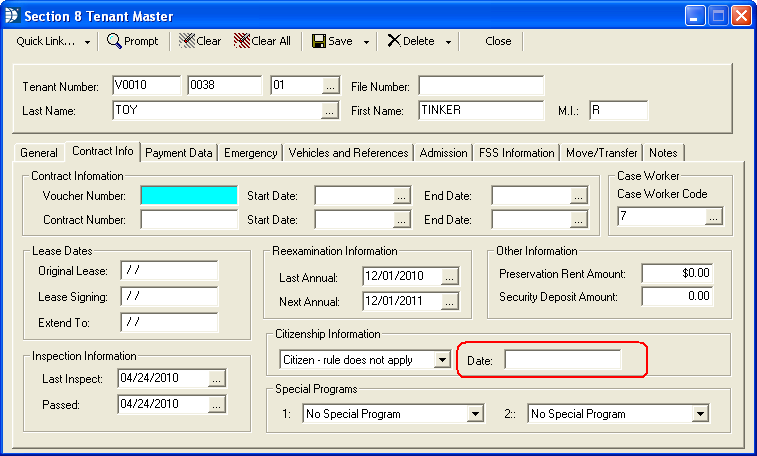

Field 3v is pulled from the date field under Citizenship Information.

Go to Maintain>>Tenants (Active)>>Contract>>Citizenship Information>>Date.

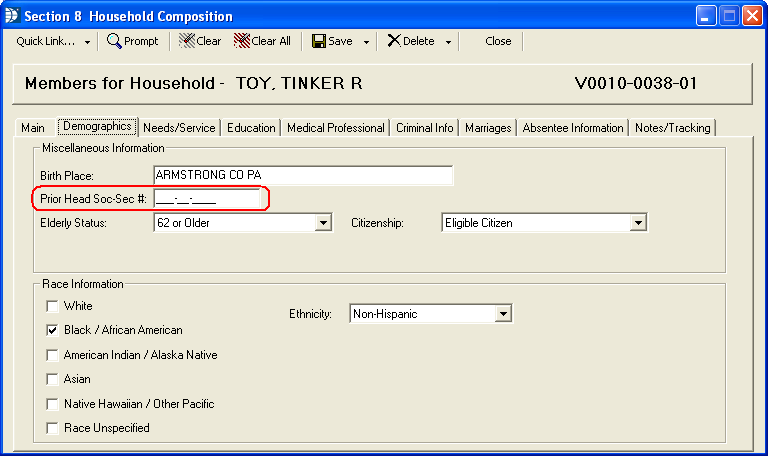

When a change is made to the head of household, the former head of household's social security number should be entered in Household Composition in the Prior Head Soc-Sec # field in the new Head of Household member information. Any SSN entered into this field will pull into field 3w on the 50058 form. HUD's Validation Tool does not validate this information.

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Demographics>>Miscellaneous Information>>Prior Head Soc-Sec #.

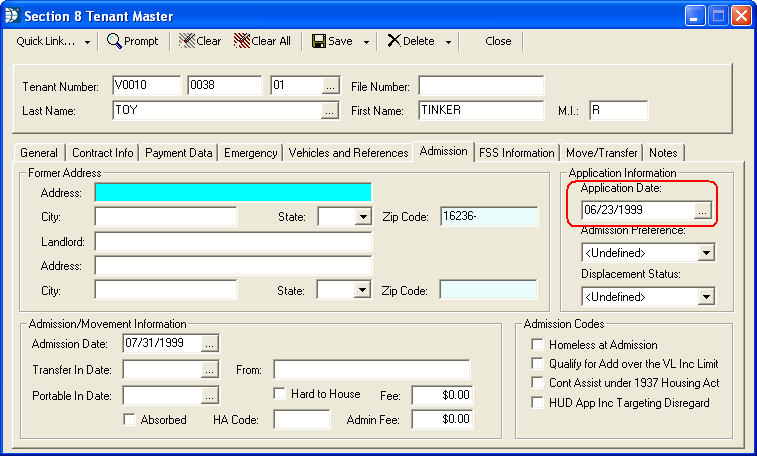

Field 4a will pull the date entered in the Application Date field in the Section 8 Tenant Master. This date will pull over into the Section 8 Tenant Master, from the Horizon Waiting List program, during a transfer using the Applicant to Tenant Wizard.

Go to Maintain>>Tenants (Active)>>Admission tab>>Application Information>>Application Date.

Field 4b pulls from the information entered or pulled from Waiting List for the tenant's former address.

Go to Maintain>>Tenants (Active)>>Admission tab>>Former Address>>Zip Code.

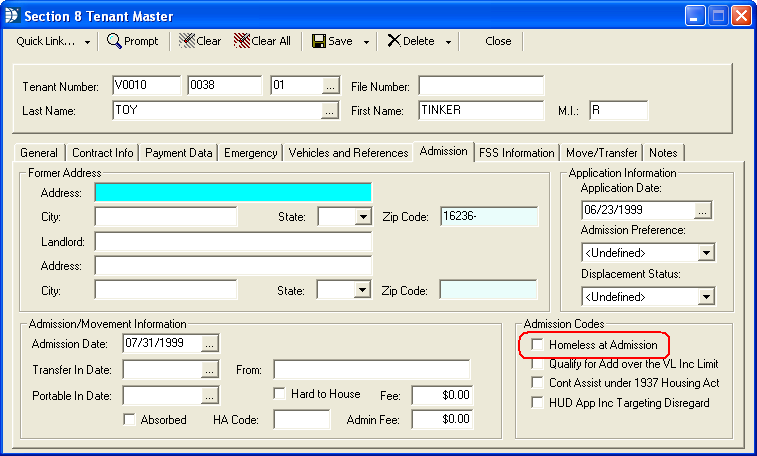

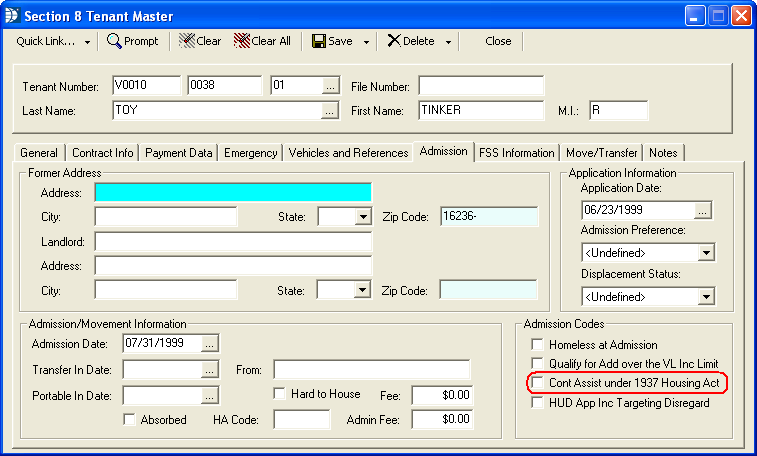

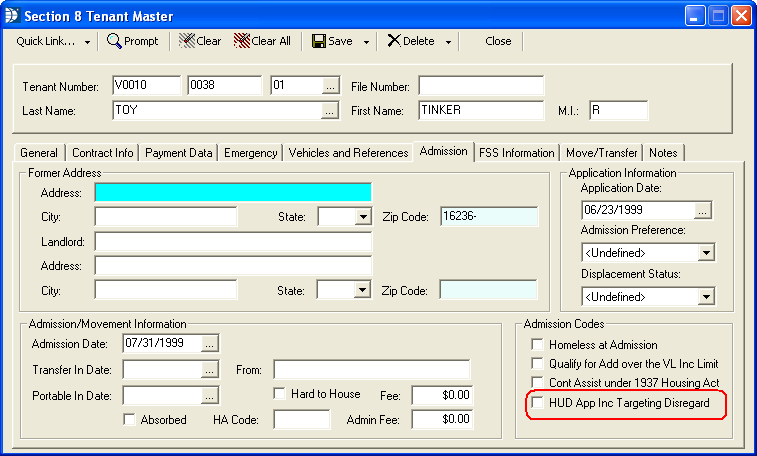

Field 4c pulls from the Homeless at Admission field in the Tenant Master (Active).

Go to Maintain>>Tenants (Active)>>Admission>>Admission Codes>>Homeless at Admission.

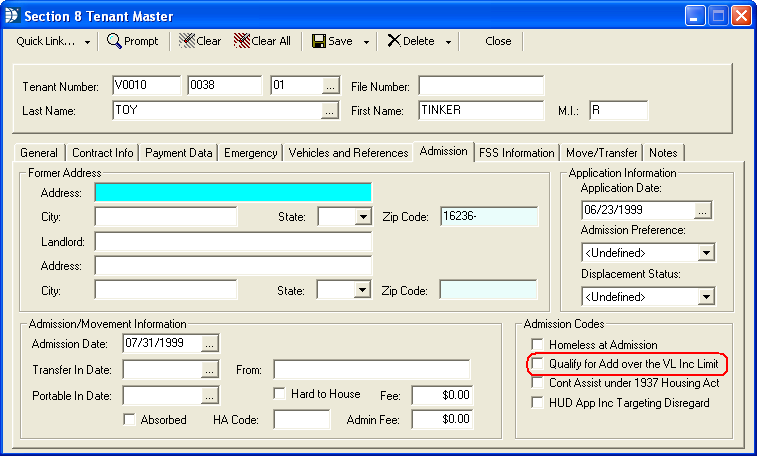

Field 4c pulls from the Does Family Qualify for Admission over the VL Income Limit checkbox. If this box is checked the program will put a Y on the 50058 form.

Go to Maintain>>Tenants (Active)>>Admission tab>>Admission Codes>>Does Family Qualify for Admission over the VL Income Limit.

Field 4e pulls from the Continuously Assisted under 1937 Housing Act checkbox. If the box is checked, Y will be displayed on the 50058 form.

Go to Maintain>>Tenants (Active)>>Admission tab>>Admission Codes>>Continuously Assisted under 1937 Housing Act.

Field 4f pulls from the HUD Approved Income Targeting Disregard checkbox. If the box is checked, Y will be displayed on the 50058 form.

Go to Maintain>>Tenants (Active)>>Admission tab>>Admission Codes>>HUD Approved Income Targeting Disregard.

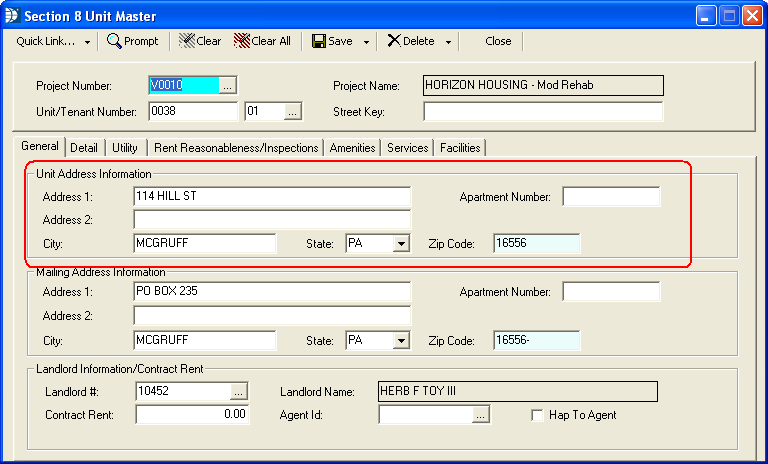

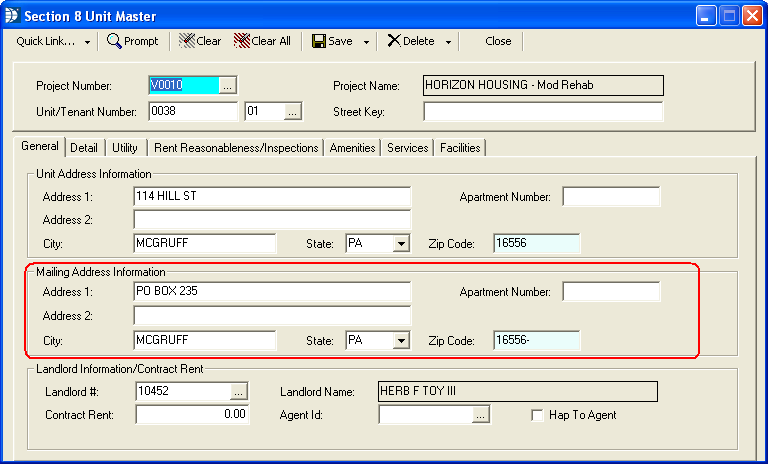

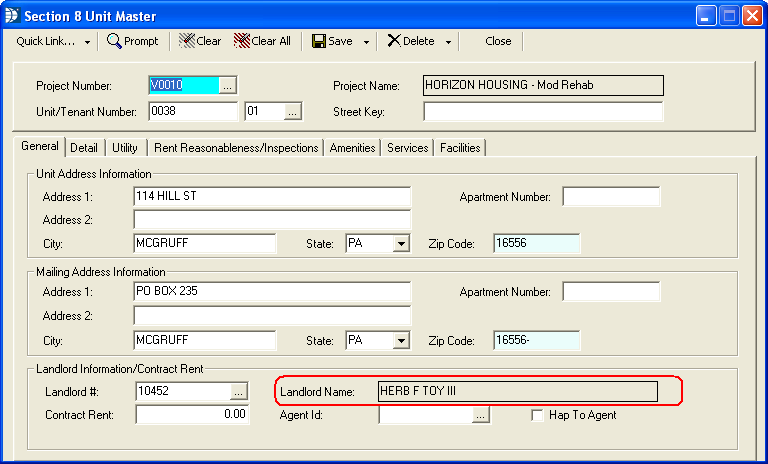

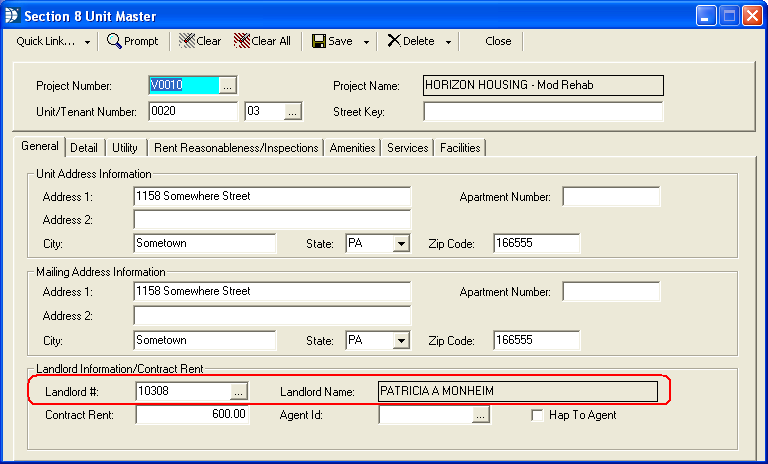

The address fields for 5a are pulled from the Section 8 Unit Master. The unit address entered in the Section 8 Unit Master is displayed in Section 8 Tenant Master, but the address cannot be updated there.

Go to Maintain>>Section 8 Tables>>Unit Master>>Main>>Address Information.

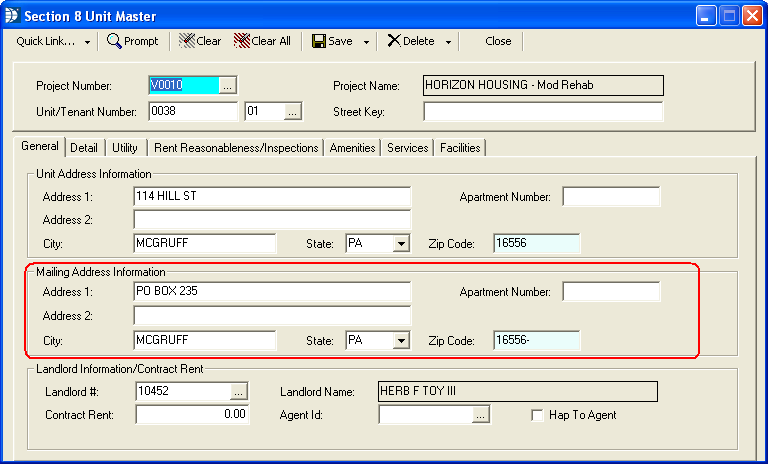

Field 5b will have a N entered if a mailing address is entered for the tenant in the Section 8 Unit Master.

Go to Maintain>>Section 8 Tables>>Unit Master>>Mailing Address Information

Field 5c will display the mailing address entered if field 5b has an N.

Go to Maintain>>Section 8 Tables>>Unit Master>>Mailing Address Information

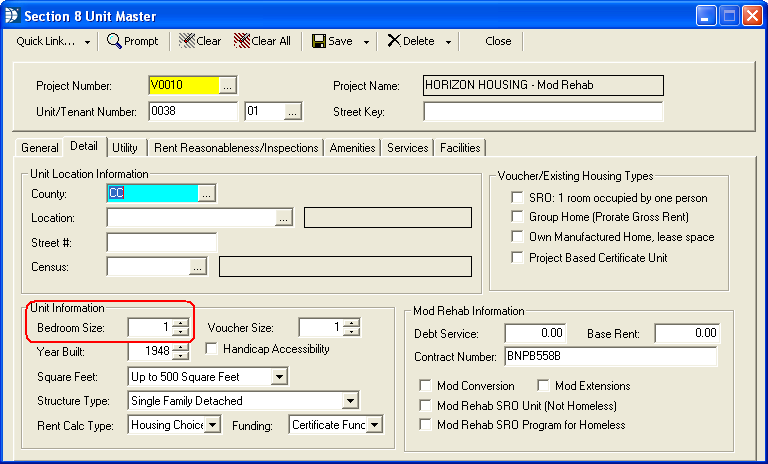

Field 5d pulls from the Section 8 Unit Master.

Go to Maintain>>Section 8 Tables>>Unit Master>>Detail>>Unit Information

Field 5e is not used for Section 8.

Field 5f is not used for Section 8.

Field 5g is not used for Section 8.

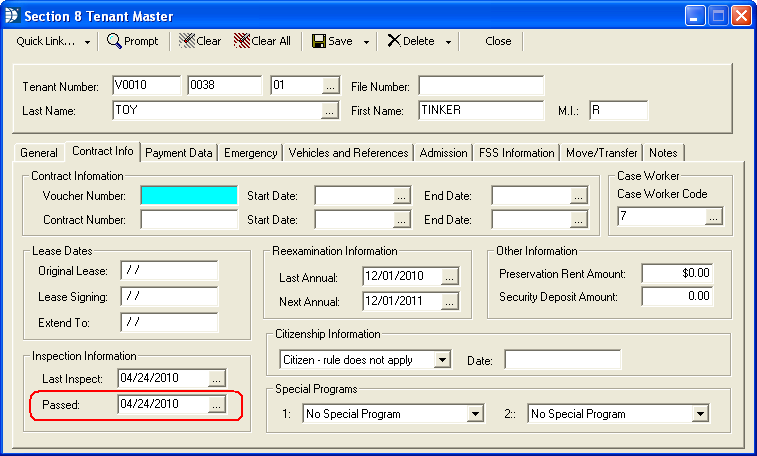

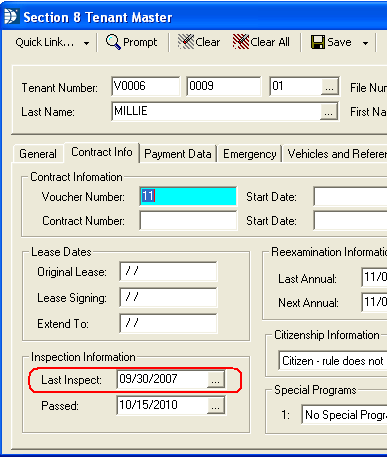

Field 5h pulls from Section 8 Tenant Master, Last Passed field.

Go to Maintain>>Tenants (Active)>>Contract Info>>Inspection Information>>Last Passed

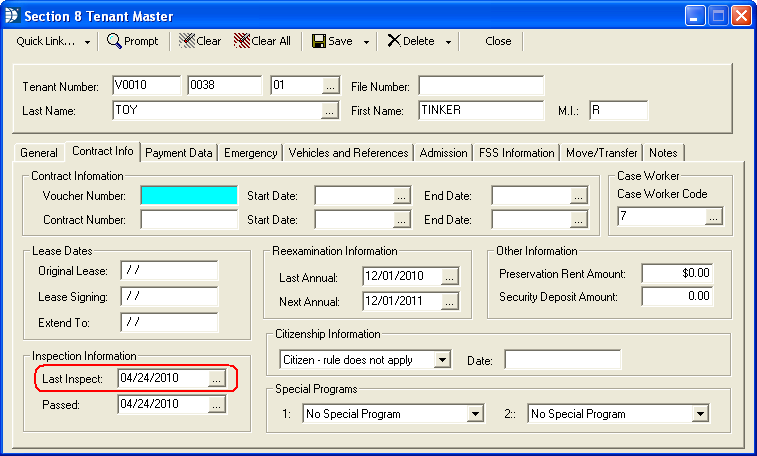

Field 5i is pulled from the Section 8 Tenant Master, Last Inspect field.

Go to Maintain>>Tenants (Active)>>Contract Info, Last Inspect

Field 5j is pulled from the Section 8 Unit Master under Detail, Unit Information.

Go to Maintain>>Section 8 Tables>>Unit Master>>Detail>>Unit Information>>Year Built

Field 5k is pulled from the Section 8 Unit Master, Structure Type field.

Go to Maintain>>Section 8 Tables>>Unit Master>>Detail>>Unit Information>>Structure Type

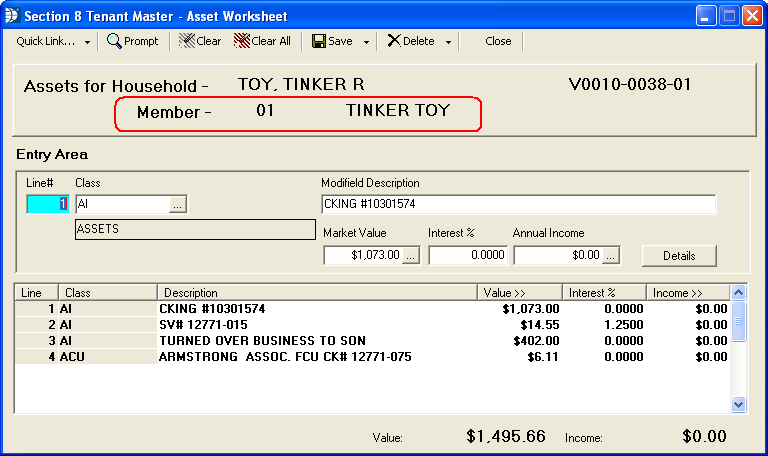

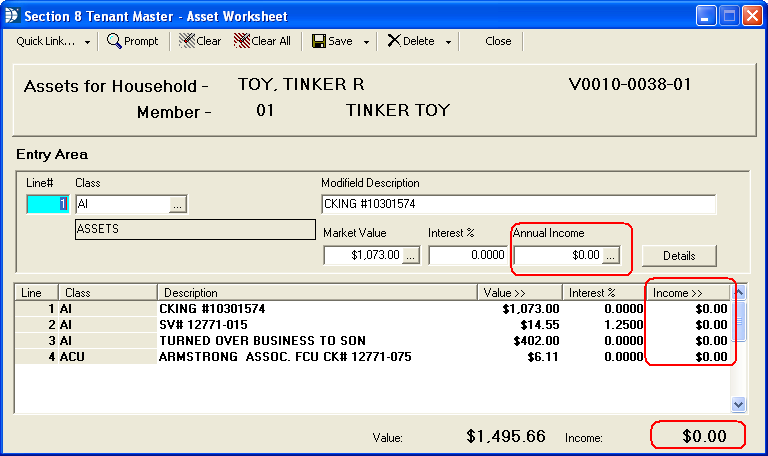

Field 6a is pulled from Household Composition for members who have an Asset listed in their Asset Worksheet.

