![]()

![]()

Revised: 04/26/11

Go to Maintain>>Pay Date Master

![]()

This program is used to setup pay dates, time card dates and cycle information. This information must be setup on a yearly basis for each payroll frequency for which payroll will be processed. Use the Create Pay Schedule button to create new pay schedules for the year for the selected pay frequency.

See Also:

Select one of the following:

Biweekly

Monthly

Semi-Monthly

Special

Weekly

If a pay frequency has been setup, it will be shown in the deduction cycle grid after a pay frequency has been selected. If the grid remains blank or if the dates are for a previous year, then pay a pay schedule needs to be created.

For a pay frequency that has been setup the following information will be displayed:

Pay Date - This is the day the pay will be processed for. The current pay date information for each cycle processed is displayed and updated in Payroll Settings on the Report Control/AP Control tab

At the beginning of every year or for the first pay being processed this date will need to be entered into Settings>>Payroll Settings>>Report Control/AP Control under the appropriate field for the pay frequencies processed.

This date is also used when Auto Setup of Time Cards is run and when Payroll is processed.

The date may be changed in pay day setup and in Payroll Settings if the pay needs to be processed for a different date (due to holidays for example) Note: Pay dates may remain the same and the check date changed in Payroll Processing when a pay date falls on a non banking date.

Begin Date - This is the time card begin date. Dates used during time card entry should begin on or after this date.

End Date - The time card end date. This date automatically comes up for time card entry, but may be changed to any date that falls between the begin and end time card dates.

Accrual Date - This date is not automatically created, but must be entered for pays that should be accrued using the date information entered in this column.

Columns 1>> through 5>> - Deduction cycle columns may be automatically created when using the Create Pay Frequency if the "Create Default Deduction Cycles" box is checked.

Options for the deduction cycles are:

0 - Every Pay

1 - First Pay of Month

2 - Second Pay of Month

3 - Third Pay of Month

4 - Fourth Pay of Month

5 - First and Second

6 - First thru Forth Pay Only

L - Last Pay of Month

X - User Defined 1

Y - User Defined 2

Z - User Defined 3

If the option to "Create Default Deduction Cycles" was not checked, only 0 and L cycles will be created and the user may enter their own cycle information or they can rerun the Create Pay Schedule process again and check the "Create Default Deduction Cycles" box.

Deduction cycles are used when setting up an employee deduction in the Employee Master to indicate which pay or pays the amount will be withheld or deducted from the employee's pay.

Deduction cycles are also associated with earnings in the Employee Master and in Atuo-Setup of Time Cards.

User defined cycles may be added in the payroll grid and used when setting up employee deductions.

The deduction cycles listed on the same line as a pay date are the default cycles set to be taken out during Auto-Setup of Time Cards and Payroll Processing. Default cycle information may be changed during the setup of time cards and the first step of payroll processing or a cycle option may be added to the preset selections in the Pay Date Master.

Creates a pay schedule depending on the pay frequency and the information entered. (See Below)

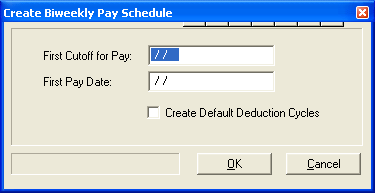

For Biweekly pay frequency the following create pay schedule program will appear:

Enter the first cutoff for pay. This is the last day of the time card period for the first pay.

Enter the first pay date for the new year.

Click in the "Create Default Deduction Cycles" if you want the payroll system to automatically create the payroll cycles. You may edit them after they are created to add any additional cycles for your pay schedule. The system will auto create a cycle for 0, 1, 2, 3, 5, 6 and L.

If you do not have a check mark in the "Create Default Deduction Cycles" only 0 and L cycles will be created. If you use cycles to send earnings to the time card or to determine when deductions will be withheld from employee's pay checks then enter the cycles manually, or recreate the pay schedule and enter a check mark in the "Create Default Deduction Cycles" box.

Click the OK button to complete the process to create the pay schedule or click Cancel to end the process without creating a schedule.

