![]()

![]()

Revised: 02/21/2012

Go to Activities>>Time Card Entry

![]()

This program is used to enter and/or edit time card information for a payroll period.

Usually the Auto-Setup Time Card program is run first to generate time card information, but you may enter time card information directly into the Time Card Entry program to process a payroll for a few or all employees.

Time card information may also be entered using Import Time Card Information or Create Global Time Card.

Note:

Payroll can be run in several different configurations which will affect which fields will be available in the view. Fields that are not available in some modes will be noted.

See Also:

Enter or select an employee to enter or edit an employee's time card information. Once an employee is selected, time card information that has been generated or previously entered will be displayed. After an employee has been selected, tabbing out of the Employee No field will take you to the Time Card Date field.

When a valid employee has been selected, their name information will be displayed in these fields. This information pulls from the Employee Master.

Information that has been generated during the Auto-Setup of Time Cards process, imported, created, or time card information that has been previously entered will be displayed when an employee is selected.

Enter or edit time card information in the open fields beginning with time card date. Information that is entered in the open fields is not savable until it has dropped into the window area at the bottom of the view.

This field displays the total dollars for the employee based upon the time card information that is shown in the window area at the bottom of the Time Card Entry view.

This field displays the total hours for the employee based upon the time card information that is shown in the window area at the bottom of the Time Card Entry view.

Note: If the total dollars and hours shown are incorrect, run the Rebuild Time Card Dollars tool.

When tabbing or entering into this field, the date will default to the current pay period end date. The default date may be changed. You may enter all of the hourly information for the same date.

Enter or select an appropriate earning code for this line of entry.

Enter the number of hours for this line if entering time for an hourly earning code. If the earnings code is a salary code there is no need to enter hours unless you have "Using Salary Hours" checked in Payroll Settings. The default hours for hourly earnings is pulled from the employee's Employee Master, Default Earning Information or 5. Direct Deposit/System tab under Hours Per Day.

Accept the default rate for the line or enter the actual rate for the employee. If the Earnings Code used for the line is listed in the employee's Default Earning Information the listed rate is used. If the Earnings Code is not listed for the employee the system will use the rate from the Main Hourly Code on line 1 of the employee's Default Earning Information multiplied by the earning codes rate factor.

For an employee who has their earning information set in an auto code, the line will default to the auto code setup in their Employee Master file. The default Auto Code information may be changed to "No" to allow the user to select general ledger account information for the line of entry or another Auto Code may be selected.

If an Auto Code is selected, general ledger account information and the percentage of distribution should be setup for the employee in the Employee Master on the 7. Distributions tab.

For employees who have no auto code selected in the Employee Master, in the default earning information area, the field will default to "No".

Note:

This filed will not be available if payroll is in department mode.

If using inter-fund codes for payroll, enter or select an inter-fund code for the line being entered. If you are not using inter-fund codes, leave this field blank.

When an inter-fund code is used that has been setup in the Inter-fund Code Master with a segment value in Interfund Payable Setup, the general ledger account number browse will be restricted to account numbers with the segment value.

Note: This field is not available in all modes.

This field will default to the department code that is entered in the employee's Default Earning Information area in the Employee Master. The default department code may be changed for this entry by entering or selecting the desired department code.

The department code must have general ledger account distribution information setup in the Department Distribution Master.

Note:

This field is only available when Department Mode is checked in Payroll Settings under Parameters.

When entering through a line the system will insert the default general ledger account number that is setup in the employee's Default Earning Information in the Employee Master. The default general ledger account number can be changed for this line.

Note: This field is not available in all payroll configurations or if an Auto Group has been selected.

When an inter-fund code is used that has been setup in the Inter-fund Code Master with a segment value in Interfund Payable Setup, then the general ledger account number browse will be restricted to account numbers with the segment value.

When you have tabbed or entered through all the entry fields the information will drop down into the window area at the bottom of the view. Information will not be saved by the program if it is not displayed in the window.

When a valid employee has been selected, this area displays time card information that has been generated during the auto setup of time cards, imported, created or entered previously.

Time card information may be changed in the window, or a line of information may be brought back up into the entry area for editing by checking the Edit Box for the line. Remember to enter through the line until it drops into the window to be saved.

If you have run the Auto-Setup Time Cards and information is not displayed for an employee check for one of these reasons:

Make sure at least one of the Default Earning Information lines has a check mark in the TC column in the Employee Master.

Make sure the employee status is "Active" in the Employee Master

In the Employee Master on tab 5. Direct Deposit/System, make sure that there is a check mark in the Do Pay box.

Do Not run the Auto Setup of time cards again. Instead fix and save the Employee Master for any of the above issues and then manually enter the employee's time card information in the Time Card Entry program.

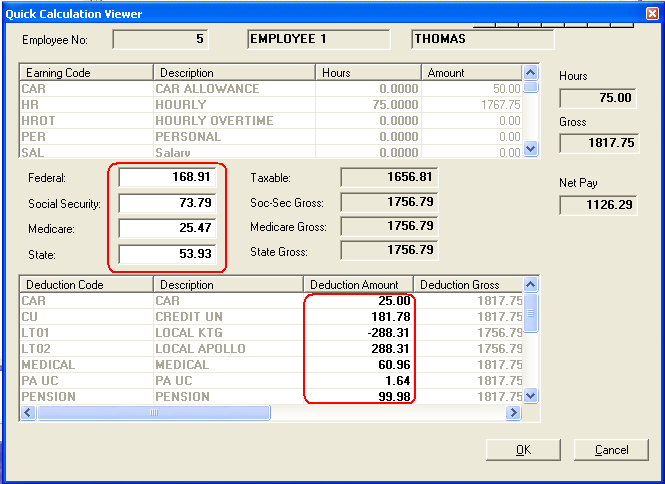

Pressing this button will bring up the Quick Calculation Viewer program to display payroll information for the selected employee.

If the displayed payroll information is not correct, make a permanent change in the Employee Master and try the Quick Calculation again.

A one time deduction change may be made within the Quick Calculation Viewer. The change will be saved in the viewer (click OK) nd can be seen in the Employee Master in the Calculation Overrides area until payroll is posted.

An example of the Quick Calculation Viewer is shown below:

The Tip Calculation button is only available when one or more TIP earning and adjusting codes are setup in the Earnings Master. Note: A restart of the Payroll module is also required after the earnings codes have been setup to have the Tip Calculation button show.

A Deduction/Benefit Code should also be setup and tied into a TIP earning code.

A Min Wage amount must be set in Payroll Settings

When an employee earns less than minimum wage between wages and tips they are claiming, pressing this button will calculate an amount to bring their pay up to minimum wage.

The Deduction/Benefit code is used to deduct TIP earnings so that the employee does not receive the Tip amount in their pay check.