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Quick Link>>Asset Information.

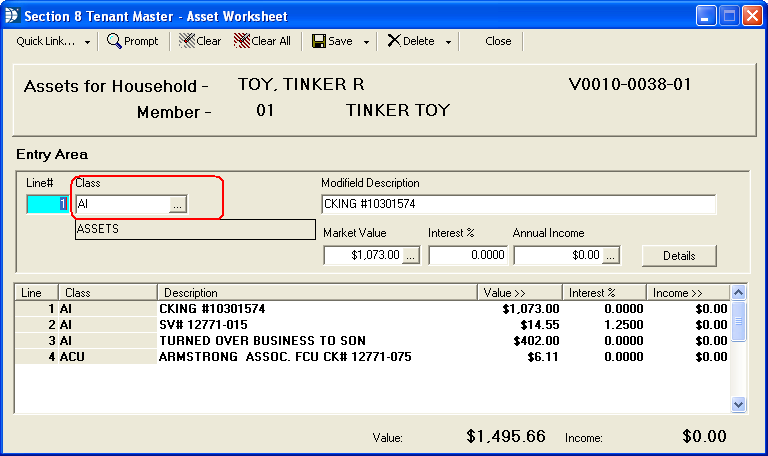

Field 6b is pulled from the member's Asset Worksheet class code. (Class codes are setup in the Income/Asset Type Master program.)

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Quick Link>>Asset Information

Field 6c if only for Public Housing.

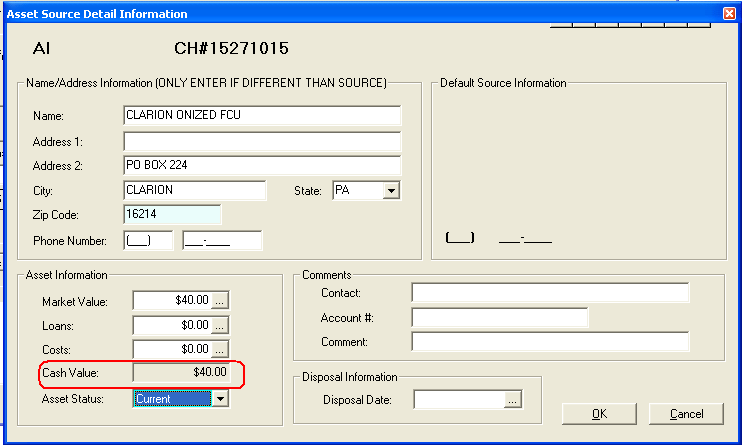

Field 6d pulls from the member's Asset Worksheet, Cash Value field.

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Quick Link>>Asset Income>>Details

When the Details button is pressed for an Asset line, the Asset Source Detail Information screen will be displayed. The Cash Value of an asset is the Market Value adjusted by Loans and Costs.

Field 6e pulls from the member's Asset Worksheet.

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Quick Link>>Asset Information.

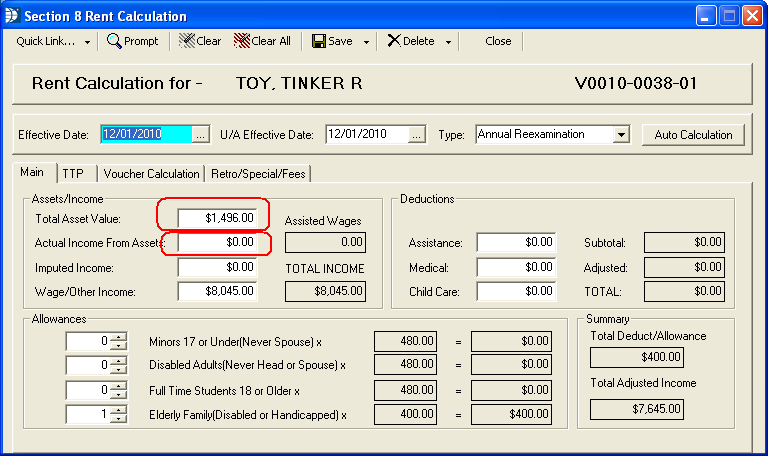

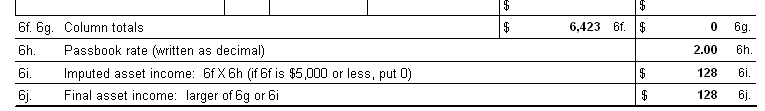

The totals for fields 6f and 6g are pulled from the Rent Calculation program. If Asset information is changed, the Rent Calculation program should be run to update the asset totals for the 50058 before running Create 50058 Record again.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation

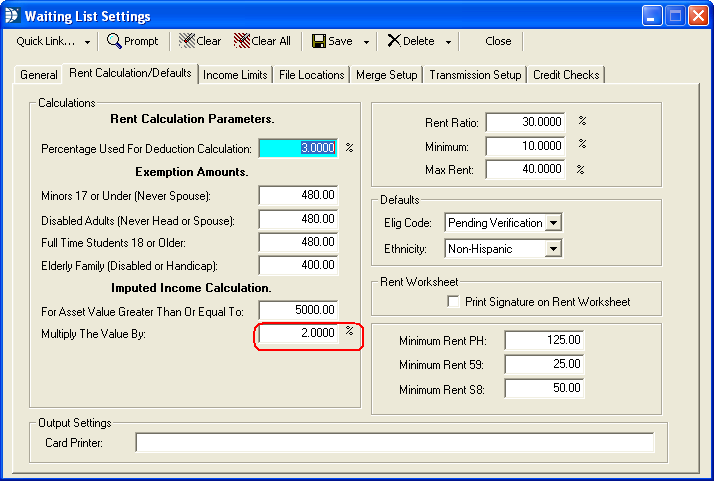

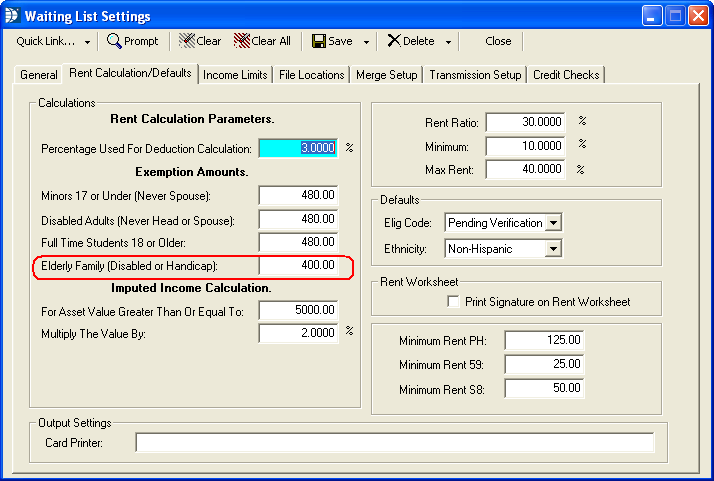

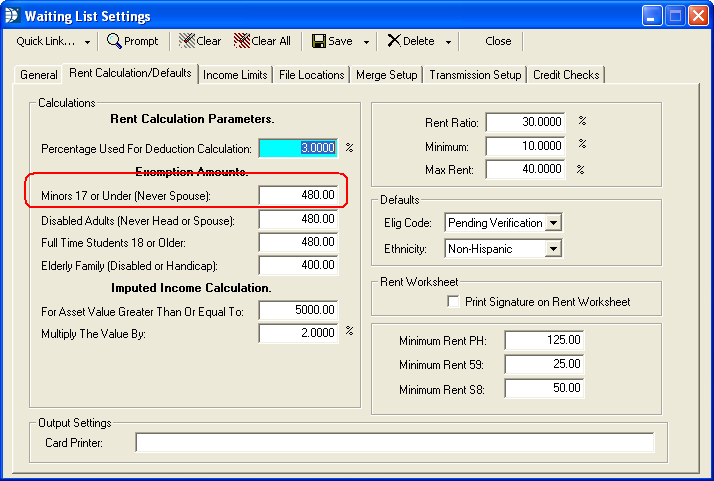

Field 6h is pulled from the Horizon Waiting List program in Waiting List Settings.

Open the Waiting List program and go to Settings>>Waiting List>>Rent Calculation/Defaults

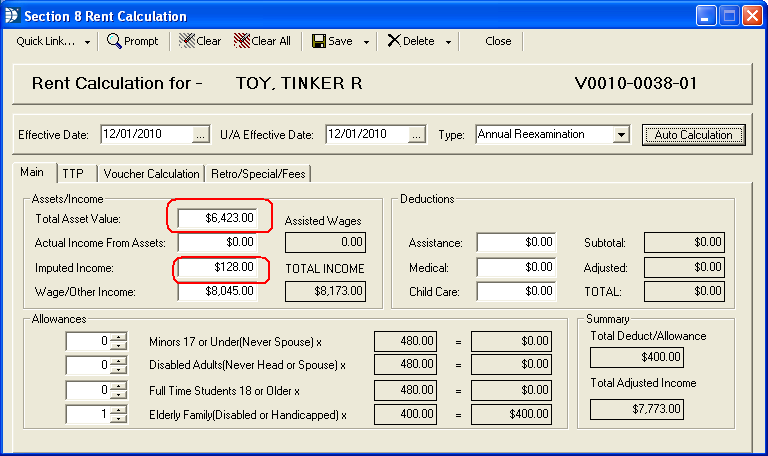

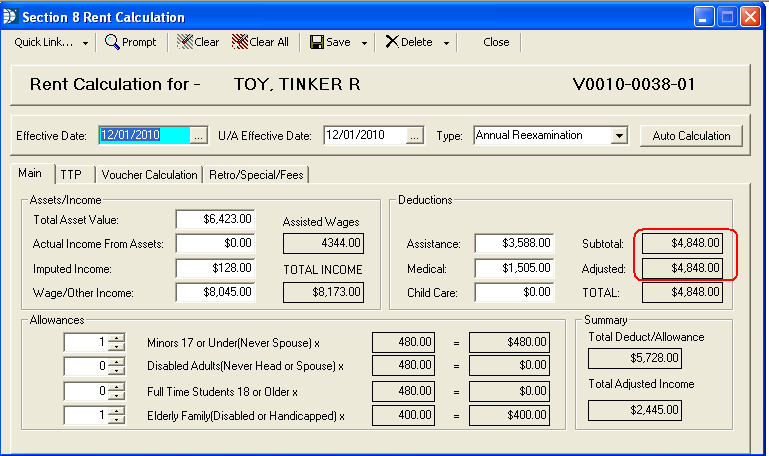

Field 6i is pulled from the Rent Calculation program. In the Rent Calculation example shown, the total asset income was $66,423 multiplied by the passbook rate of 2% = $128.46 which is rounded to $128.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation

Total Asset income for the Rent Calculation is pulled from member's Asset Worksheet information

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Quick Link>>Asset Information

Field 6j will display the larger of field 6g or 6i as shown below:

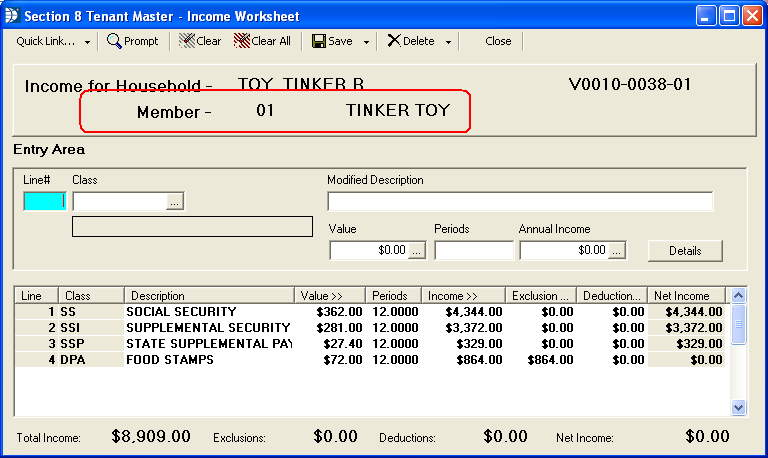

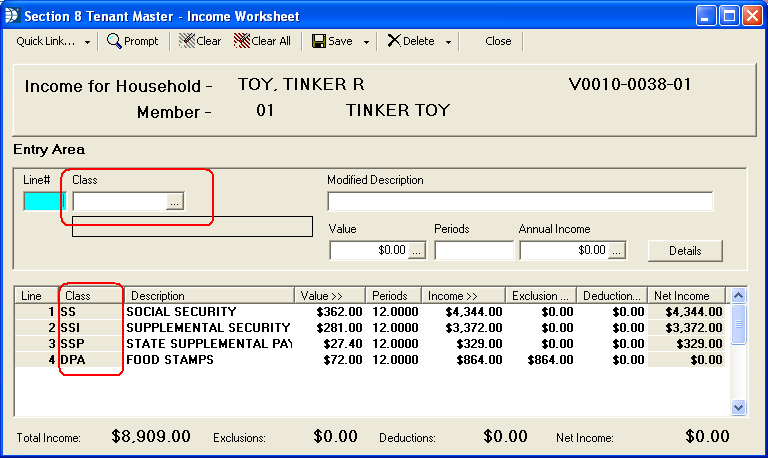

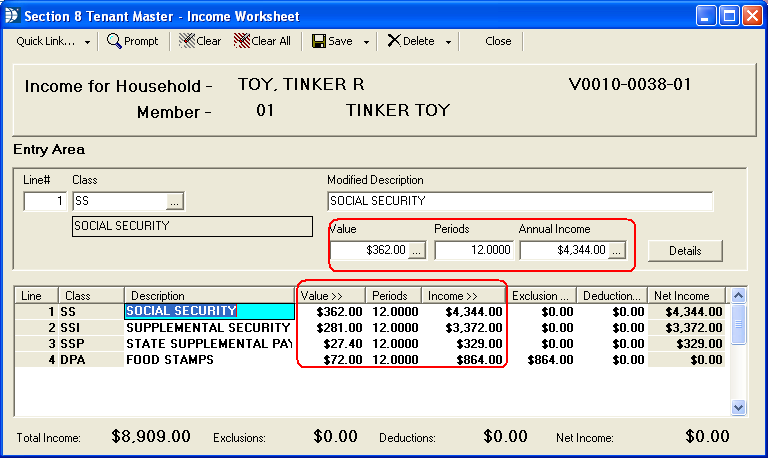

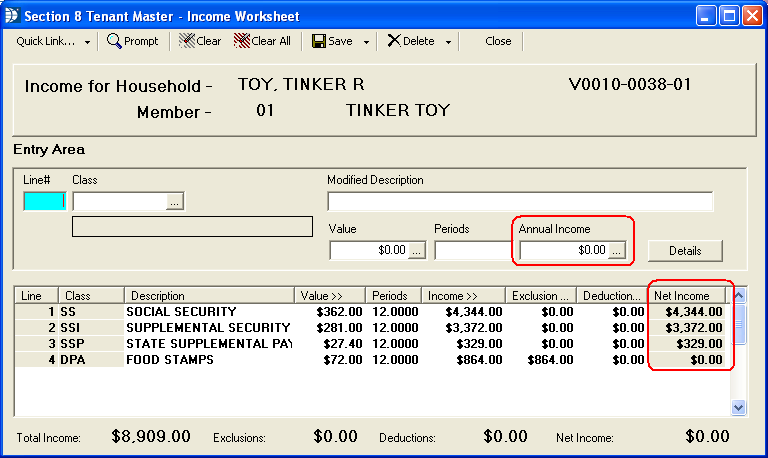

Field 7a pulls from Household Composition for household members who have income entered on their Income Worksheet. Member information from Household Composition is displayed on the member's Income Worksheet.

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Quick Link>>Income Information

Field 7b pulls from member's Income Worksheet information. Class information is setup in Income/Asset Type Master File (go to Maintain>>Tenant Management Tables>>Income/Asset Codes).

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Quick Link>>Income Worksheet

Field 7c pulls from the calculation information from the member's Income Worksheet.

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Quick Link>>Income Worksheet

Field 7d pulls from member's Income Worksheet.

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Quick Link>>Income Information

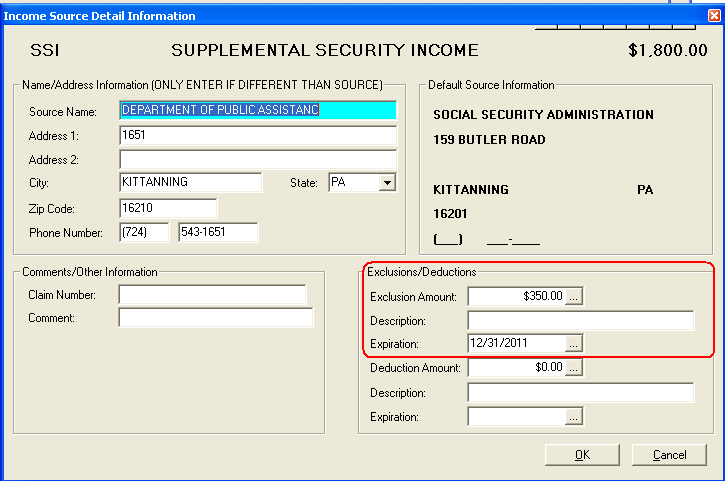

Field 7e pulls from member's Income Worksheet>>Income Source Detail Information.

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Quick Link>>Income Information>>Details

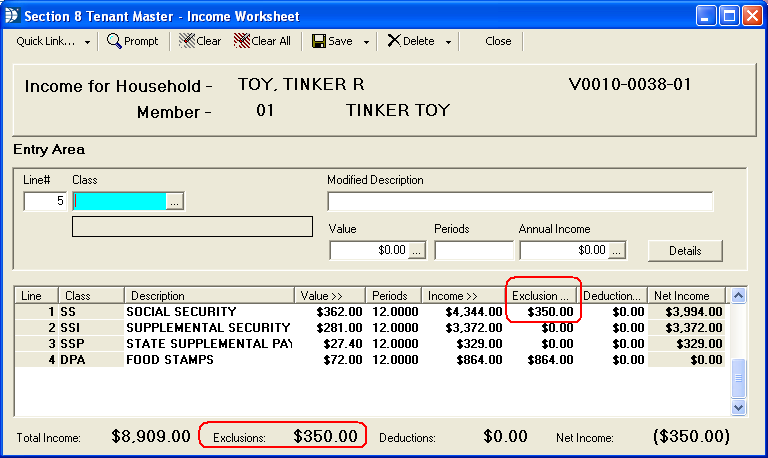

After an exclusion has been entered and OK clicked the Income Worksheet will display the exclusion in the grid and at the bottom of the screen as shown:

In the above example you will notice that the net income is shown incorrectly. If this should happen, please run the Renumber/Update Tenant File from the Section 8 Tenant Master, Quick Link menu. If the net income is still incorrect, please call the Horizon Help Desk for assistance.

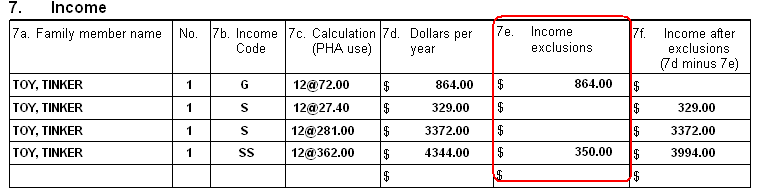

Exclusions are shown on the 58 as shown below:

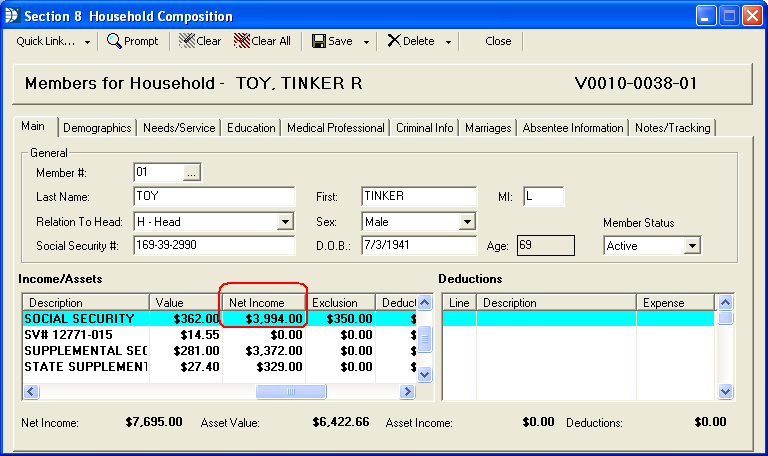

Field 7f pulls from the member's Income Worksheet information and is displayed in the Income Worksheet as well as in the Income/Assets grid in Household Composition (shown below)

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition

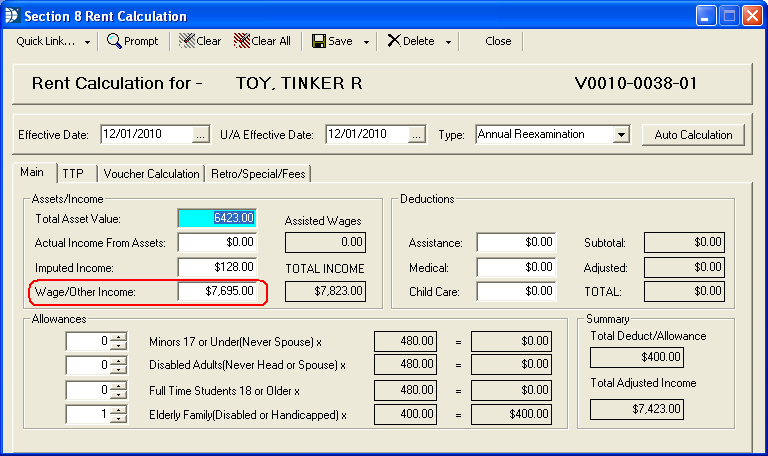

Field 7g pulls from Rent Calculation>>Wage/Other Income.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation

Field 7h is currently not in use by HUD.

