![]()

![]()

Revised: 04/26/11

Go to Maintain>>Distribution Master

![]()

The master distribution program is used to distribute deduction/benefit liabilities and expenses across several General Ledger accounts based on the Wage/Salary Expense account used in the Employee Master/Time Card Entry.

Enter or select a valid Company/Fund ID for the master distribution code you are setting up.

The Company/Fund ID controls which ledger/company the general ledger numbers are pulled from.

When a valid Company/Fund ID is selected it's name will be displayed here.

Enter or select the general ledger wage account to distribute deduction/benefit debits and credits for.

When this wage account is used for an employee, the deductions/benefits listed on the employee's 6. Deductions/Expenses tab in the Employee Master will be expensed to the general ledger numbers set up here for the deduction if the deduction has the "Use Master Distribution Process for Withholding Amount" checked in the Deduction/Benefit Master on the General Ledger Account Information tab.

The description for a selected general ledger wage account will be displayed here.

When a wage account is selected, any information that has been previously setup will be shown in the grid when the grid is clicked. The information may be adjusted as needed.

If no information has been entered for the selected wage account, press the Import Expense Codes button to bring up a Default Expense Account for Creating Distribution box where users may select a general ledger account number to distribute the amounts to.

Account information may be entered/adjusted in the grid

Additional deductions may be entered or selected in the grid

The grid shows the following information:

Deduction Code>> - The header when clicked will open a browse view where additional codes may be selected/changed for the line the cursor is on.

Description - The description for the selected Deduction Code will be displayed.

G/L Account to Debit - Used for Employer paid benefits. If this is not an employer paid benefit leave this field blank. Enter or select the general ledger expense account number to debit.

Employer Credit Account - Used for Employer paid benefits. If this is not an employer paid benefit leave this field blank. Enter or select the general ledger liability account number to credit.

Withholding Credit Account - Used for Employee withholdings. If this is not an employee withholding leave this field blank. Enter or select the general ledger liability account number to credit.

Note: Lines may be deleted from the grid by clicking on the line and then the delete button.

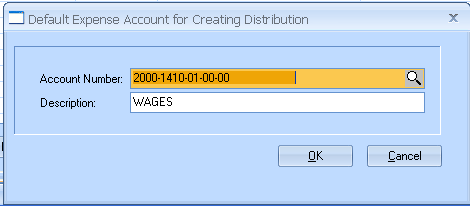

Click this button to open the "Default Expense Account for Creating Distribution" box shown below:

Enter or select a general ledger account number. This number will be the general ledger account number for all the deductions that are imported for the selected GL Wage Account. The imported general ledger account number may be changed/edited once the deductions are in the grid.

Displays the description of the general ledger account number selected.

Click this button to import deduction/expense information into the grid with the general ledger account number selected.

Click this button to cancel out of the import and close the Import box.