![]()

![]()

Revised: 05/19/2015

Go to Maintain>> GL Account Master

This program is used to add, edit or view general ledger account number information and is available in several Modules.

See Also:

The following programs are available from the Quick Link Menu:

For a new account number, enter the number in this field. The number of characters entered will depend on the account structure set in General Ledger Settings in the Financial module. Account numbers are key fields and may not be changed once they are setup.

To maintain an account number's information, enter or browse for an existing account number. Edit the information you need to update and save.

For a new account number enter an account description, up to 30 characters in length, for the account number you entered.

For an existing account number, the description will be displayed here. You can change this description at any time.

Enter or select an account type. Default information may be set up in the account type file. This information will pull into the GL Account Master as you tab through the fields. Default information may be changed for this general ledger account number.

This field is used if you are running multiple companies/ledgers and are summarizing one ledger into another; otherwise, leave this field blank. Enter or select the company/ledger ID to summarize the information posted to this account number, if needed.

If you are using a summary ledger, enter the account number from the summarized ledger/company ID to summarize to; otherwise, leave this field blank.

This field is currently not used.

If a default Statement Type was set for the selected Account Type, it will be shown here.

If no default was set or if you want to change the default, select one of the following types:

Balance Sheet Account

Profit and Loss Account

To view more information on Statement Types click here.

The default parenthesis control is set in the Account Type Master. Either accept the default or select one of the following:

Parenthesis on Credit Balance

Parenthesis on Debit Balance

For more information on parenthesis control click here.

The default compression is set in Settings; General Ledger Settings under the System Information tab. The default may be changed here for each account.

Compression controls how information is posted or interfaced into the general ledger. Posted information can be compressed into a single line by date or period or the information may be set to not compress at all.

Compression may be set to one of the following:

Date Compression

No Compression

Period Compression

Select the appropriate box code from the drop down list or leave this field blank if the general ledger number is not associated with 1099 earnings.

The list is as follows:

Fees to Attorneys

Interest

Non Employee Compensation

Other Income

Rents

Royalties

Enter a check mark in the box if the general ledger account is to print on financial statements only. Account numbers that have this box checked will not show on any of the Trial Balance reports unless the Only Print Accounts Marked F/S box is checked.

A checkmark in the square indicates that this account is allocated. Transactions posted to this account will be distributed to other accounts. This account should always have an ending balance of zero. An allocation model should be set up for the allocation process.

Allocation codes are setup in the Allocation Master.

Place a checkmark in this box to indicate that dynamic allocations are to apply.

An account using Dynamic Allocations will prompt the user during input for the correct allocation model to use for this entry.

If you want amounts posted to this account number to allocate to other account numbers by percentage when posted, you must set up an allocation model and assign it here. Enter or select an allocation model for this field. Allocation models are set up in the Allocation Master in the Financial module.

Leave this field blank if you do not intend to allocate funds.

This field is tied to the Account Type selected for the account number.

If the account type chosen has been set up to link to a check book, this field will be available for input. If available, select the company/ledger for the check book.

When the account number is used in a journal voucher, the transaction date, information, etc will also post into the selected company/ledger's check book.

This field is tied to the account type selected for the account number.

If the account type chosen has been set up to link to a check book, this field will be available for input. If available, select a check book ID. The linked check book may be in a different company/ledger than the one the user is logged into currently, depending upon the CB Location selected.

Information that is posted to this account number through a journal voucher will also be entered into the selected check book.

If the account type has not been set up to link to a check book this field will be dimmed.

Enter or select a general ledger number for a profit and loss account to close the account balance to when the End Year Process is done in the Financial module.

Closing accounts are used for profit and loss account types. Balance sheet accounts should not have a closing account.

A default closing account may be pulled from Settings>>General Ledger Settings. This should only be done if the company has only one closing account for all accounts. If there is more than one closing account, then a default closing account should not be set and instead every profit and loss account should have their closing account saved here. If a profit and loss account does not have a valid closing account, the fiscal year will not close until a valid one is selected.

Changing the default closing account in this view, will change it for this account number only.

A range of general ledger account numbers may have their closing account information updated using the Update Closing Accounts program in the Financial module.

Closing account information is included in GL Account List

For more information on Closing Accounts click here.

Use these date fields to limit the dates the account number will be available. These dates may be left blank. When blank this account will be available for use in any date that is active in the Accounting Period Master.

When dates are entered in Journal Entry and AP Voucher Entry the module will not allow this general ledger account number to be used for dates before the Start Date or after the End Date entered.

Enter or select a date to begin the general ledger account's effective range. This field may be left blank.

Enter or select a date to end the general ledger account's effective range. This field may be left blank.

This feature is used with Financial Statements in the Template Master. Assign a number code to several general ledger account numbers for grouping on a financial statement.

Assign a code to a FS Group to use in a Financial Statement - Template Master. Assign the same code in the same FS Group # to other general ledgers to create a "group"

For example: Enter 102 in FS Group 1 on this and several other GL accounts

Group Codes may be also be assigned or changed using the Group Code 1 and FDS Grouping programs.

Leave this field blank or enter a grouping code in one or several of the FS Grouping fields.

These fields do not affect how the account functions and will not appear on reports. The purpose is for a quick reference about this account or what transactions should be posted into it.

Note: For some companies, User Defined fields are used for customized functions. Please follow the instructions given during training to complete these fields.

These fields can be given user friendly names under Settings>>General Ledger Settings>>User Defined tab.

There are 9 User Defined fields. 3 Text fields, 3 Number fields, and 3 Date fields. These fields are used for informational purposes and do not affect GL processing. Once a label for a field is entered in settings, this label will appear as the field name in the GL Account Master. This makes it easier for users to enter the correct information in these fields. Any field that has not been assigned a name will be labeled "Unused UDF#", # being 1, 2, or 3.

The information to be entered in these fields should be alpha-numeric text. Text entered may be up to 30 characters.

For Example: Text field 1 may be set up with a label of "Fund Name".

In the GL Account Master, an account may have information saved in "Fund Name". For example: State Grant - Users will be able to view this information as a reference.

The information to be entered in these fields must be a number. The number entered may be up to 9,999,999,999.9999.

For Example: Numeric field 1 may be set up with a label of "Grant Amount".

In the GL Account Master, an account may have numeric information saved in the field labeled "Grant Amount". For example: 20000.0000. Users will be able to view this information as a reference.

The information to be entered in these fields must be a date.

For Example: Date field 1 may be set up with a label of "Date Ending".

In the GL Account Master, an account may have information saved in "Date Ending". For example: 12/31/2014 Users will be able to view this information as a reference.

These fields give users a place to enter the name of the fund, the dollar amount of the fund and the date the fund/grant will end.

Check in one or more of the following check boxes to EXCLUDE the account number.

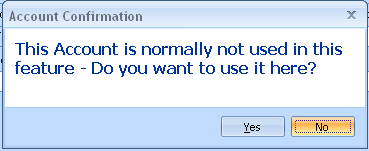

When this box is checked, an Account Confirmation box will be displayed (shown below) when the account number is used in Voucher Entry.

When this box is checked, an Account Confirmation box will be displayed (shown below) when the account number is used in AP Contract Voucher Entry.

When this box is checked, an Account Confirmation box will be displayed (shown below) when the account is used in GL Journal Entry.