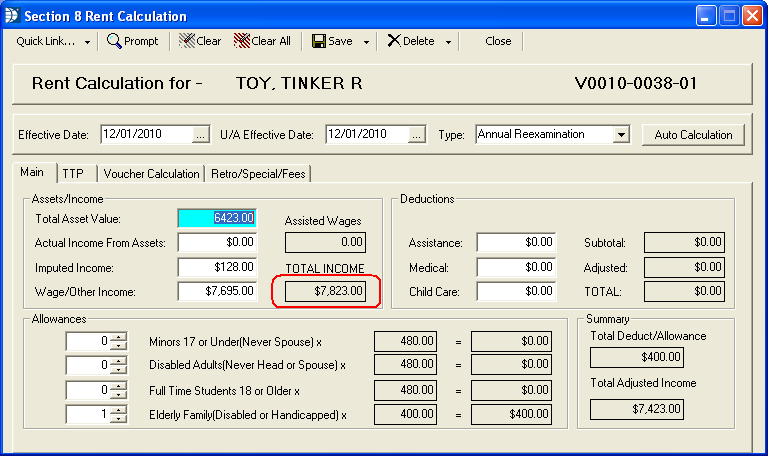

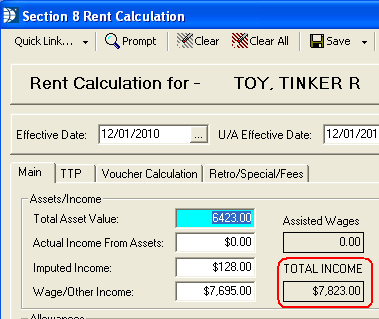

Field 7i is pulled from Rent Calculation, Total Income field.

The information for the Rent Calculation program is pulled from member's Income and Asset Worksheets, which can be accessed by going to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Quick Link>>Income or Asset Information.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation

In the above example, the Total Income amount is the total of Wage/Other Income plus Imputed Income (6i) which was greater than Actual Income From Assets (6g).

Field 8a is pulled from the Rent Calculation program, Total Income field. This information is the same as the information for field 7i.

The information for the Rent Calculation program is pulled from member's Income and Asset Worksheets, which can be accessed by going to Maintain>>Tenants (Active)>>Quick Link>>Household Composition>>Quick Link>>Income or Asset Information.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation

In the above example, the Total Income amount is the total of Wage/Other Income plus Imputed Income (6i) which was greater than Actual Income From Assets (6g).

Field 8b is not used for Section 8.

Field 8c is not used for Section 8.

Field 8d is not used for Section 8.

Field 8e is not used for Section 8.

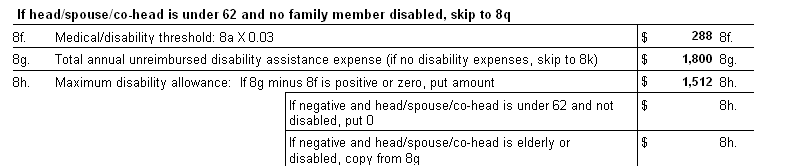

The program will multiply the amount shown in field 8a times 0.03 and display the rounded amount in field 8f.

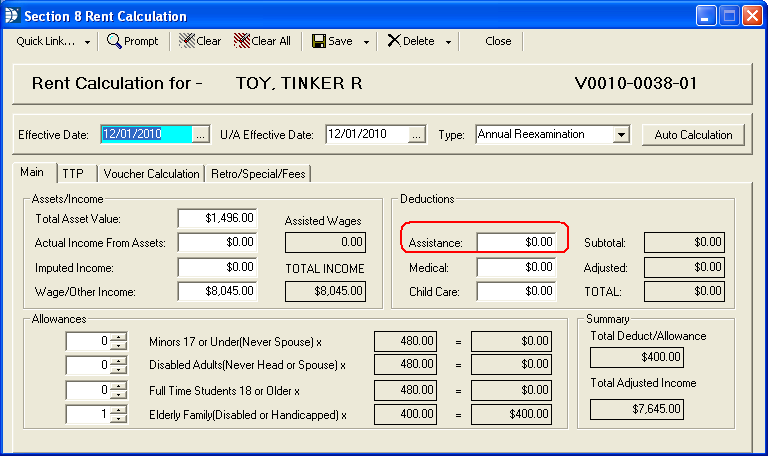

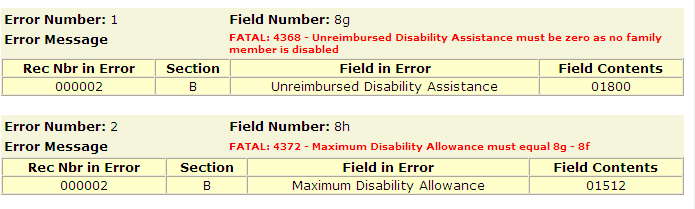

Field 8g is pulled from the Rent Calculation program based on member's Deduction Worksheet for Deduction Classes that have been setup with a Parameter:Type Code of Assistance. This field may be blank if there are no eligible deductions.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation

If the head/spouse/co-head is under 62 and not disabled and no family members are disabled, the following error will be generated if a Deduction Code classified as an Assistance Type code is used for a deduction:

To fix, remove the deduction or select a deduction class that is not a type code of assistance.

Field 8h has 3 possible fields:

1. The first 8h field will display the difference between 8g - 8f if positive. If negative or zero a zero amount will be displayed.

2. The second 8h field will display a zero or nothing if no one in the household is disabled and not older than 62 and the calculated amount is a negative amount.

3. The third 8h field should copy the amount from 8g, if the tenant is age 62 or more or is disabled and the amount in 8g is a positive number and is less than 8f.

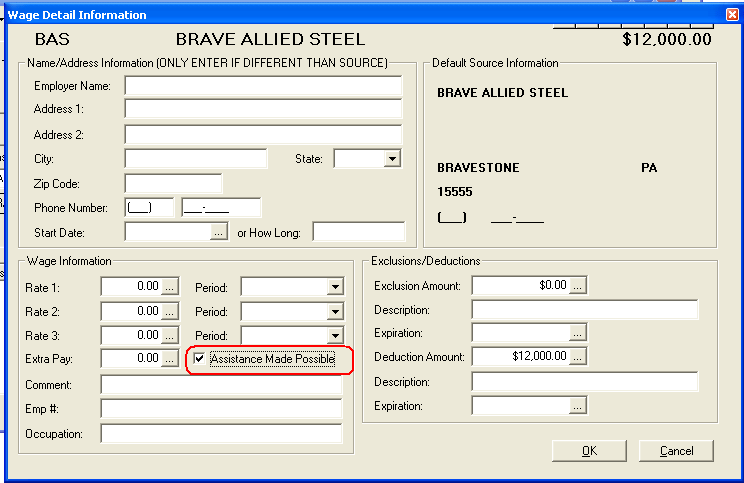

An Income Code that has been setup in the Income/Asset Type Master File with a wage New Type (i.e. Own Business, Military Pay, Federal Wage, Other Wage, HA Wage) will have the Assistance Made Possible field available.

When the Assistance Made Possible field is checked, the earnings associated with the code will be shown in field 8i.

Field 8j will display the information from 8h, 8i or 8g depending upon member disability and/or age of head/spouse/co-head.

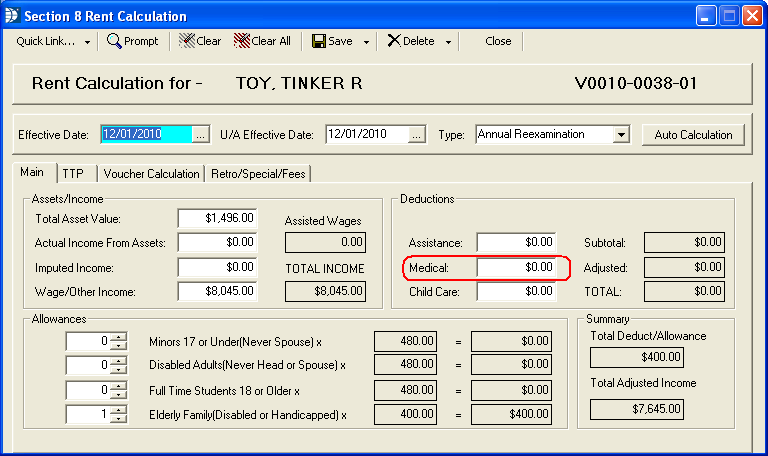

Field 8k pulls from the Rent Calculation program based on information entered in member Disability Worksheets.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation

Field 8m pulls from the tenant's rent calculation. Assistance will not be added to medical unless there is a check mark in the wage earners "Assistance made possible" field in the Income Worksheet and a family member is disabled.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation

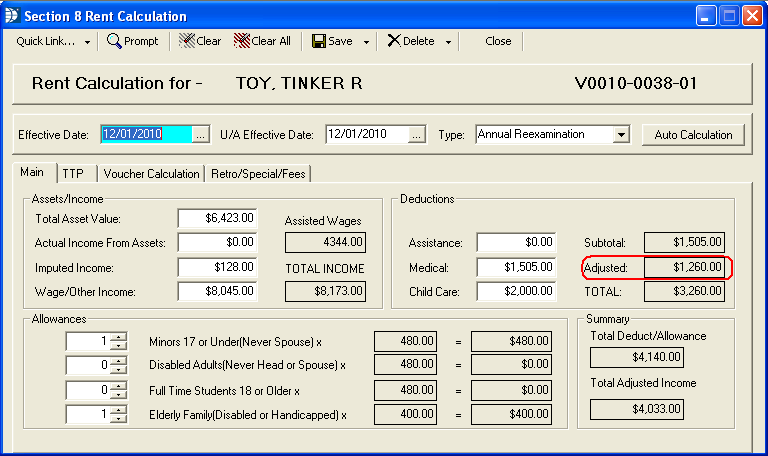

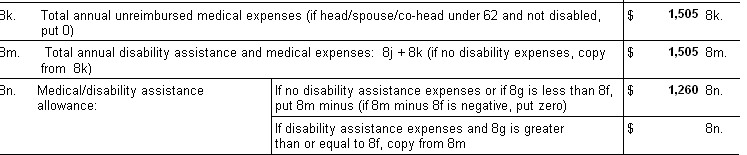

8n1. If none of the family members had disability assistance expenses, a zero will be entered or if the disability assistance amount from 8g is less than the medical/disability threshold from 8f, the program will subtract the amount from 8m from the amount in 8f. If the subtracted amount is a negative a zero will be entered.

8n2. If the disability assistance expenses shown in 8g is greater than or equal to the medical/disability threshold from 8f, the total from 8m will be copied over to this section of 8n.

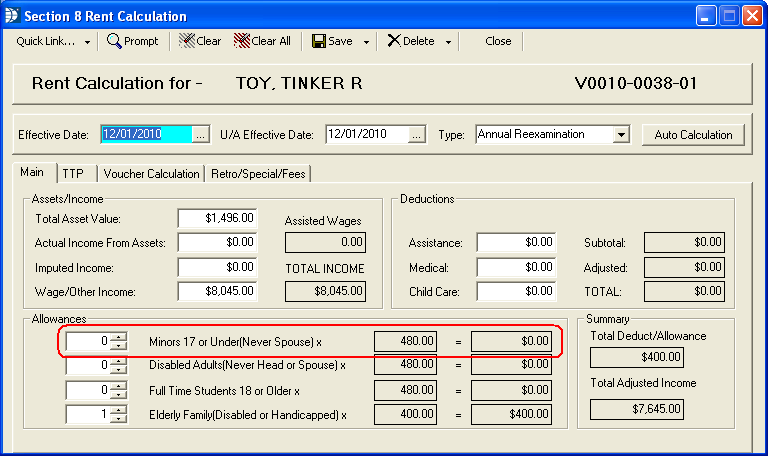

This information is pulled from the Tenant's Rent Calculation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation

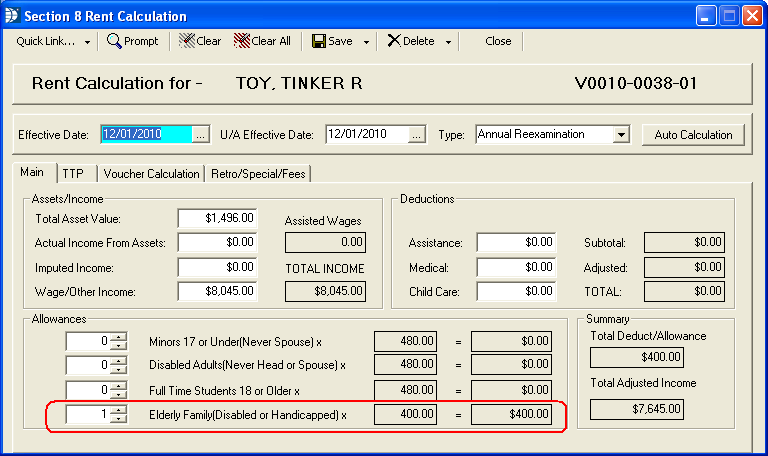

The elderly family/disability allowance for 8p is pulled from the information in the tenant's Rent Calculation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation

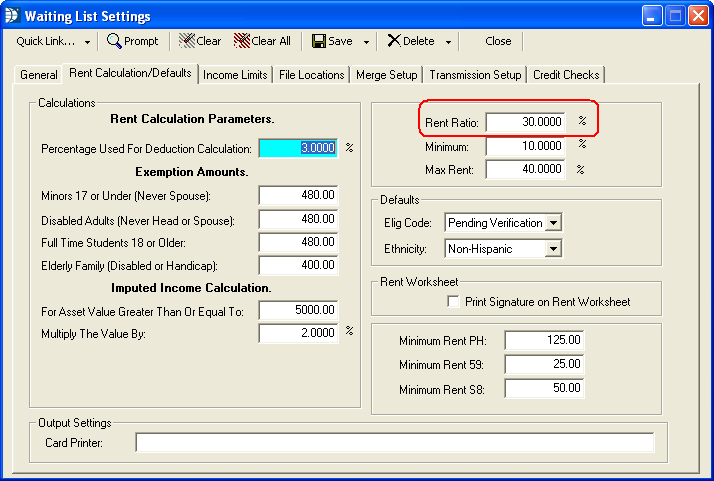

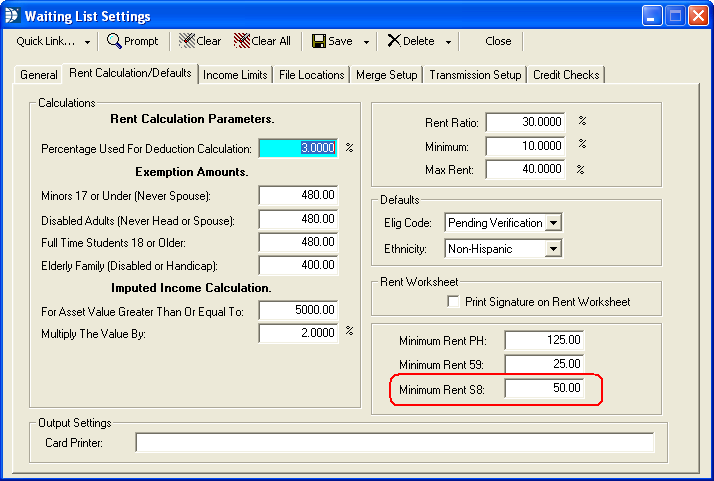

The rent calculation default amount is pulled from Waiting List Settings found in the Waiting List module

Field 8q is totaled from the member information entered in Household Composition.

Go to Maintain>>Tenants (Active)>>Quick Link>>Household Composition

Full-time student information is entered in Household Composition under the Education tab. Check the Full-time student box:

Disability is set under Needs/Service:

Field 8r pulls from the default information set in Waiting List Settings in the Waiting List module.

Open the Waiting List module, go to Settings>>Waiting List

Field 8s pulls from the tenant's Rent Calculation; Allowance information.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation

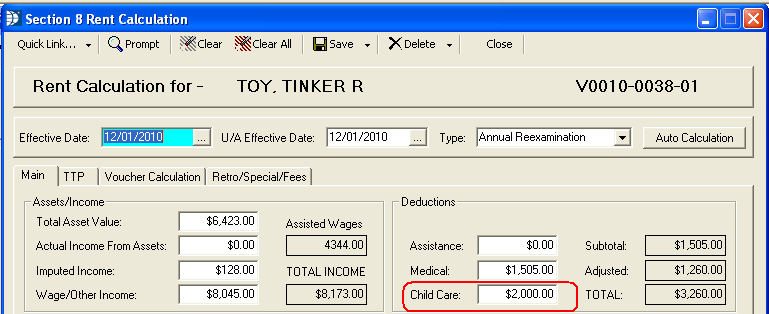

Field 8t pulls from the tenant's Rent Calculation total for Child Care deductions based on member's Deduction Worksheet information.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation

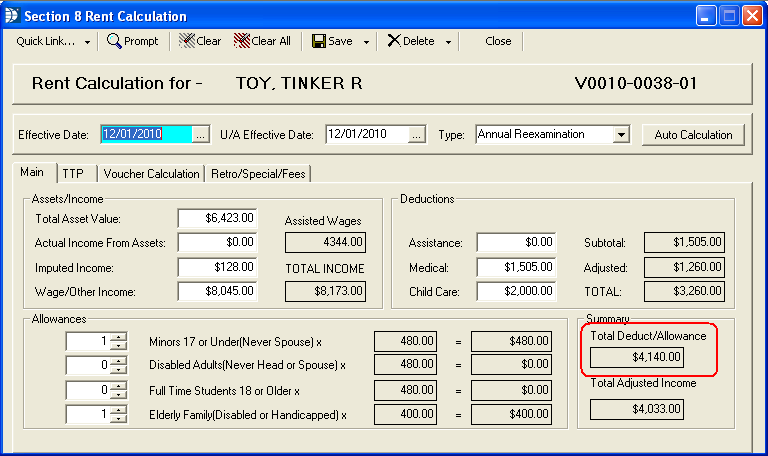

Field 8x pulls from the tenant's Rent Calculation>>Total Deduct/Allowance field.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation

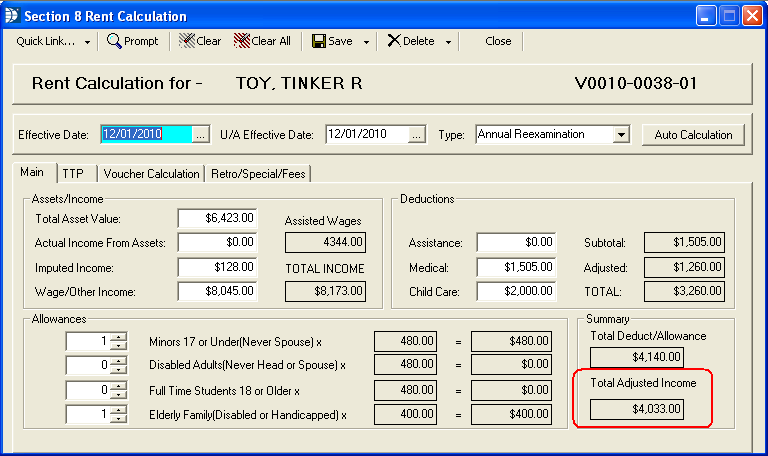

Field 8y pulls from the tenant's Rent Calculation program>>Total Adjusted Income.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation

The program will divide the total annual income shown in 8a by 12 to get the total monthly income amount for field 9a.

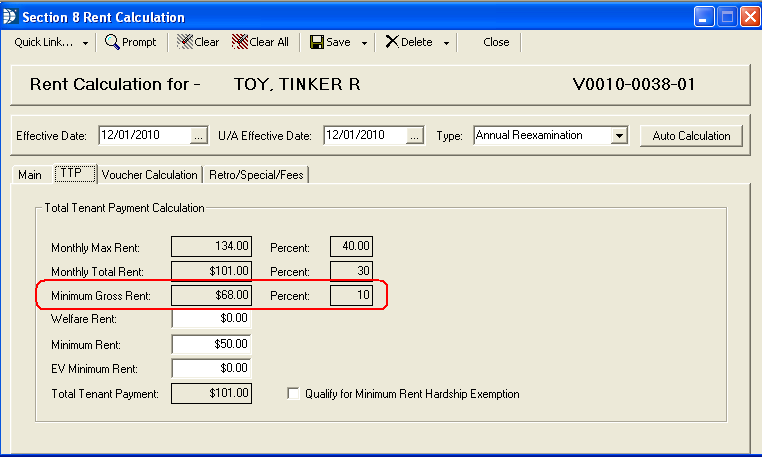

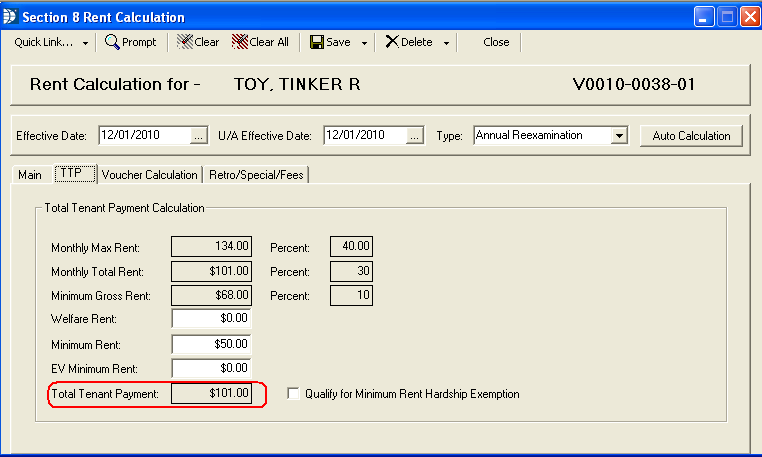

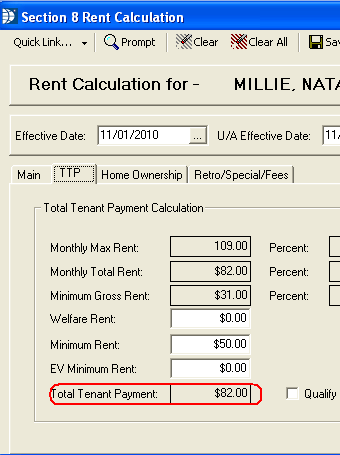

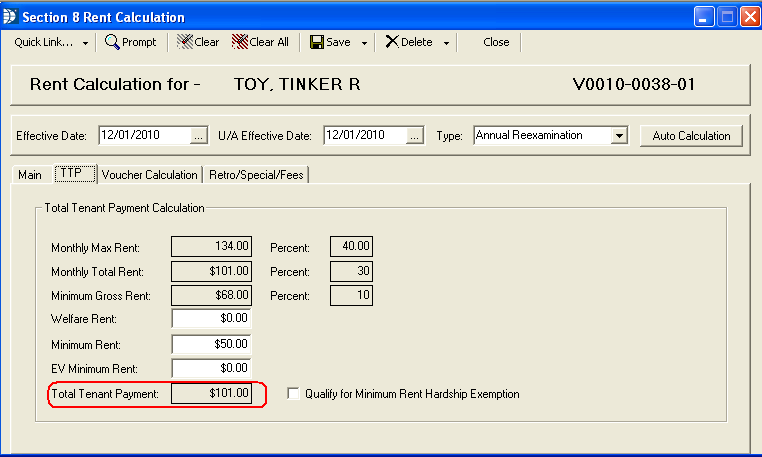

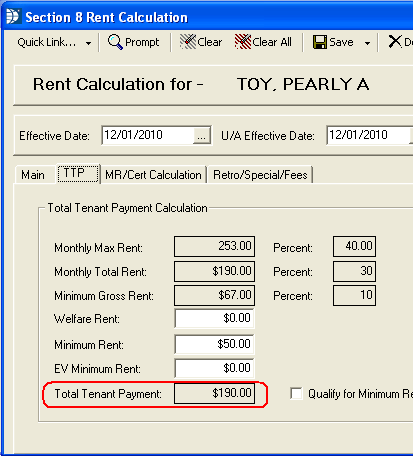

Field 9c, is pulled from the tenant Rent Calculation>>TTP>>Minimum Gross Rent

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>TTP

Note: Calculation percentages are set in Waiting List Settings.