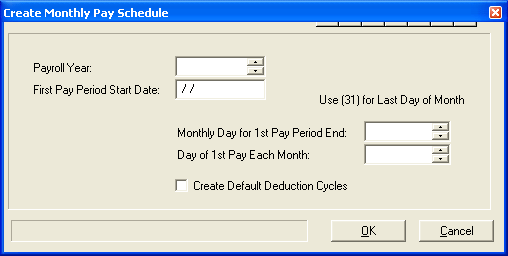

For Monthly pay frequency the following create pay schedule program will appear:

Enter the year you are setting up the payroll schedule for.

For Example Enter:

2011

Enter the date the time cards should start on for the first pay.

Enter the date the time cards for the first pay should end. Always use 31 if the pay period usually ends on the last day of the month.

Enter the day of the month that the monthly payroll will be paid upon.

Check the box to have the deduction cycles setup in the grid.

Click in the "Create Default Deduction Cycles" if you want the payroll system to automatically create the payroll cycles. You may edit them after they are created to add any additional cycles for your pay schedule. The system will auto create a cycle for 0 and 1.

If you do not have a check mark in the "Create Default Deduction Cycles" only 0 and L cycles will be created. If you use cycles to determine when earnings will be sent to the time card or when deductions will be withheld from employee's pay checks, then enter the cycles manually, or recreate the pay schedule and enter a check mark in the "Create Default Deduction Cycles" box.

Click the OK button to create the selected pay frequency schedule or click Cancel to close the view.

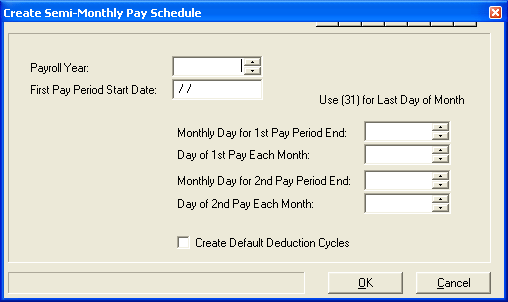

When the Pay Frequency of Semi-Monthly is selected and the Create Pay Schedule button is accessed the following screen will be shown:

Enter the year you are setting up the payroll schedule for.

For Example Enter:

2011

Enter the date the time cards should start on for the first pay.

Enter the date the time cards for the first pay should end.

Enter the day of the month that the first pay of the month will be paid upon.

Enter the date the time cards for the second pay period of the month should end. Always use 31 if the second pay period usually ends on the last day of the month.

Enter the day of the month that the second pay of the month will be paid upon. Always use 31 if the second pay period usually is paid on the last day of the month. If the payday is not the last day of the month then enter the exact date.

For Example: if your semi-monthly pay days are on the 15th and the 30th of the month use those dates.

Check the box to have the deduction cycles setup in the grid.

Click in the "Create Default Deduction Cycles" if you want the payroll system to automatically create the payroll cycles. You may edit them after they are created to add any additional cycles for your pay schedule. The system will auto create a cycle for 0, 1, and 2.

If you do not have a check mark in the "Create Default Deduction Cycles" only 0 and L cycles will be created. If you use cycles to determine when earnings will be sent to the time cards or when deductions will be withheld from employee's pay checks, then enter the cycles manually, or recreate the pay schedule and enter a check mark in the "Create Default Deduction Cycles" box.

Click the OK button to create the selected pay frequency schedule or click Cancel to close the view.

With special pay frequency selected, the user will need to enter their own pay information.

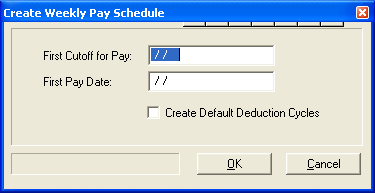

When the Pay Frequency of Weekly is selected and the Create Pay Schedule button is accessed the following screen will be shown:

Enter the time card cutoff date for the first pay.

Enter the date of the first weekly payroll.

Check the box to have the deduction cycles setup in the grid.

Click in the "Create Default Deduction Cycles" if you want the payroll system to automatically create the payroll cycles. You may edit them after they are created to add any additional cycles for your pay schedule. The system will auto create a cycle for 0, 1, 2, 3, 5, 6 and L.

If you do not have a check mark in the "Create Default Deduction Cycles" only 0 and L cycles will be created. If you use cycles to determine when earnings will be sent to the time card or when deductions will be withheld from employee's pay checks, then enter the cycles manually, or recreate the pay schedule and enter a check mark in the "Create Default Deduction Cycles" box.

Click the OK button to create the selected pay frequency schedule or click Cancel to close the view.