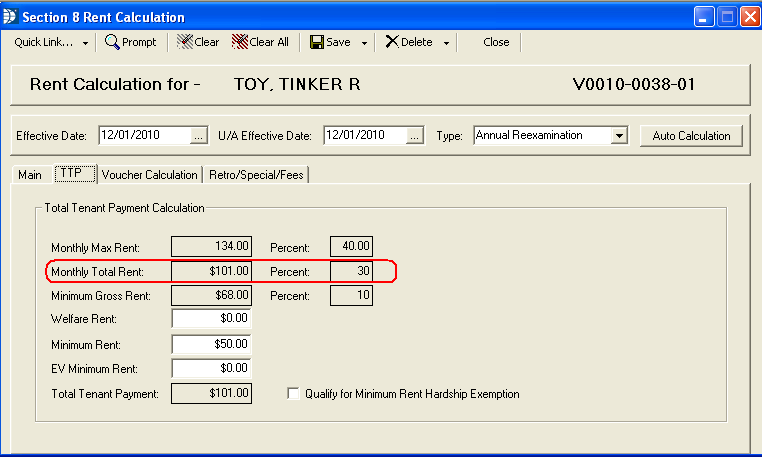

For field 9d, the program will divide the total adjusted annual income from 8y by 12 to get the adjusted monthly income amount.

The percentage figure for 9e is pulled from Waiting List Settings.

In the Waiting LIst module, go to Settings>>Waiting List>>Rent Calculation/Defaults

For field 9f, the program will multiply the adjusted monthly income amount in 9d times the figure in 9e and divide by 100.

This calculation is shown in the tenant's rent calculation on the TTP tab.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation

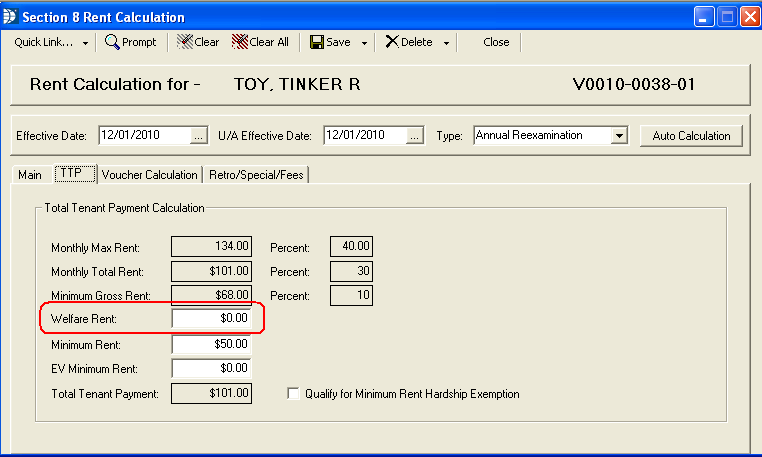

Field 9g pulls the Welfare Rent information entered by the user in the Rent Calculation program for families that receive Welfare assistance for shelter and utilities.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>TTP>>Welfare Rent

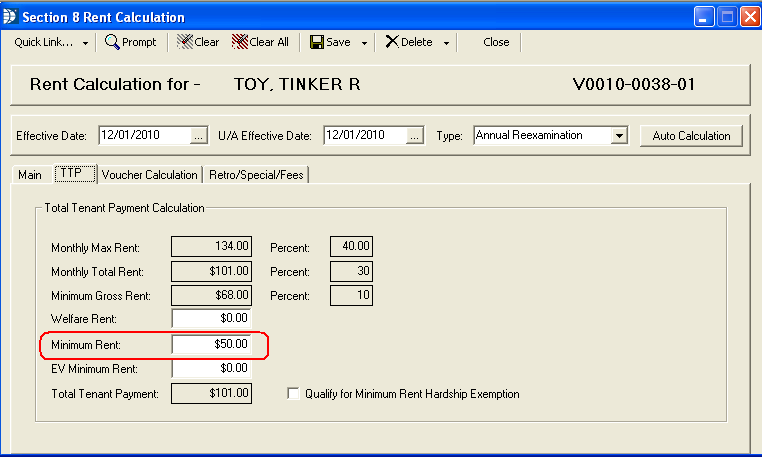

Field 9h pulls from the tenant's Rent Calculation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>TTP

Default Minimum rent information is pulled from Waiting List Settings in the Waiting List module.

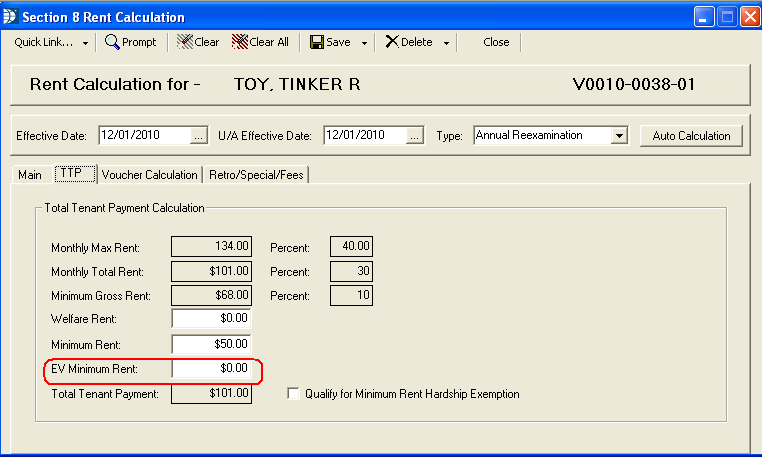

Field 9i is pulled from the information users have entered in the EV Minimum Rent field in the Rent Calculation program.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>TTP>>EV Minimum Rent

For field 9j, the program will pull the tenant's TTP from the Rent Calculation program.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>TTP

The program will pull the tenant's last TTP, if applicable, from the previous rent calculation for field 9k.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation

With the cursor in the Effective Date field, press F7 to pull up the previous Rent Calculation. Go to the TTP tab page to view the previous Total Tenant Payment figure.

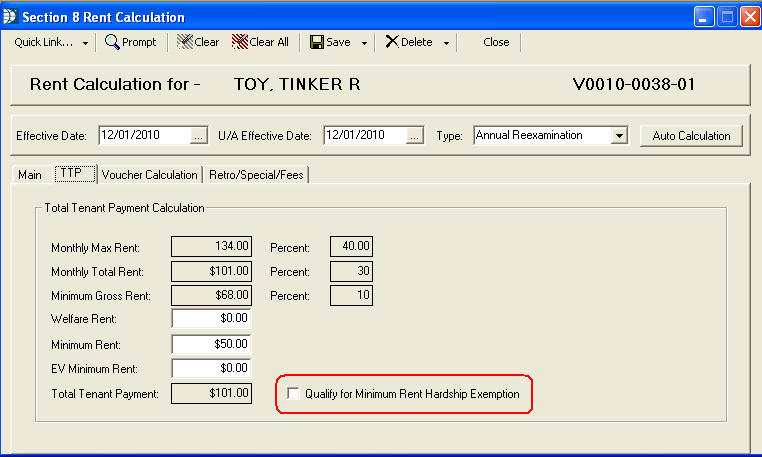

Field 9m pulls from the tenant Rent Calculation>>TTP>>Qualify for Minimum Rent Hardhip Exemption. If checked, a Y will be pulled into field 9m.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>TTP

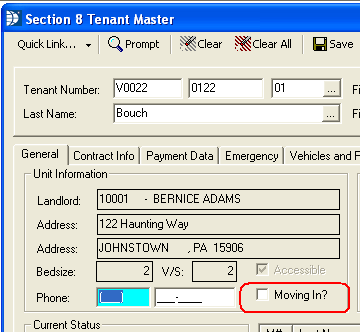

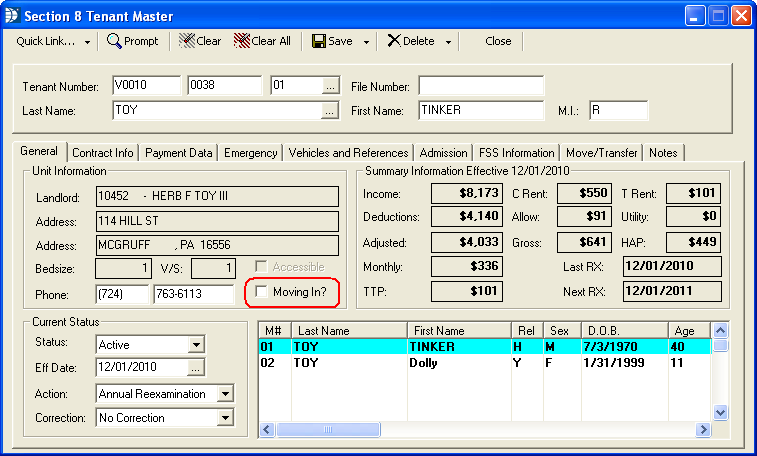

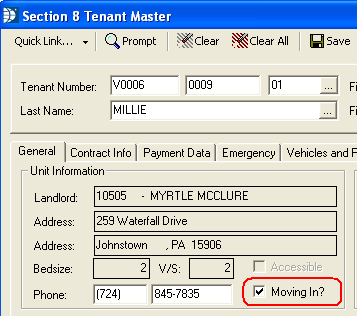

Field 11b is pulled from the Section 8 Tenant Master>>Moving In field. If this field is checked, a Y will be generated for the 50058.

Go to Maintain>>Tenants (Active)>>General>>Unit Information>>Moving In?

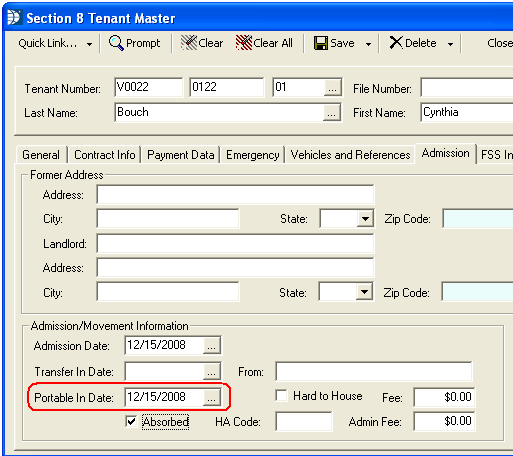

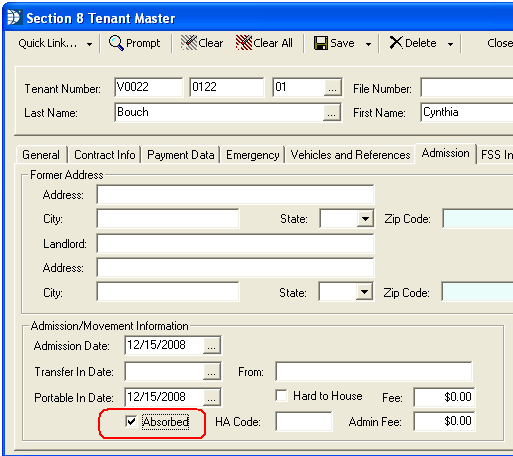

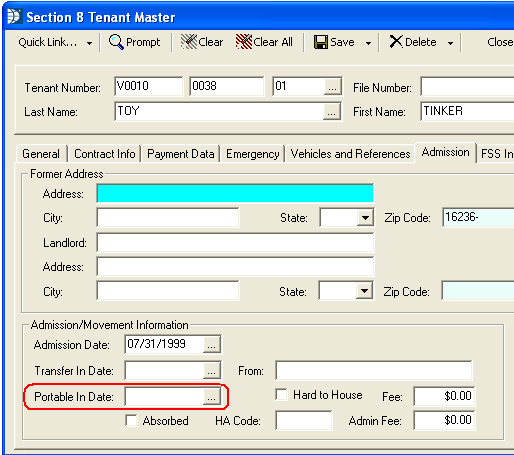

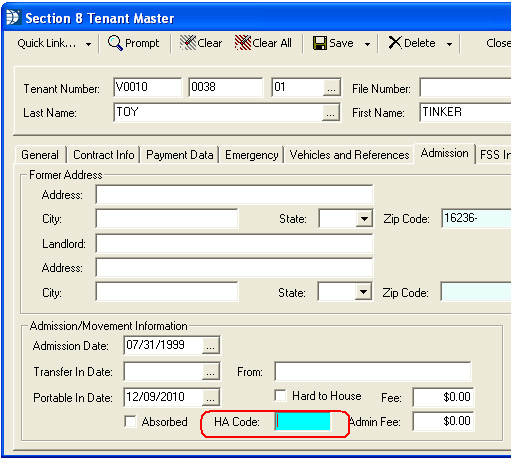

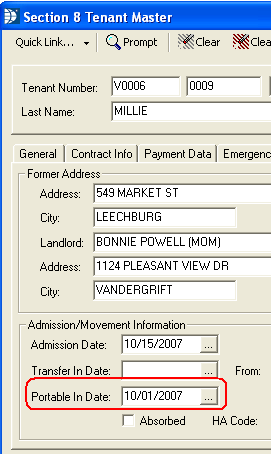

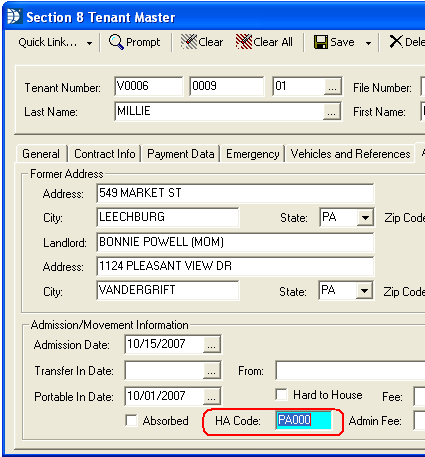

Field 11d pulls from Section 8 Tenant Master>>Portable In Date.

If there is a date in this field, the tenant will be considered a port in and a Y will be generated for the 50058.

Go to Maintain>>Tenants (Active)>>Admission>>Admission/Movement Information

Field 11e pulls based on whether there is a checkmark in the Absorbed field in the Section 8 Tenant Master field. If the field is checked a 0 is generated for the 50058.

A PHA should always put a 0 in this field. A PHA cannot bill another PHA for payments under a project based HAP contract.

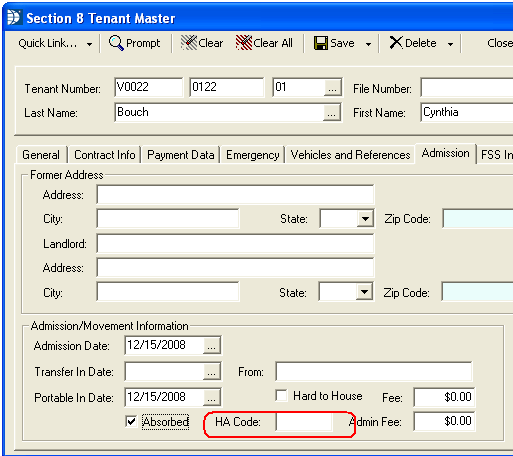

Field 11f pulls the PHA code that has been entered in the HA Code field in the Section 8 Tenant Master.

Go to Maintain>>Tenants (Active)>>Admission>>Admission/Movement Information>>HA Code

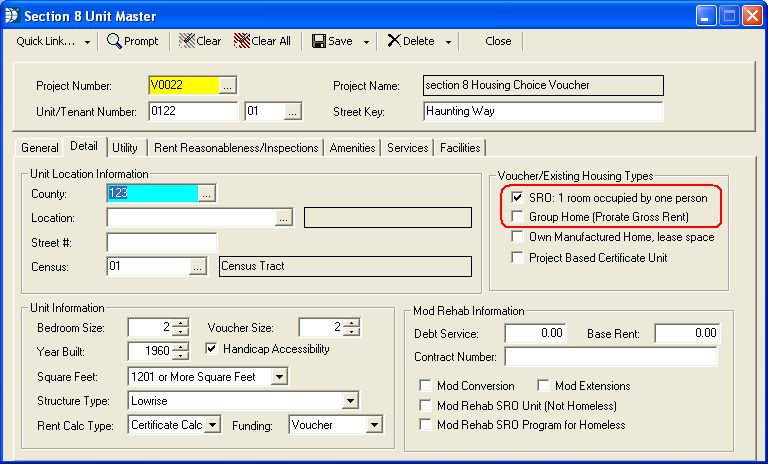

Field 11g is pulled from the Section 8 Unit Master>>SRO or Group Home options.

Place a check mark in one of the following to have the "housing type" show as XX on the 50058:

SRO: 1 room occupied by 1 person

Group Home (prorate gross rent)

Go to Maintain>>Section 8 Tables>>Unit Master>>Detail>>Voucher/Existing Housing Types

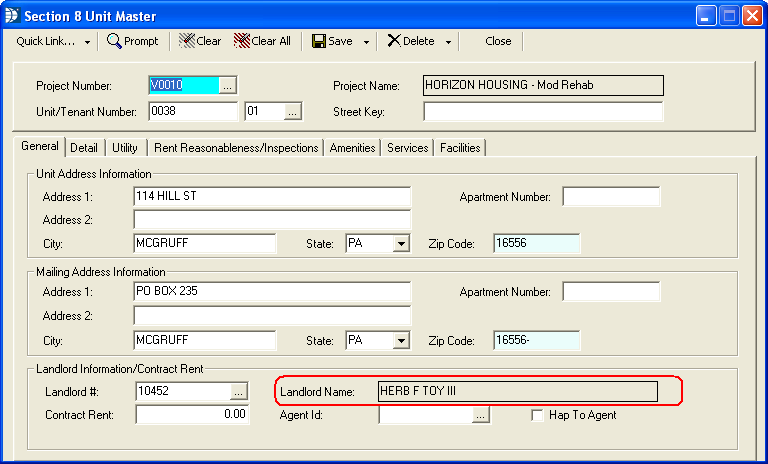

Field 11h is pulled from the Section 8 Unit Master>>Landlord # and Name.

Go to Maintain>>Section 8 Tables>>Unit Master>>General>>Landlord Information/Contract Rent>>Landlord # or Landlord Name

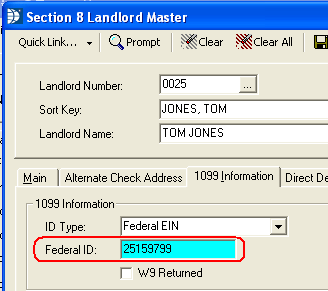

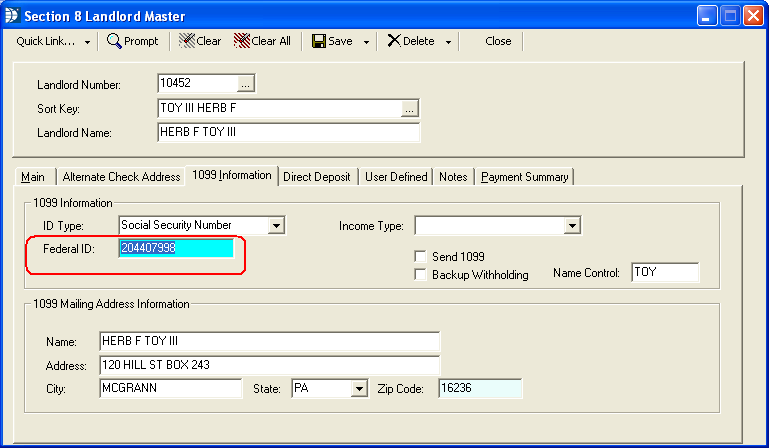

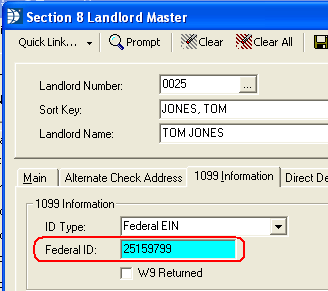

Field 11i is pulled from the Federal ID field in the Landlord Master file that has been linked to the tenant in the Section 8 Unit Master.

Go to Maintain>>Landlords>>1099 Information>>1099 Information>>Federal ID

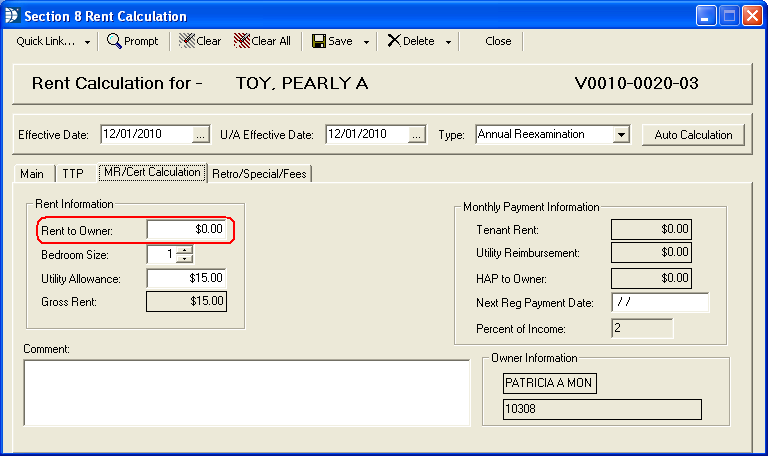

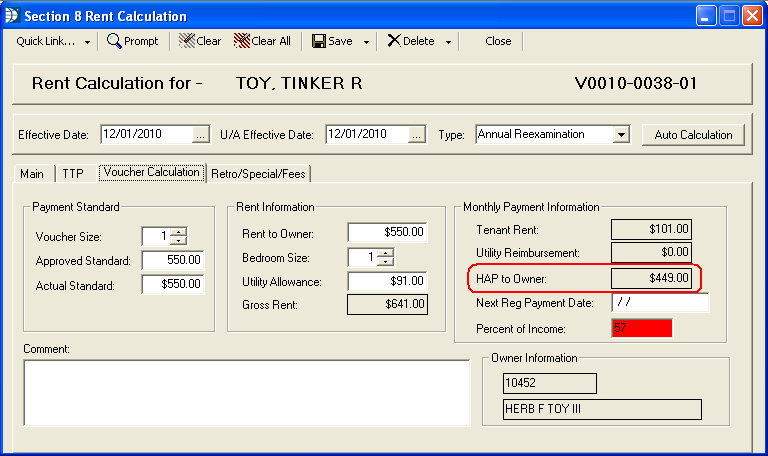

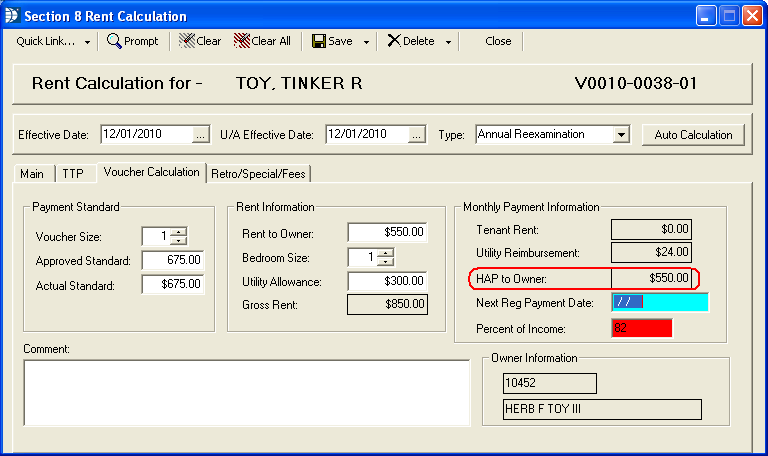

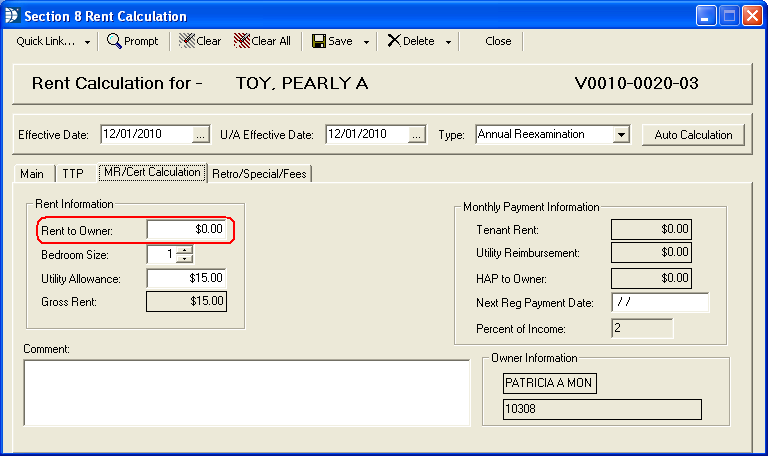

Field 11k pulls from the tenant's Rent Calculation>>Rent to Owner information.

Rent to owner may be entered manually in the rent calculation or setup to pull into the rent calculation from the Section 8 Unit Master>>Contract Rent.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>MR/Cert Information>>Rent to Owner

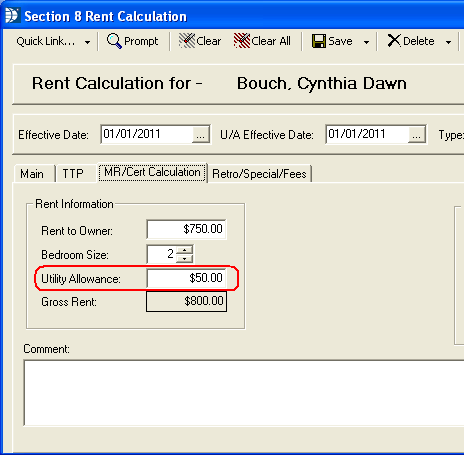

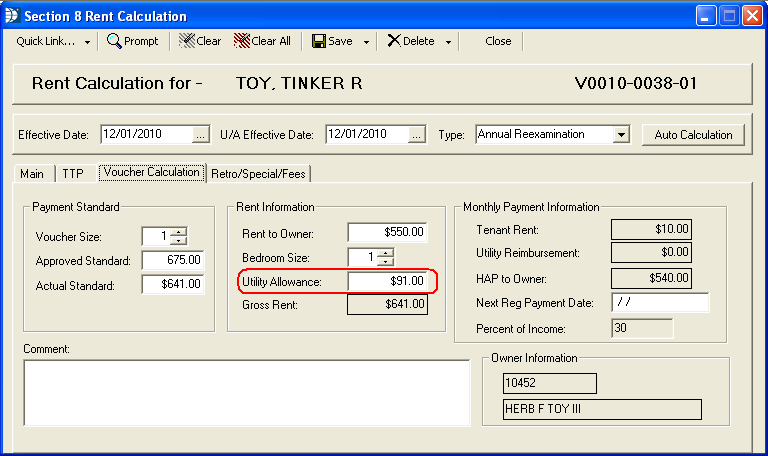

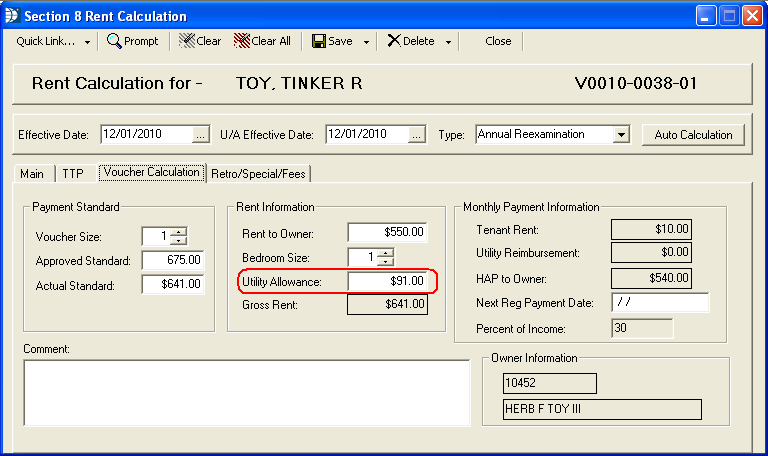

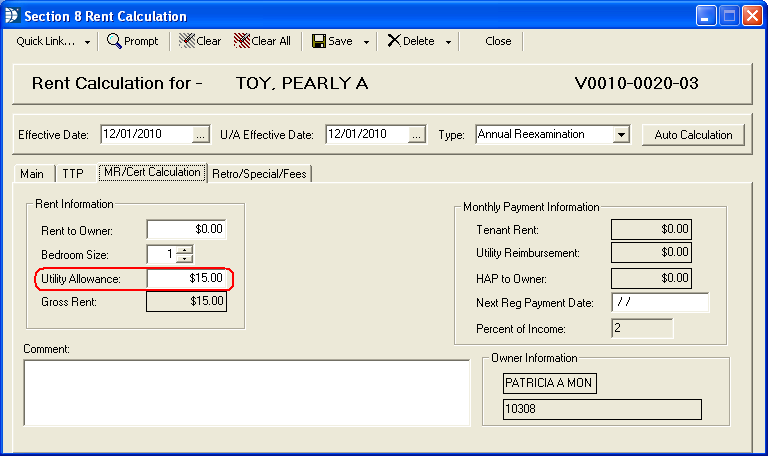

Field 11m pulls from the utility allowance information in the tenant's Rent Calculation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>MR/Cert Calculation>>Rent Information>>Utility Allowance

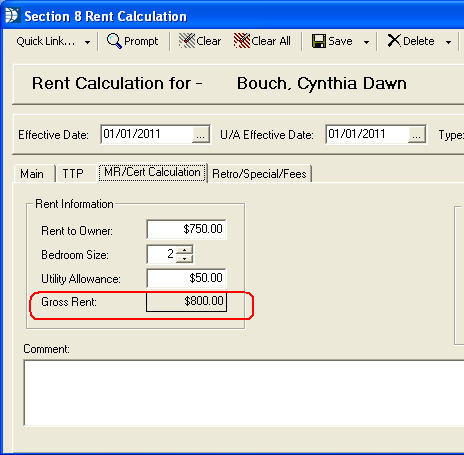

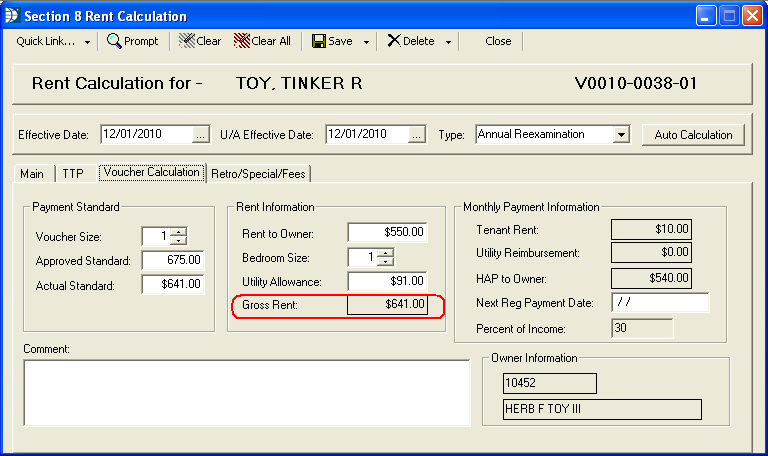

Field 11n pulls from the Gross Rent field in the tenant's Rent Calculation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>MR/Cert Calculation>>Rent Information>>Gross Rent

Field 11q pulls from the Total Tenant Payment field in the tenant's Rent Calculation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>TTP>>Total Tenant Payment

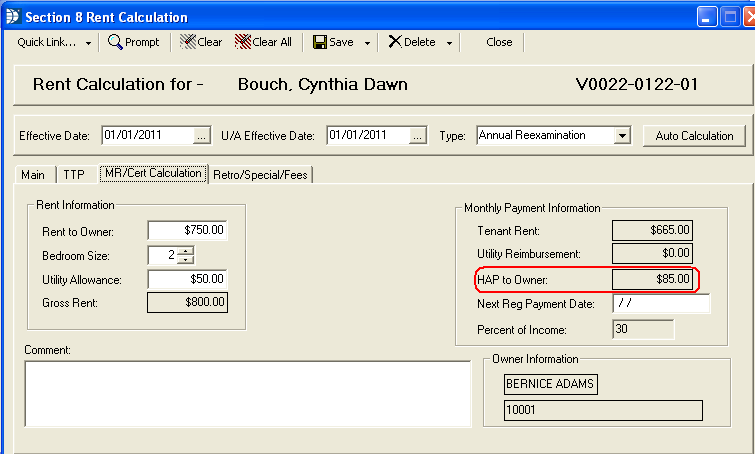

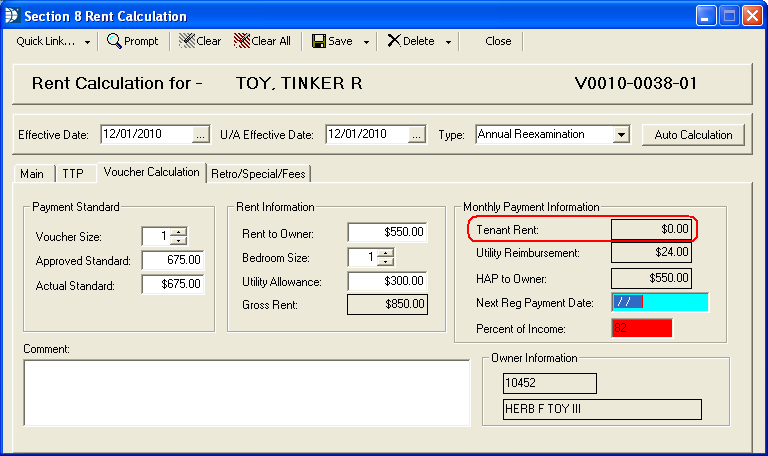

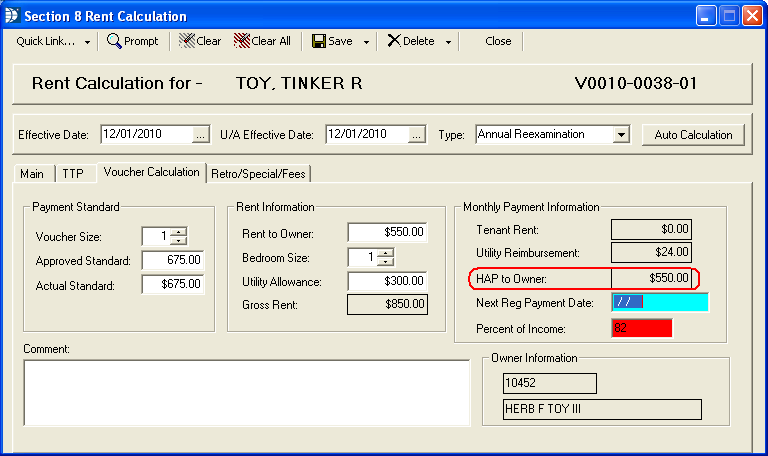

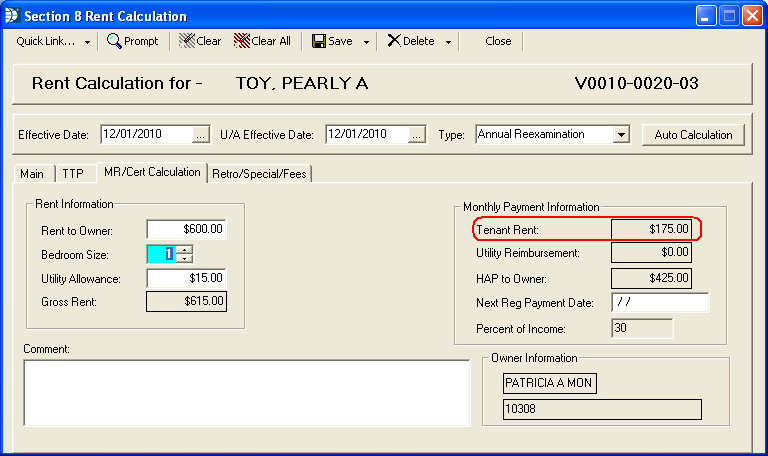

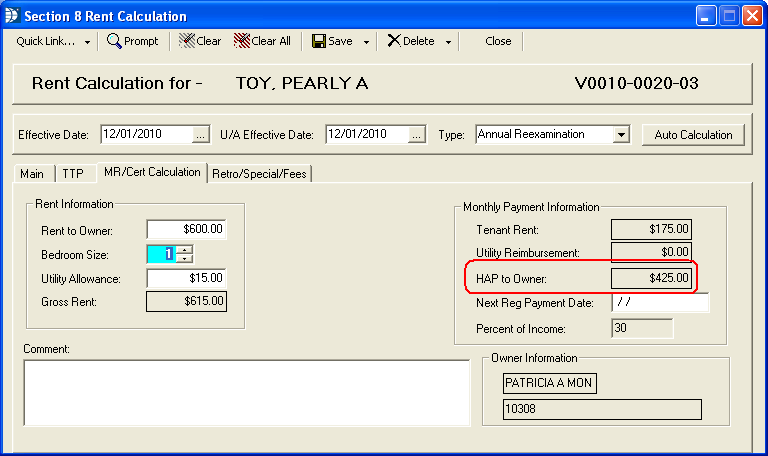

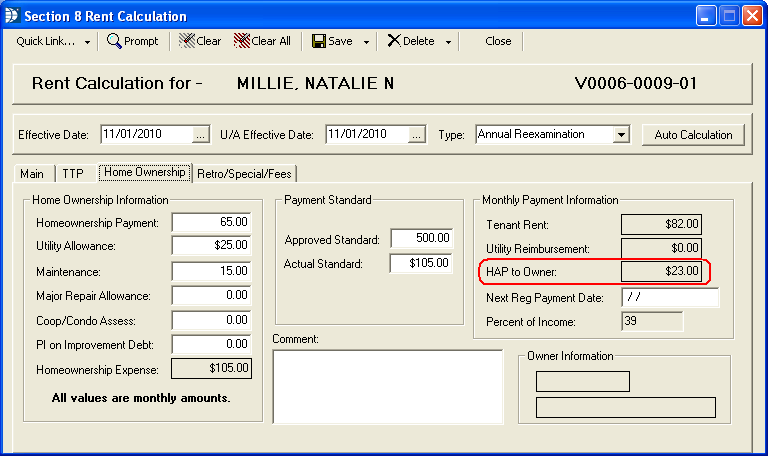

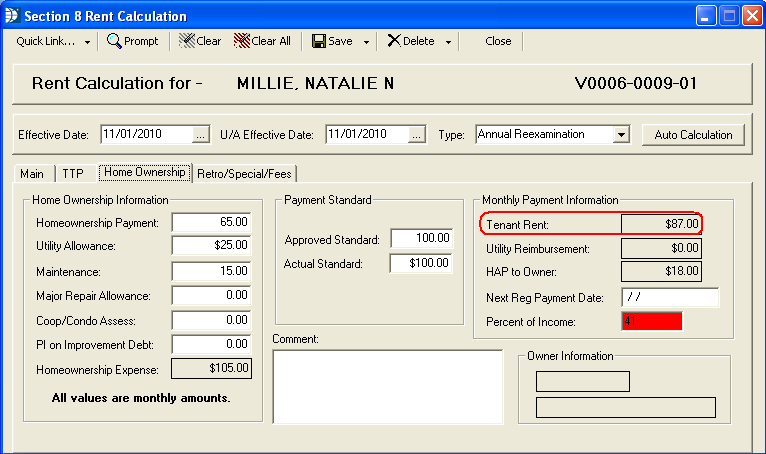

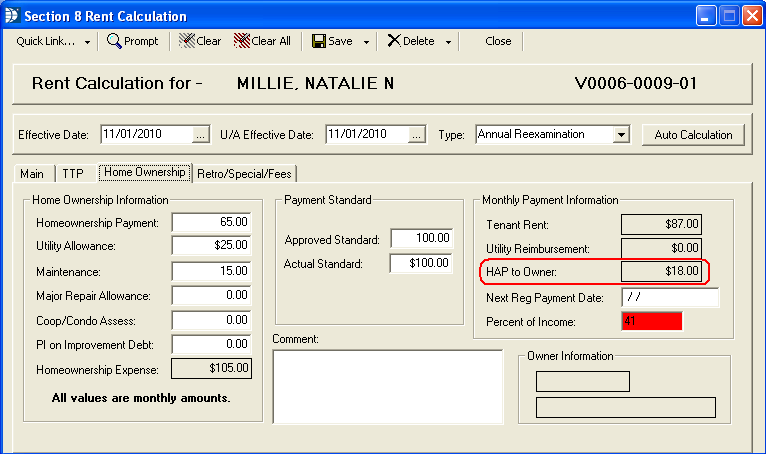

Field 11r pulls from the HAP to owner field in the tenant's Rent Calculation, unless the rent is prorated.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>MR/Cert Calculation>>Monthly Payment Information>>HAP to Owner

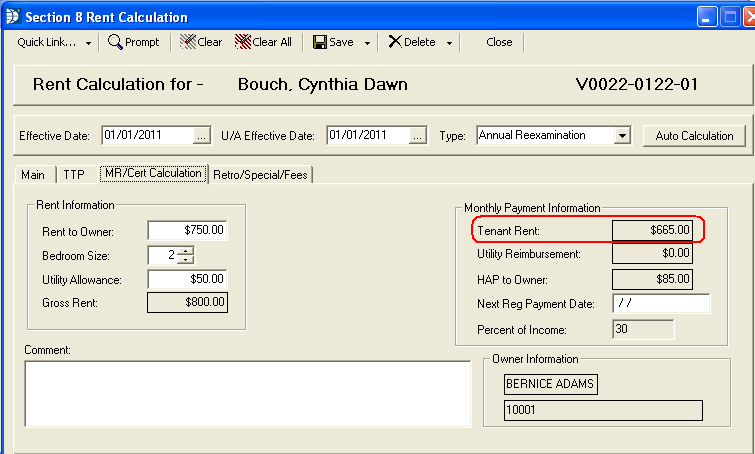

Field 11s pulls from the Tenant Rent field in the tenant's Rent Calculation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>MR/Cert Calculation>>Monthly Payment Information>>Tenant Rent

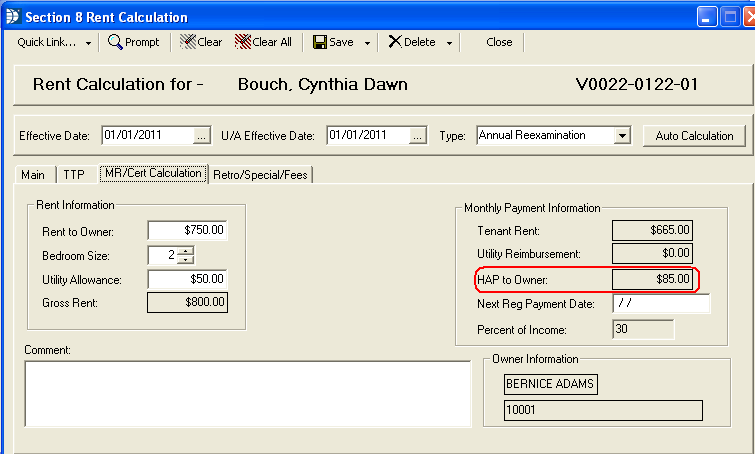

Field 11t pulls from the HAP to Owner field in the tenant's Rent Calculation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>MR/Cert Calculation>>Monthly Payment Information>>HAP to owner

This portion of the 50058 has not been needed to date. If you need this information, please call the Horizon Help desk.

For field 12a, the program will pull the voucher bedroom information from the Unit Master.

Go to Maintain>>Section 8 Tables>>Unit Master>>Detail>>Voucher Size

Field 12b pulls this information from the Section 8 Tenant Master>>Moving In? field. If checked the program will enter a Y.

Field 12c pulls from the Section 8 Tenant Master, Hard to House field. If checked the program will show a Y in this field.

Go to Maintain>>Tenants (Active)>>Admission tab>>Admission/Movement Information>>Hard to House

Field 12d will insert a Y if there is a date in the Portable In Date field in the Section 8 Tenant Master.

Go to Maintain>>Tenants (Active)>>Admission tab>>Admission/Movelment Information>>Portable In Date

Field 12e is pulled from the HAP to Owner field in the Rent Calculation

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>

Field 12f pulls from the information entered into the Section 8 Tenant Master, HA Code field.

Go to Maintain>>Tenants (Active)>>Admission tab>>Admission/Movement Information>>HA Code

Field 12g pulls from the Unit Master>>Detail tab.

Go to Maintain>>Section 8 Tables>>Unit Master>>Detail tab>>Voucher/Existing Housing Types

Field 12h pulls from the Section 8 Unit Master>>General tab>>Landlord Information/Contract Rent

Go to Maintain>>Section 8 Tables>>Unit Master>>General tab>>Landlord Information/Contract Rent>>Landlord Name

Field 12i pulls from the Section 8 Landlord Master for the Landord that has been linked to the Section 8 Unit Master on the 1099 Information tab.

Go to Maintain>>Landlords>>1099 Information>>Federal ID

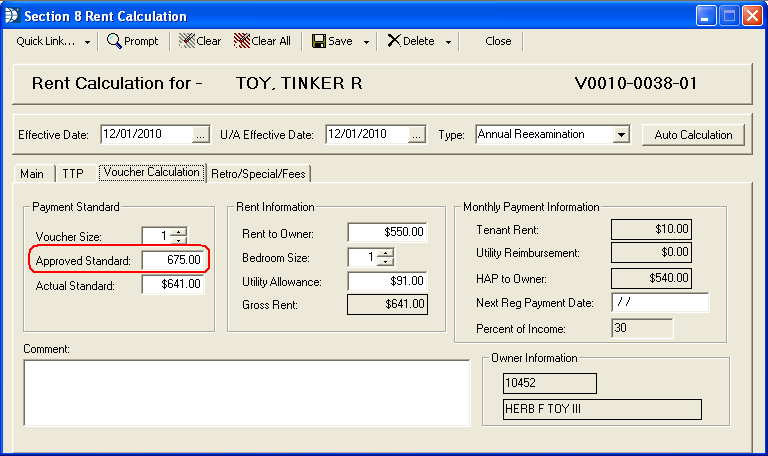

Field 12j pulls from the tenant's Rent Calculation>>Voucher Calculation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Voucher Calculation tab>>Approved Standard

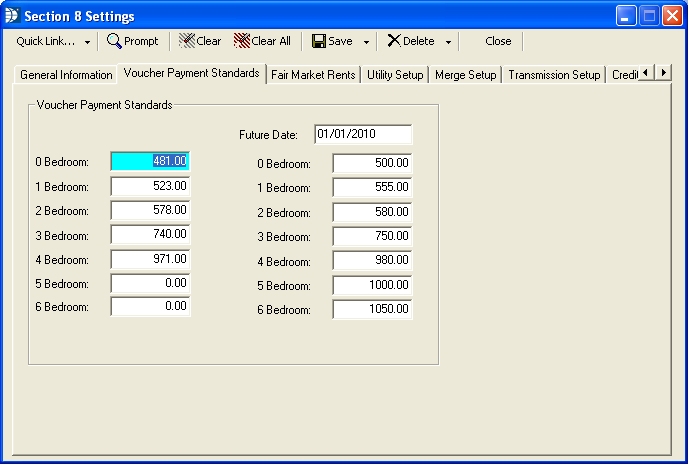

Default Voucher Payment Standards are setup in Section 8 Settings.

Go to Settings>>Section 8 Management>>Voucher Payment Standards

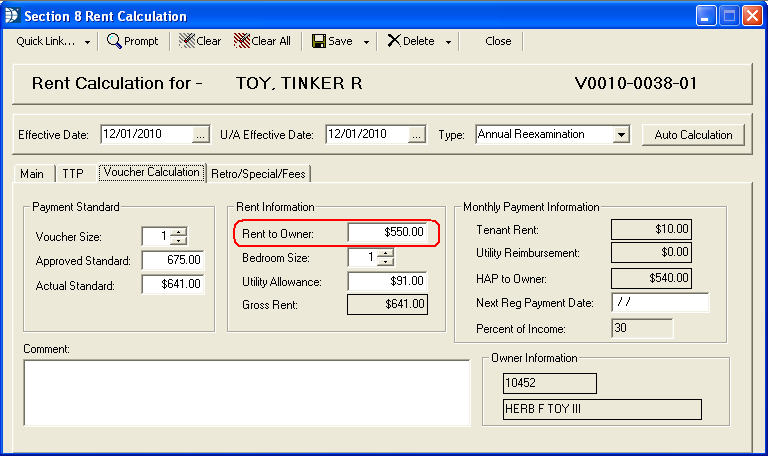

Field 12k pulls from the tenant's Rent Caclulation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Voucher Calculation

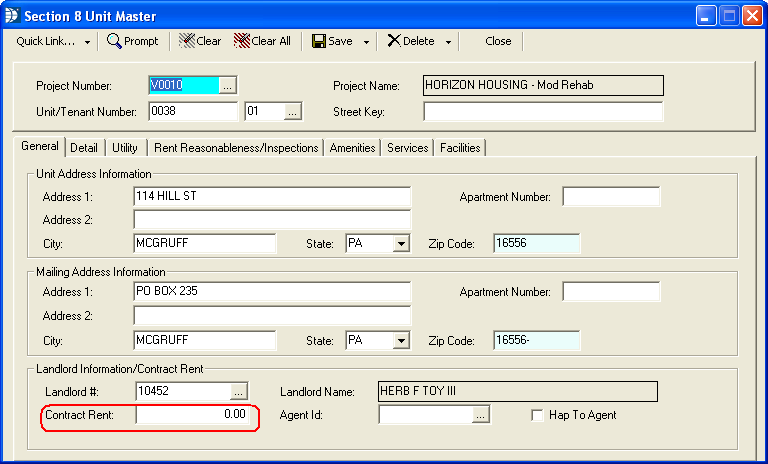

The Rent to Owner default may be setup in the Section 8 Unit Master.

Go to Maintain>>Section 8 Tables>>Unit Master>>General>>Contract Rent

Field 12m pulls from the tenant's Rent Calculation.

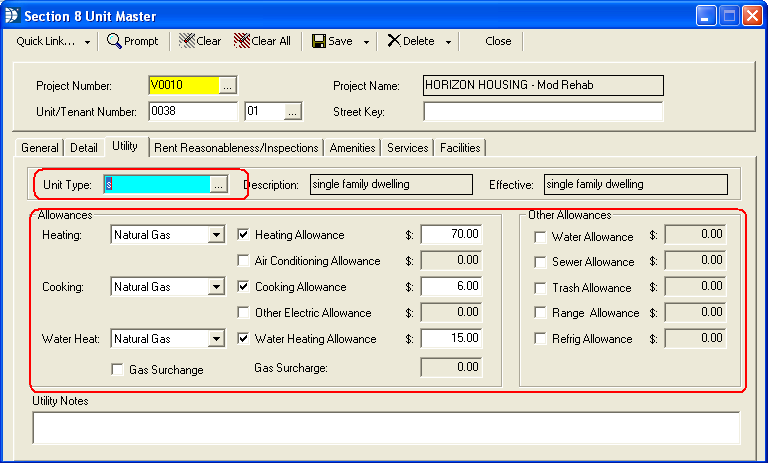

Utility allowance information may be entered manually or pulled from the utility allowance table associated in the Section 8 Unit Master (see next section)

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation

Utility Allowance information is pulled into the Rent Calculation program from the Section 8 Unit Master. Select a Utility table, power sources and allowance information for the unit.

Go to Maintain>>Section 8 Tables>>Unit Master>>Utility tab

Field 12p pulls from the tenant's Rent Calculation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation

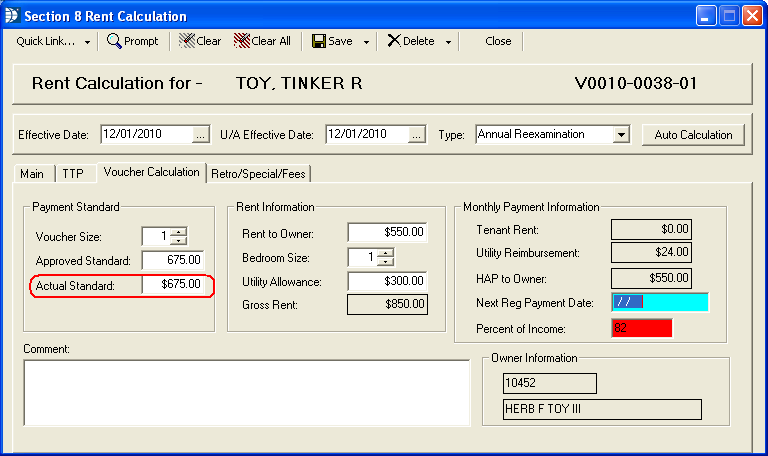

For field 12q the program calculates the lower of the payment standard (pulled for 12j) or the Gross Rent amount (shown in 12p). This calculation is shown in the tenant's Rent Calculation in the Actual Standard field.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Voucher Calculation tab>>Actual Standard

For field 12r, the program will pull the tenant's TTP from the Rent Calculation program.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>TTP

For field 12s the program will calculate the difference between the amounts from 12q and 12r. This information is usually the same as the HAP to Owner in the tenant's Rent Calculation program.

For field 12t the program will calculate the difference between the amounts from 12p and 12s.

Field 12u pulls from the tenant's Rent Calculation>>HAP to owner field.

Go to Maintain>>Teanants (Active)>>Quick Link>>Rent Calculation>>Voucher Calculation>>HAP to Owner

Field 12v pulls from the tenant's Rent Calculation>>Tenant Rent field.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Voucher Calculation>>Tenant Rent

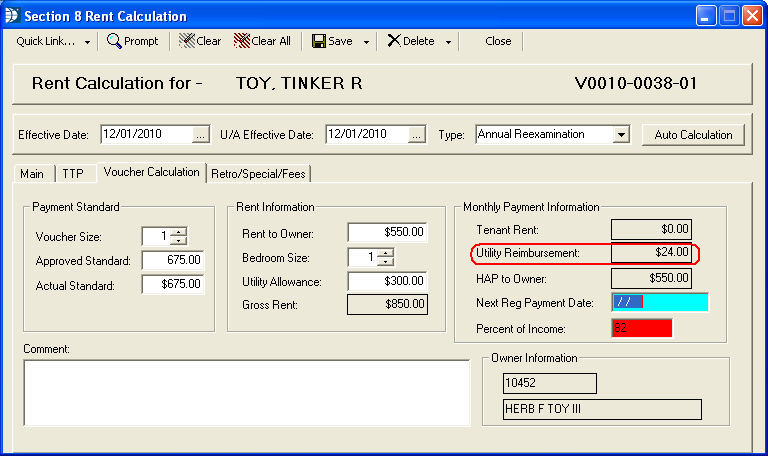

Field 12w pulls from the tenant's Rent Calculation>>Utility Reimbursement field.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Voucher Calculation>>Utility Reimbursement

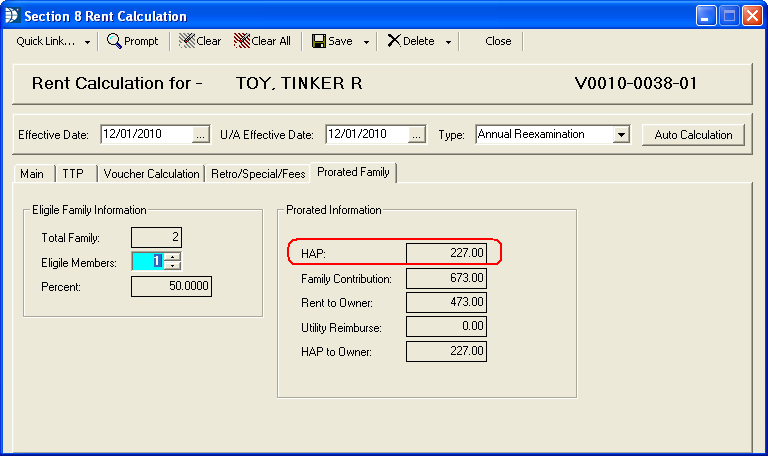

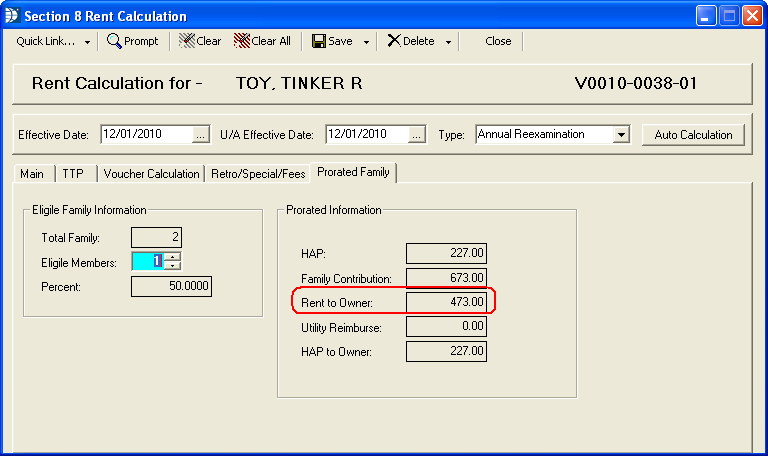

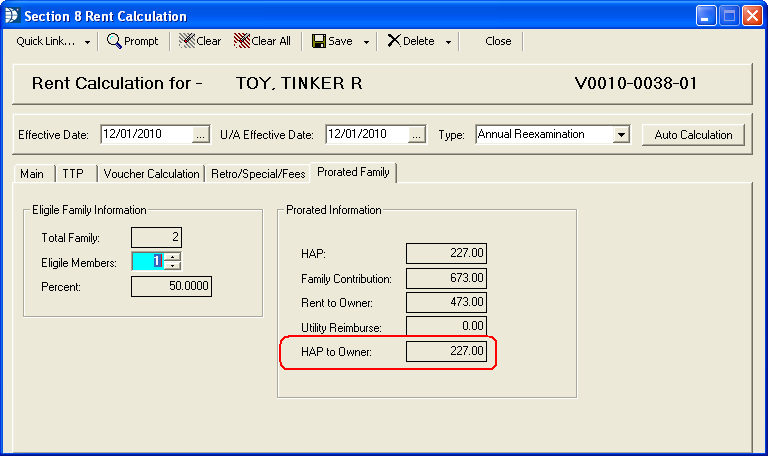

Field 12ab pulls from the tenant's Rent Calculation>>HAP to Owner field.

Note: This information is only pulled when the rent is prorated.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Voucher Calculation>>HAP to Owner

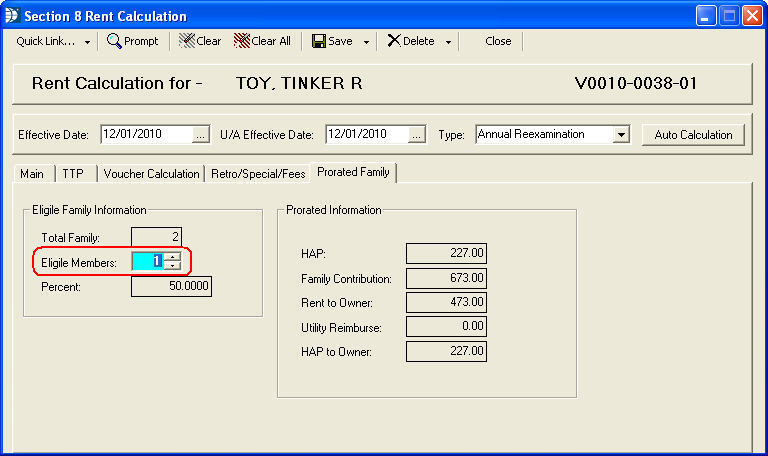

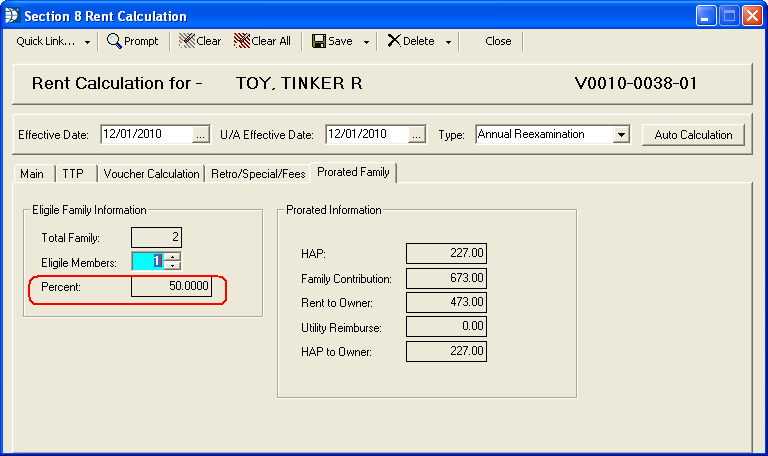

Field 12ac will pull from the tenant's Rent Calculation>>Prorated Family tab. Eligible information is based on the active member citizenship information entered in Household Composition.

Note: This information is only pulled when the rent is prorated.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Porated Family>>Eligible Members

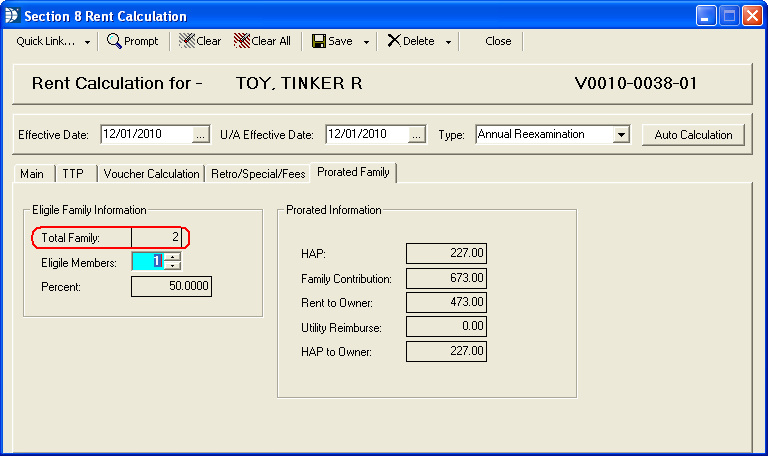

Field 12ad will pull from the tenant's Rent Calculation>>Total Family field. Family totals are based on the total of all active members entered in Household Composition.

Note: This information is only pulled when the rent is prorated.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Prorated Family>>Total Family

Field 12ae pulls from the tenant's Rent Calculation.

Note: This information is only pulled when the rent is prorated.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Prorated Family>>Percent

Field 12af pulls from the tenant's Rent Calculation.

Note: This information is only pulled when the rent is prorated.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Prorated Family>>HAP

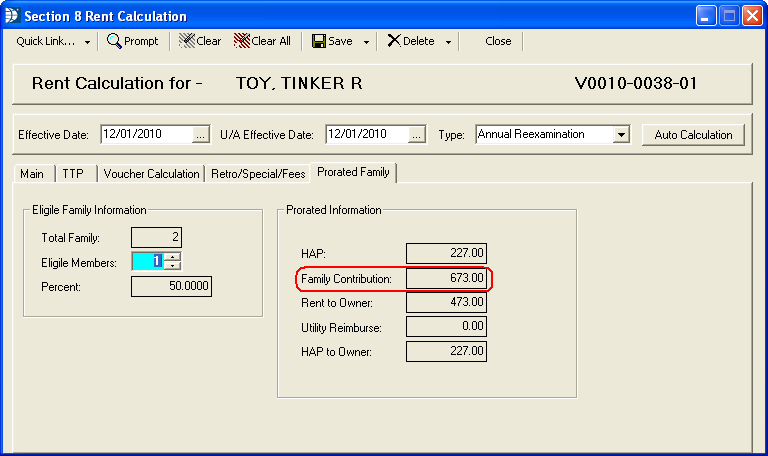

Field 12ag pulls from the tenant's Rent Calculation>>Family Contribution field.

Note: This information is only available/pulled for prorated rent tenants.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Prorated Family>>Family Contribution

Field 12ah pulls from the tenant's Rent Calculation>>Utility Allowance.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Voucher Calculation>>Utlity Allowance

Field 12ai pulls from the tenants Rent Calculation>>Prorated Family>>Rent to Owner.

Note: This information is only available for tenants with prorated rent.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Prorated Family>>Rent to Owner

Field 12aj pulls from the tenant's Rent Calculation>>Prorated Family>>HAP to Owner.

Note: This information is only available when the tenant's rent is prorated.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Prorated Family>>HAP to Owner

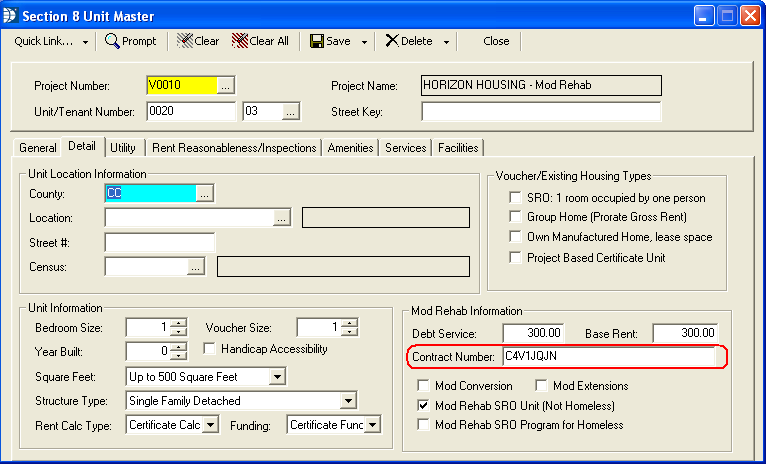

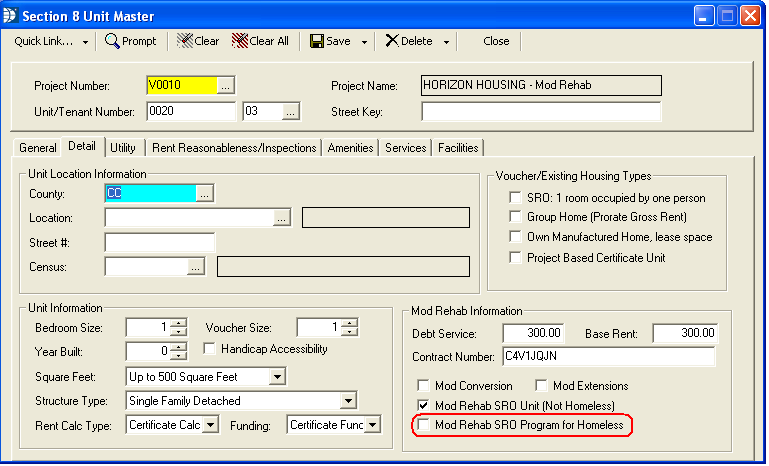

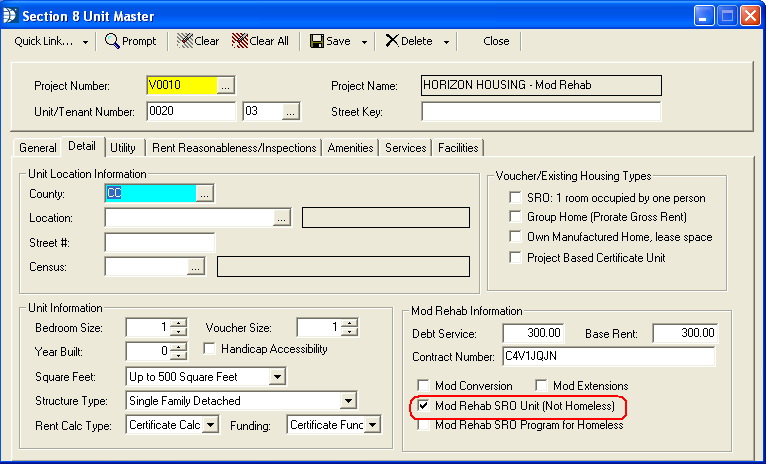

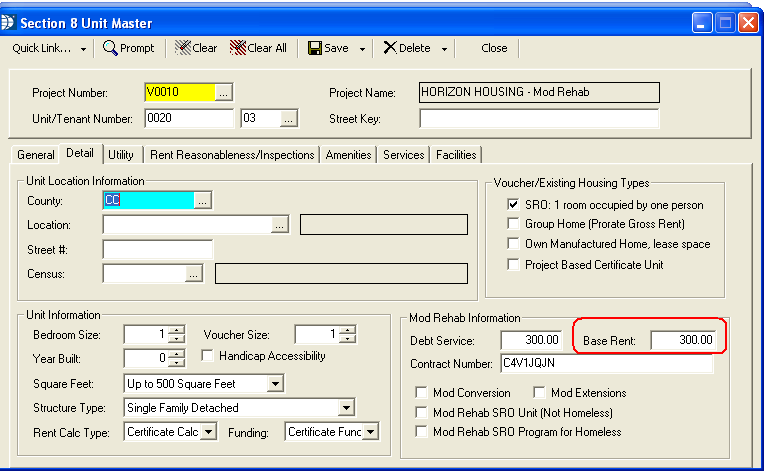

This page of the 50058 is only used when the project/unit are setup for Moderate Rehabilitation.

Field 13a pulls the HAP contract number from the tenant's Unit Master.

Go to Maintain>>Section 8 Tables>>Unit Master>>Detail>>Mod Rehab Information>>Contract Number

Field 13b will display a Y if the "Mod Rehab SRO Program for Homeless" field is checked in the Section 8 Unit Master.

Go to Maintain>>Section 8 Tables>>Unit Master>>Details>>Mod Rehab Information>>Mod Rehab SRO Program for Homeless

Field 13c will display a Y if the "Mod Rehab SRO Unit (Not Homeless)" field is checked in the Section 8 Unit Master.

Go to Maintain>>Section 8 Tables>>Unit Master>>Details>>Mod Rehab Information>>Mod Rehab SRO unit (Not Homeless)

Field 13d will pull owner information based on the landlord assigned in the Section 8 Unit Master.

Go to Maintain>>Section 8 Tables>>Unit Master>>General>>Landlord Information/Contract Rent>>Landlord # and Landlord Name

Field 13e pulls the tenant's associated (see 13d) owner information from the Section 8 Landlord Master.

Go to Maintain>>Landlords>>1099 Information>>1099 Information>>Federal ID

Field 13f pulls the information that has been setup in the Section 8 Unit Master>>Base rent field.

Go to Maintain>>Section 8 Tables>>Unit Master>>Detail>>Mod Rehab Information>>Base Rent

Field 13g pulls from Section 8 Unit Master>>Debt Service.

Go to Maintain>>Section 8 Tables>>Unit Master>>Detail>>Mod Rehab Information>>Debt Service

Field 13h pulls from the tenant's Rent Calculation>>Rent to Owner field. The rent to owner can be entered into the rent calculation manually or pulled into the rent calculation from Section 8 Unit Master>>Contract Rent.

Contract rent must equal the total of the Base Rent and Debt Service fields in the Section 8 Unit Master or an error notification will be displayed when the Create 50058 Record program is run.

Go to Maintain>>Tenant's (Active)>>Quick Link>>Rent Calculation>>MR/Cert Calculation>>Rent Information>>Rent to Owner

Field 13i pulls from the Utility Allowance information in the tenant's Rent Calculation.

Utility allowance information for the rent calculation may be entered manually by the user or pulled based upon a utility allowance table that has been linked to the tenant's Section 8 Unit Master with allowances checked.

Go to Maintain>>Tenants (Active)>>Quick Link>Rent Calculation>>MR/Cert Calculation>>Utility Allowance

Field 13j pulls from the Total Tenant Payment field in the tenant's Rent Calculation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>TTP>>Total Tenant Payment

Field 13k pulls from Tenant Rent in the tenant's Rent Calculation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>MR/Cert Calculation>>Monthly Payment Information>>Tenant Rent

Field 13m pulls from HAP to owner in the tenant's Rent Calculation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>MR/Cert Calculation>>Monthly Payment Information>>HAP to Owner

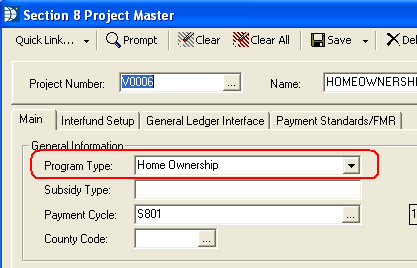

Page 15 of the 50058 pulls for tenants whose Program Type in the Project Master is set to Home Ownership.

Go to Maintain>>Section 8 Tables>>Project Master>>>>Main>>General Information>>Program Type

Field 15a will generate a Y if the Moving In? box is checked for a tenant. If the box is unchecked a N will be on the form.

Go to Maintain>>Tenants (Active)>>General>>Unit Information>>Moving in?

Field 15b pulls the date that is entered in the Last Inspec field.

Go to Maintain>>Tenants (Active)>>Contract Info>>Last Inspect

Field 15c will generate a Y if there is a date in the tenant's Portable In Date field. If the date is blank, the program will generate a N,

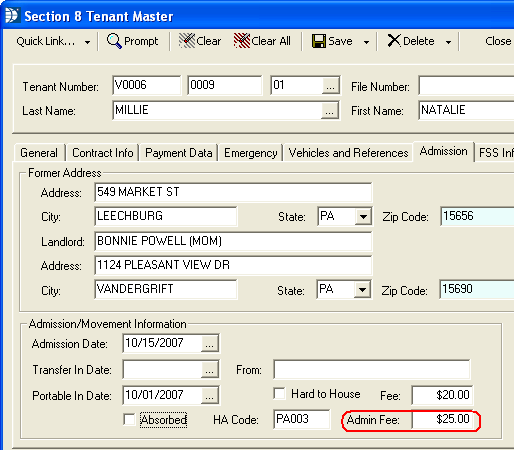

Field 15d pulls from the Rent Calculation>>HAP to owner plus the Admin Fee entered in the Section 8 Tenant Master if this tenant is a portability tenant who has not been absorbed.

HAP to Owner - Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Home Ownership>>HAP to Owner

Admin Fee - Go to Maintain>>Tenants (Active)>>Admission tab>>Admin Fee

Field 15e pulls from the HA Code field in the Section 8 Tenant Master for portability tenants who have not been absorbed.

Go to Maintain>>Tenants (Active)>>Admission tab>>Admission/Movement Information>>HA Code

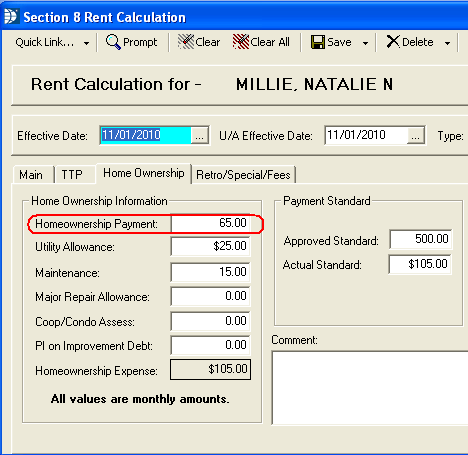

Field 15f pulls from the tenant's Rent Calculation>>Homeownership Payment. This information should include principal and interest on initial mortgage debt, taxes and insurance (PITI) and any mortgage insurance premium (MIP), if applicable.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Home Ownership>>Homeownership Information>>Homeownership Payment

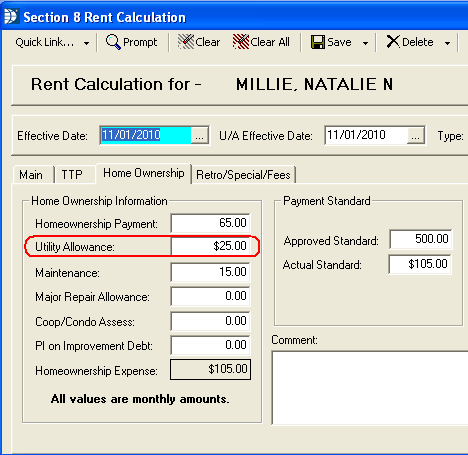

Field 15g pulls from the Utility Allowance in the tenant's Rent Calculation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Home Ownership>>Homeownership Information>>Utility Allowance

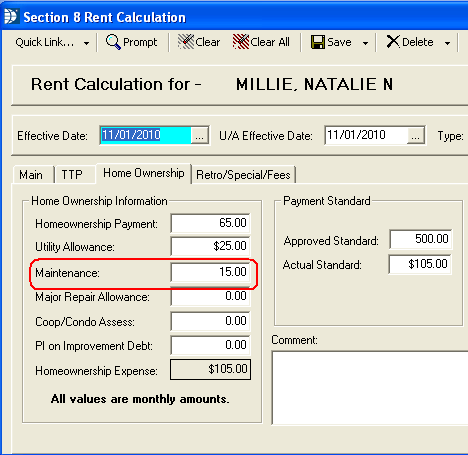

Field 15h pulls from the Maintenance field in the tenant's Rent Calculation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Home Ownership>>Home Ownership Information>>Maintenance

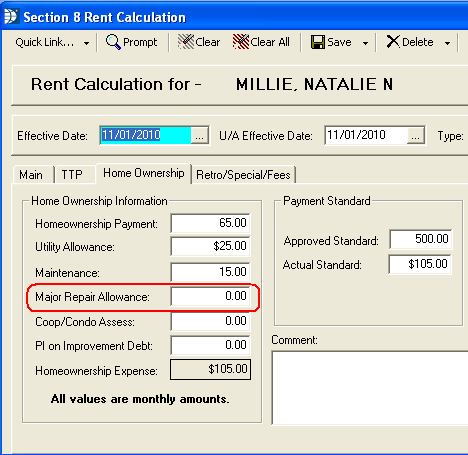

Field 15i pulls from Major Repair Allowance in the tenant's Rent Calculation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Home Ownership>>Home Ownership Informaiton>>Major Repair Allowance

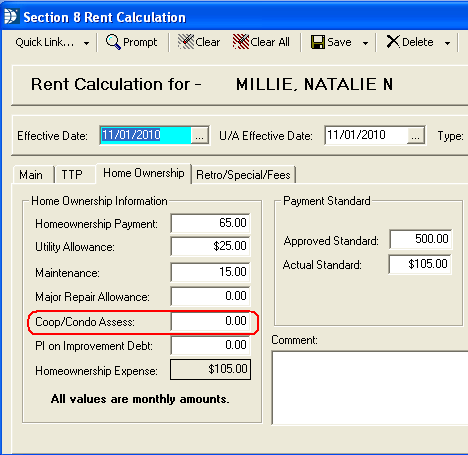

Field 15j pulls from the Coop/Condo Assess field in the tenant's Rent Calculation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Home Ownership>>Home Ownership Information>>Coop/Condo Assess

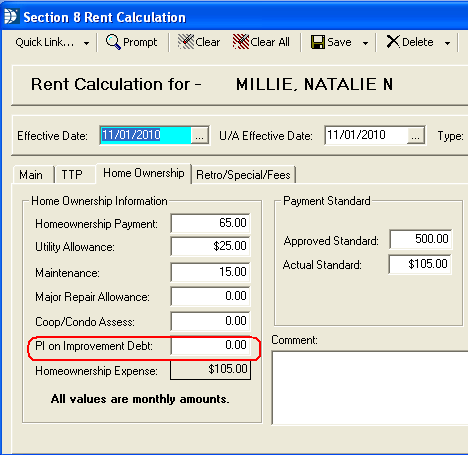

Field 15k pulls from the PI on Imporovement Debt information entered in the tenant's Rent Calculation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Home Ownership>>Home Ownership Information>>PI on Improvement Debt

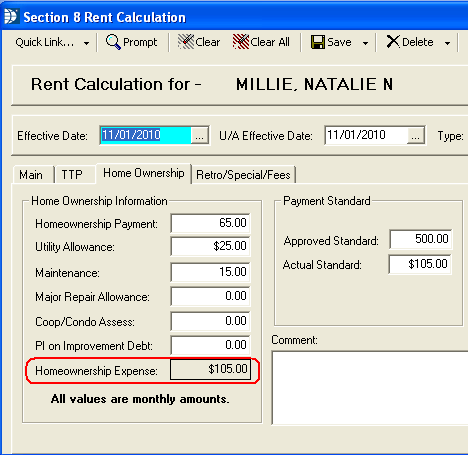

Field 15m pulls from the Homeownership Expense field in the tenant's Rent Calculation. This field is the total of 15f, 15g, 15h, 15i, 15j and 15k.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Home Ownership>>Home Ownership Information>>Homeownership Expense

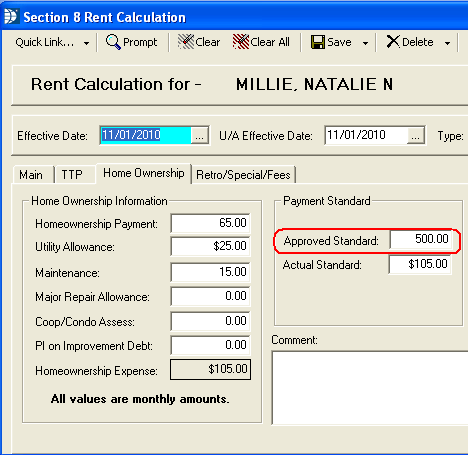

Field 15n pulls from the Approved Standard field in the tenant's Rent Calculation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Home Ownership>>Payment Standard>>Approved Standard

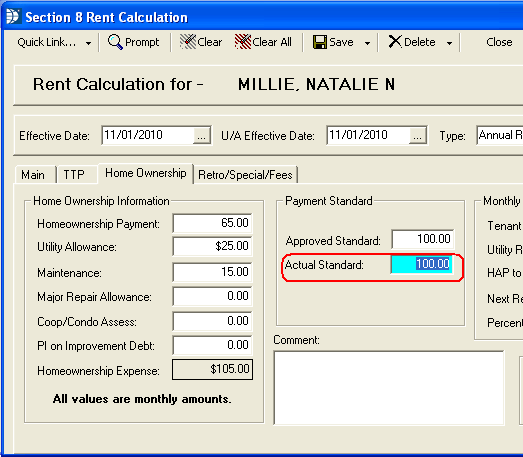

Field 15p pulls from the Actual Standard field in the tenant's Rent Calculation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Home Ownwership>>Payment Standards>>Actual Standard

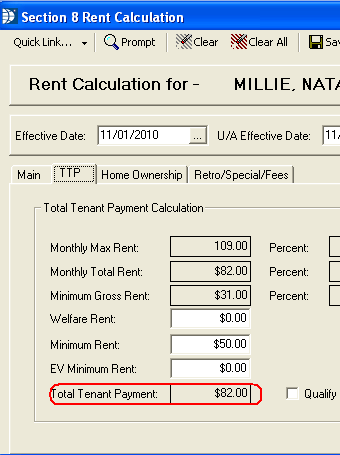

Field 15q pulls from the Total Tenant Payment field in the tenant's Rent Calculation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>TTP>>Total Tenant Payment Calculation>>Total Tenant Payment

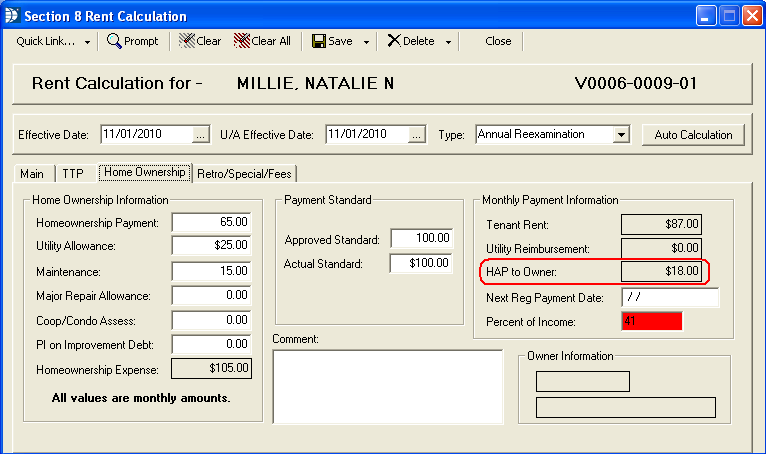

Field 15r pulls from the HAP to Owner field in the tenant's Rent Calculation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Home Ownership>>Monthly Payment Information>>HAP to Owner

Field 15s pulls from the Tenant Rent field in the tenant's Rent Calculation, unless the tenant's rent is prorated.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Home Ownership>>Monthly Payment Information>>Tenant Rent

Field 15aa pulls from the HAP to Owner field in the tenant's Rent Calculation.

Go to Maintain>>Tenants (Active)>>Quick Link>>Rent Calculation>>Home Ownership>>Monthly Payment Information>>HAP to Owner

Page 17 of the 50058 is used for FSS and WtW voucher information.

FSS

Welfare to Work Voucher (None of our current clients are using this information, if it is needed, please call the Horizon Help Desk for assistance)

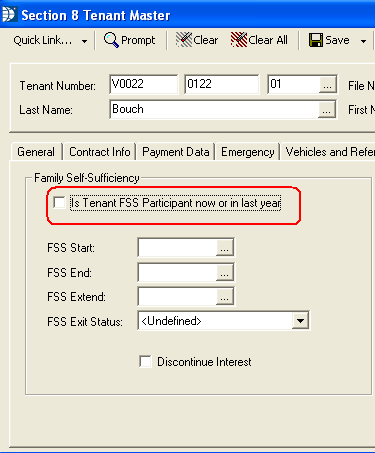

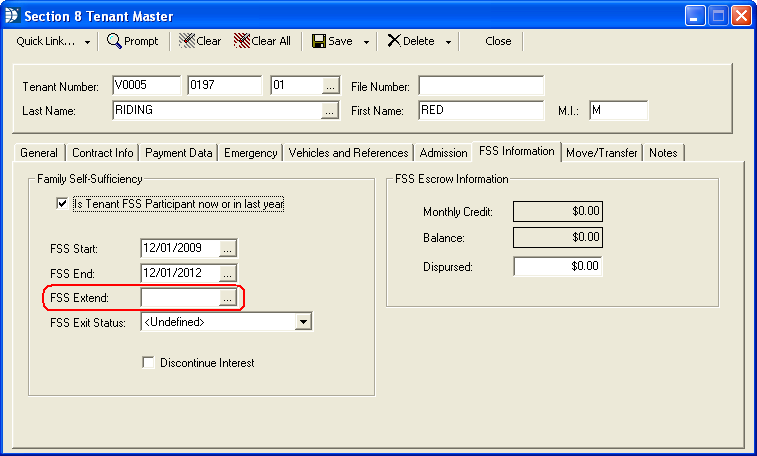

Field 17a pulls the FSS indicator from the "Is Tenant FSS Participant now or in the last year?" in the Section 8 Tenant Master. If this field has a checkmark in it, the box for FSS will have XX in them.

Go to Maintain>>Tenants (Active)>>FSS Information>>Family Self Sufficiency>>Is Tenant FSS Participant now or in the last year?

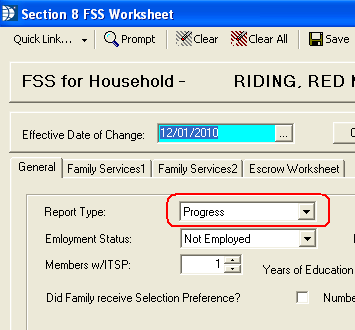

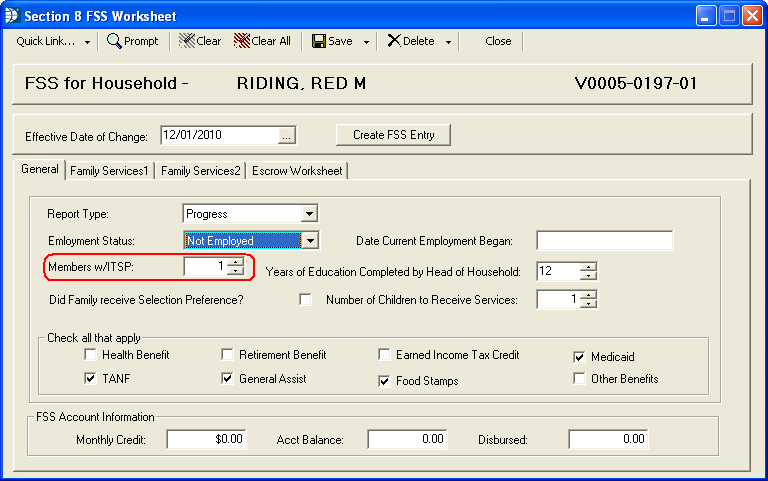

Field 17b is pulled from the Section 8 FSS worksheet>>Report Type. Select enrollment, exit or progress to have this information included on the FSS 50058.

Go to Maintain>>Tenants (Active)>>Quick Link>>FSS Worksheet>>General>>Report Type

Note: The FSS Worksheet is only available on the Quick Link menu when the "Is Tenant FSS Participant now or in the last year" is checked.

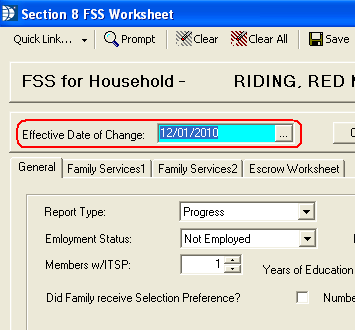

Field 17c pulls from Section 8 FSS Worksheet>>Effective Date of Change. The program will default this date to match the tenant's effective date (Eff Date) from the general tab. The date may be changed in the FSS Worksheet if applicable. Previously saved worksheet dates can be accessed by using the F7 or F8 keys while the cursor is in the date field.

Go to Maintain>>Tenants (Active)>>Quick Link>>FSS Worksheet>>Effective Date of Change

Note: The FSS Worksheet is only available on the Quick Link menu when the "Is Tenant FSS Participant now or in the last year" is checked.

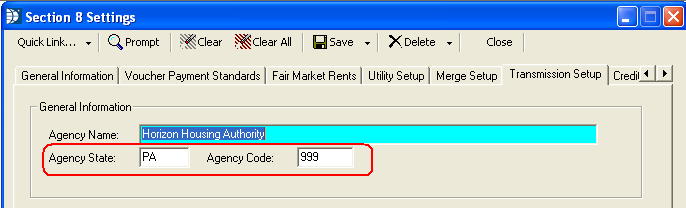

Field 17d pulls from Section 8 Settings>>Transmission Setup>>General Information>>Agency State and Agency Code.

Go to Settings>>Section 8 Management>>Transmission Setup>>General Information>>Agency State and Agency Code

Note: The FSS Worksheet is only available on the Quick Link menu when the "Is Tenant FSS Participant now or in the last year" is checked.

This information is currently not setup. If you need this information for the 50058, please call the Horizon Help Desk for assistance.

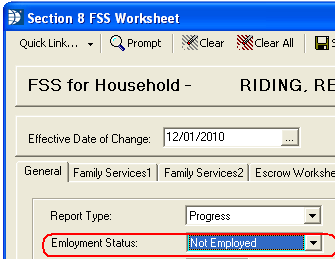

Field 17h 1 pulls from Section 8 FSS Worksheet>>Employment Status. Select Full Time, Part Time or Not Employed.

Go to Maintain>>Tenants (Active)>>Quick Link>>FSS Worksheet>>General>>Employment Status

Note: The FSS Worksheet is only available on the Quick Link menu when the "Is Tenant FSS Participant now or in the last year" is checked.

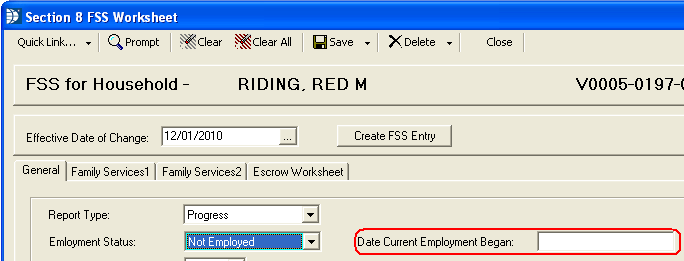

Field 17h 2 pulls from Section 8 FSS Worksheet>>Date Current Employment Began.

Go to Maintain>>Tenants (Active)>>Quick Link>>FSS Worksheet>>General>>Date Current Employment Began

Note: The FSS Worksheet is only available on the Quick Link menu when the "Is Tenant FSS Participant now or in the last year" is checked.

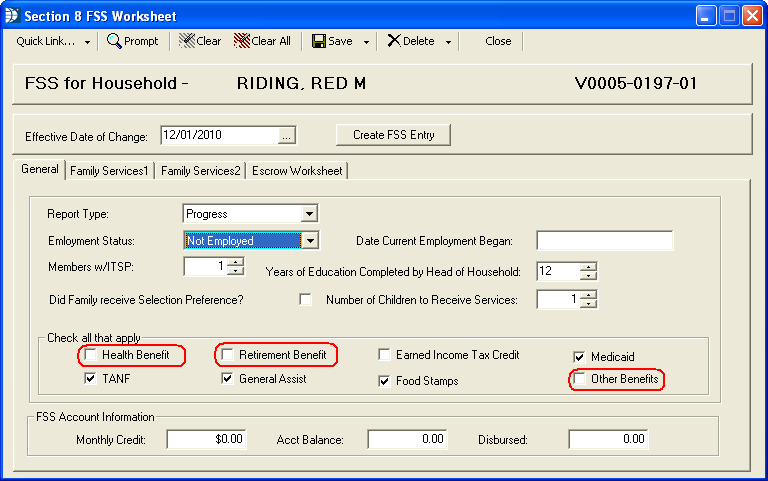

Field 17h 3 pulls from the Section 8 FSS Worksheet>>Check all that Apply>>Health Benefit, Retirement Benefit and Other Benefits.

Go to Maintain>>Tenants (Active)>>Quick Link>>FSS Worksheet>>General>>Health Benefit, Retirement Benefit and/or Other Benefits

Note: The FSS Worksheet is only available on the Quick Link menu when the "Is Tenant FSS Participant now or in the last year" is checked.

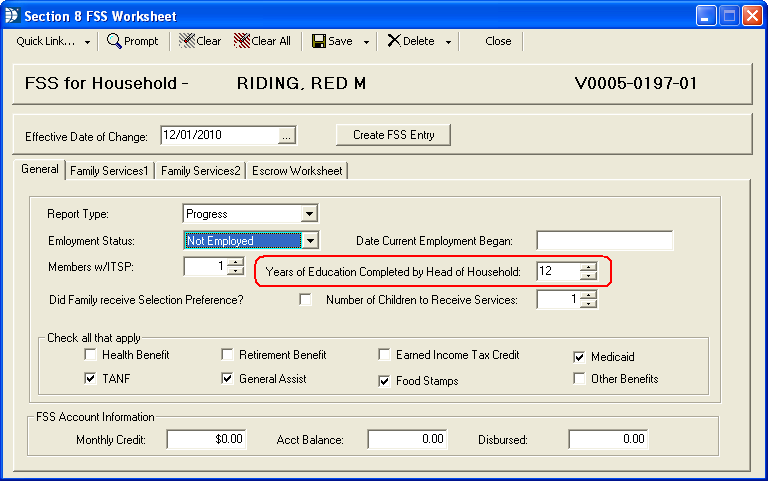

Field 17h 4 pulls from the Section 8 FSS Worksheet>>Years of Education Completed by the Head of Household.

Go to Maintain>>Tenants (Active)>>Quick Link>>FSS Worksheet>>General>>Years of Education Completed by the Head of Household

Note: The FSS Worksheet is only available on the Quick Link menu when the "Is Tenant FSS Participant now or in the last year" is checked.

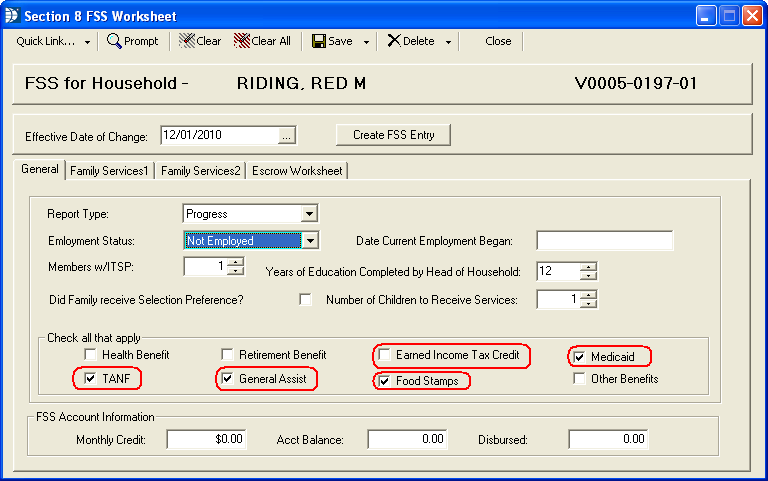

Field 17h 5 pulls from the Section 8 FSS Worksheet>>Earned Income Tax Credit, Medicade, TANF, General Assistance, and/or Food Stamps.

Go to Maintain>>Tenants (Active)>>Quick Link>>FSS Worksheet>>General>>Check All that Apply>>Earned Income Tax Credit, Medicade, TANF, General Assistance, and/or Food Stamps.

Note: The FSS Worksheet is only available on the Quick Link menu when the "Is Tenant FSS Participant now or in the last year" is checked.

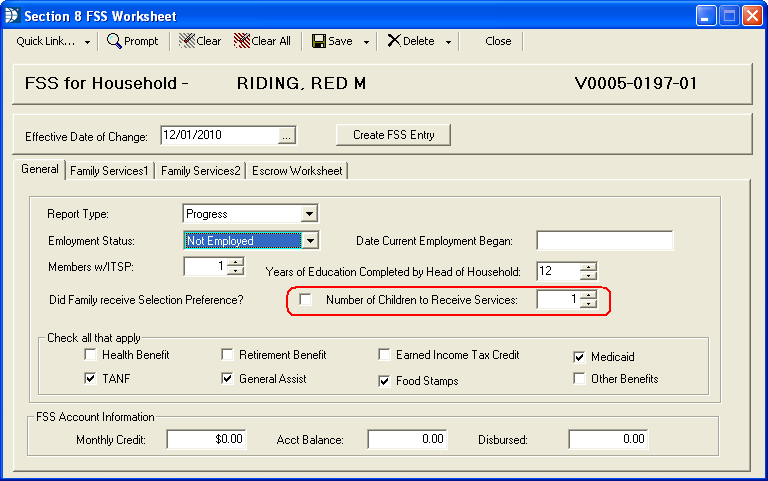

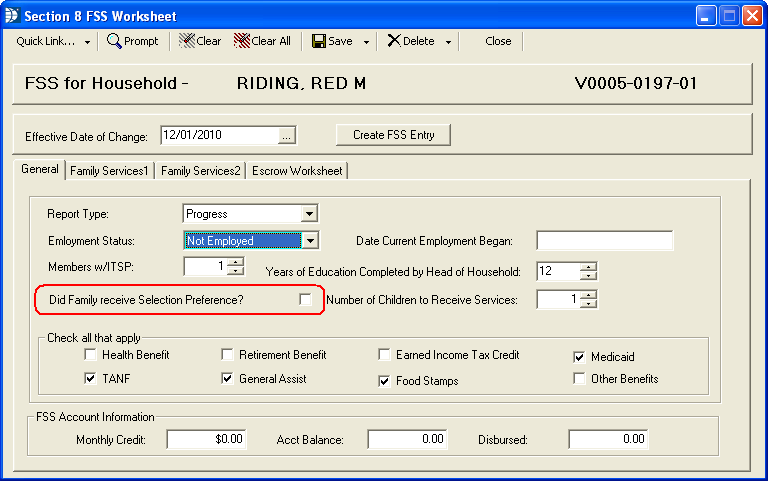

Field 17h 6 pulls from the Section 8 FSS Worksheet>>Number of Children to Receive Services.

Go to Maintain>>Tenants (Active)>>Quick Link>>FSS Worksheet>>General>>Number of Children to Receive Services

Note: The FSS Worksheet is only available on the Quick Link menu when the "Is Tenant FSS Participant now or in the last year" is checked.

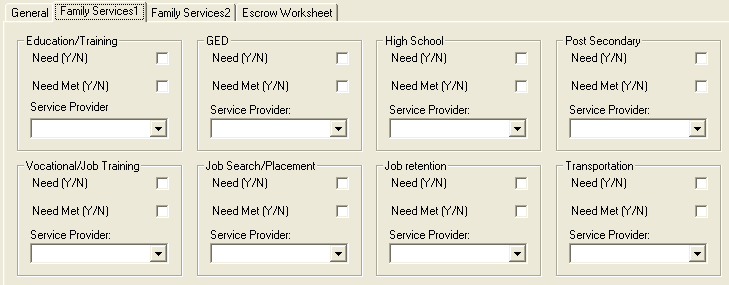

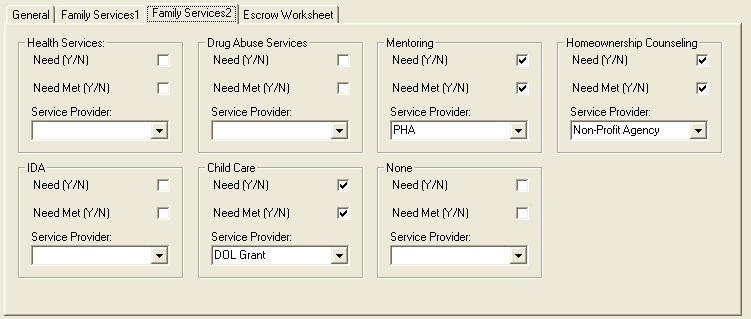

Field 17i Family Services information is pulled from the information entered into the Family Services 1 and Family Services 2 tabs of the Section 8 FSS Worksheet.

Go to Maintain>>Tenants (Active)>>Quick Link>>FSS Worksheet>>Family Services 1 and/or Family Services 2 tabs:

Note: The FSS Worksheet is only available on the Quick Link menu when the "Is Tenant FSS Participant now or in the last year" is checked.

Family Services 1

Family Services 2

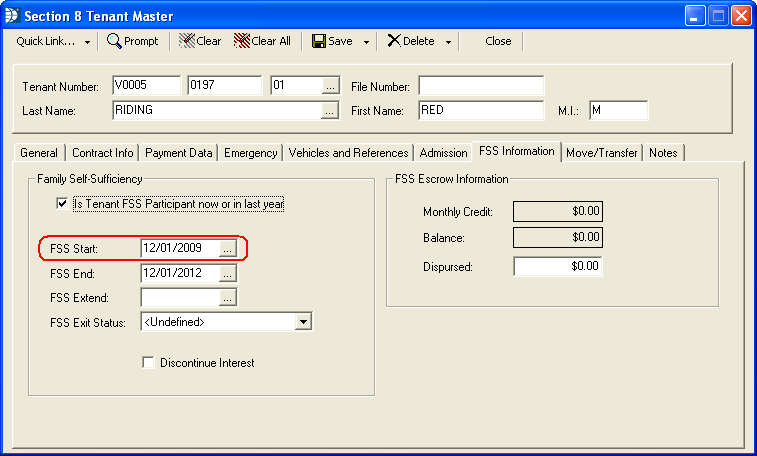

(1) Initial Start Date (mm/dd/yyyy) of contract of participation (FSS enrollment report only)

17j (1) pulls from Section 8 Tenant Master>>FSS Start.

Go to Maintain>>Tenants (Active)>>FSS Information>>Family Self Sufficiency>>FSS Start

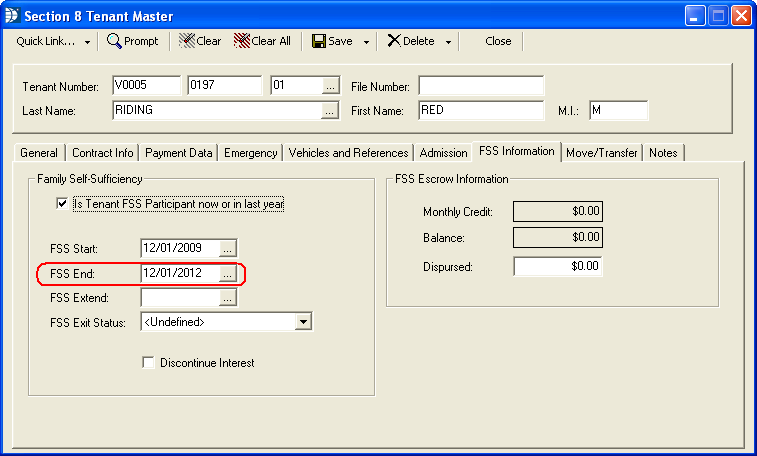

(2). Initial end date (mm/dd/yyyy) of contract of participation (FSS enrollment report only)

Field 17j (2) pulls the end date of the contract from the Section 8 Tenant Master>>FSS End field.

Go to Maintain>>Tenants (Active)>>FSS Information>>Family Self Sufficiency>>FSS End

(3) Contract date extended to (mm/dd/yyyy) (if applicable)

Field 17j 3 pulls the date from the Section 8 Tenant Master>>FSS Extend field.

Go to Maintain>>Tenants (Active)>>FSS Information>>Family Self Sufficiency>>FSS Extend

(4) Number of family members with Individual Training and Services Plan

Field 17j 4 pulls from the Section 8 FSS Worksheet>>Members w/ITSP field.

Go to Maintain>>Tenants (Active)>>Quick Link>>FSS Worksheet>>General>>Members w/ITSP

Note: The FSS Worksheet is only available on the Quick Link menu when the "Is Tenant FSS Participant now or in the last year" is checked.

(5) Did the family receive selection preference because of a FSS related service program participation? (FSS enrollment report only) (Y or N)

Field 17j 5 pulls from the Section 8 FSS Worksheet>>Did Family Receive Selection Preference.

Go to Maintain>>Tenants (Active)>>Quick Link>>FSS Worksheet>>General>>Did Family Receive Selection Preference

Note: The FSS Worksheet is only available on the Quick Link menu when the "Is Tenant FSS Participant now or in the last year" is checked.

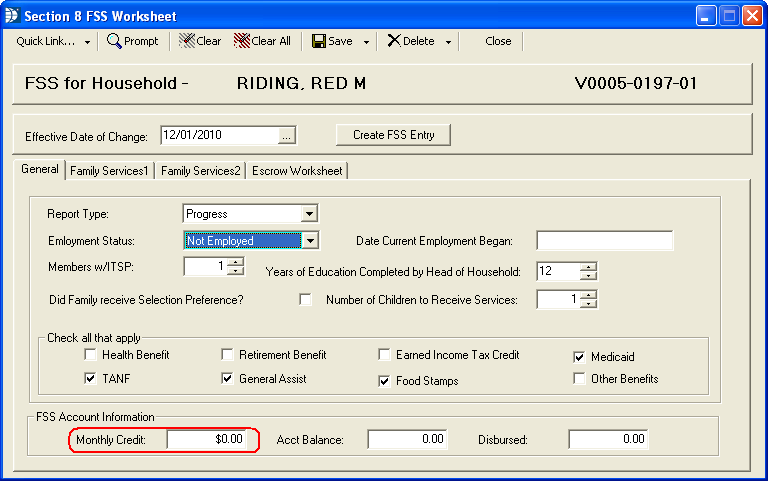

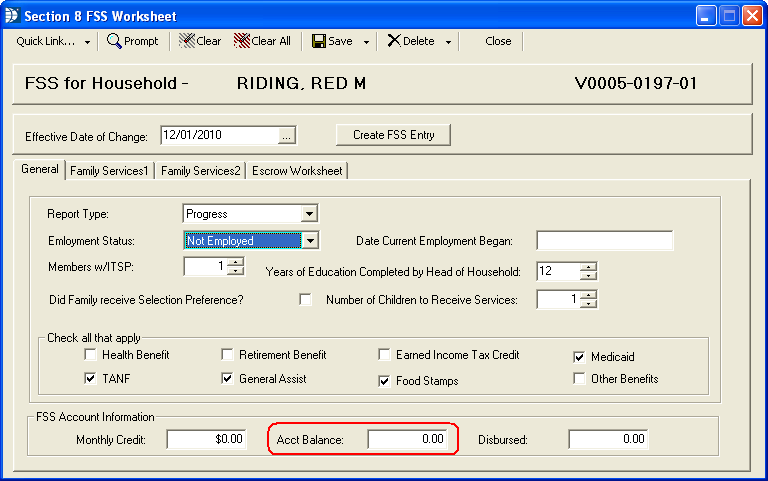

(1) Current FSS Account monthly credit

Field 17k (1) pulls from Section 8 FSS Worksheet>>Monthly Credit.

Go to Maintain>>Tenants (Active)>>Quick Link>>FSS Worksheet>>General>>FSS Account Information>>Monthly Credit

(2) Current FSS account balance

Field 17k (2) pulls from Section 8 FSS Worksheet>>Acct Balance.

Go to Maintain>>Tenants (Active)>>Quick Link>>FSS Worksheet>>General>>FSS Account Information>>Acct Balance

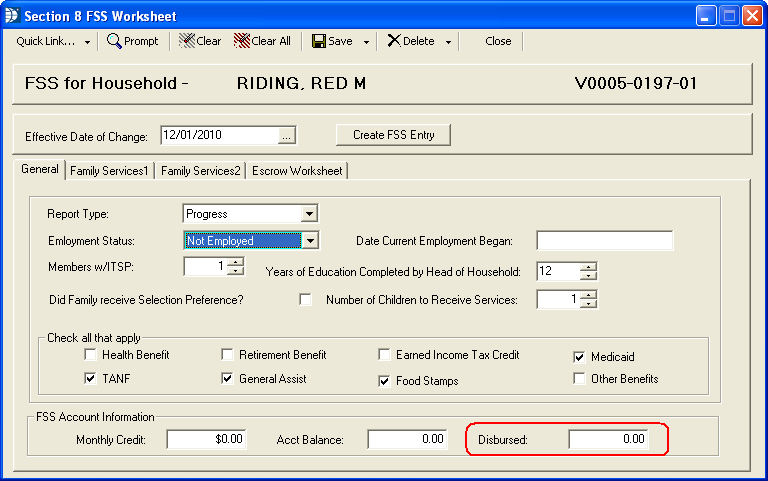

(3) FSS account amount disbursed to the family (cumulative as of end of reporting period)

Field 17k (3) pulls from Section 8 FSS Worksheet>>Disbursed.

Go to Maintain>>Tenants (Active)>>Quick Link>>FSS Worksheet>>General>>FSS Account Information>>Disbursed

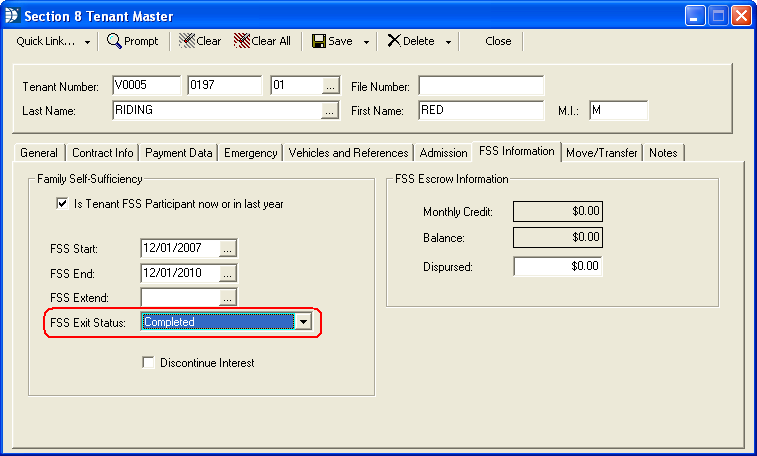

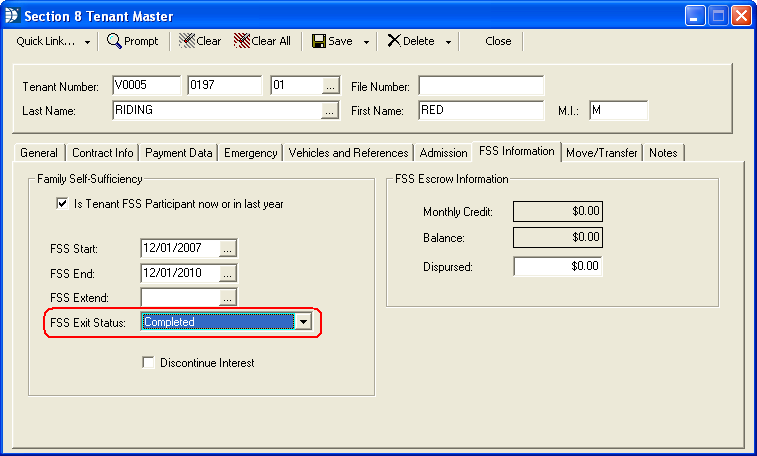

(1) Did family complete contract of participation? (Y or N)

Field 17m (1) pulls a Y if the FSS Exit Status is one of the following:

Completed

Homeownership

An N will be returned for any other selected exit status.

Go to Maintain>>Tenants (Active)>>FSS Information>>Family Self-Sufficiency>>FSS Exit Status

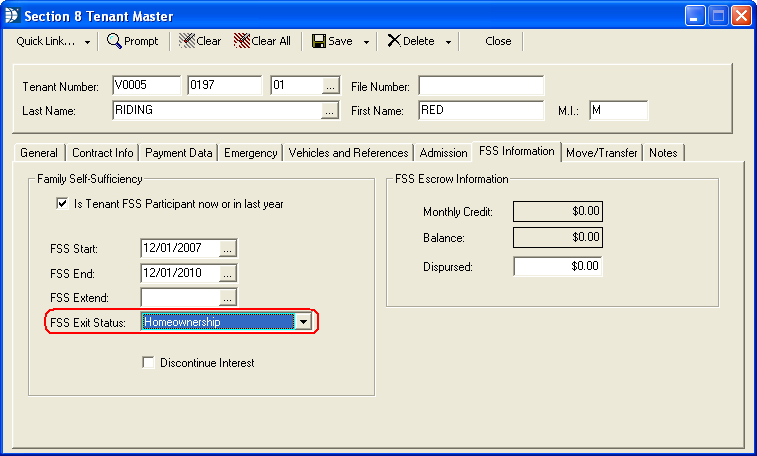

(2) If (1) is Yes, did family move to homeownership? (Y or N)

Field 17m (2) will return a Y if FSS Exit Status is set to Homeownership.

Go to Maintain>>Tenants (Active)>>FSS Information>>Family Self-Sufficiency>>FSS Exit Status

(3) If (1) is No, primary reason for exit:

Field 17m (3) will return a N for 17m (1) and place a check mark in a corresponding box, if the FSS Exit Status has one of the following options selected:

Asked to Leave

Expired

FSS Service Unavailable

Left Voluntarily

Portability Move-Out

Go to Maintain>>Tenants (Active)>>FSS Information>>Family Self-Sufficiency>>FSS Exit Status

Currently, Horizon has no clients using this option. If this option is necessary for you, please call the Horizon Help Desk for assistance.